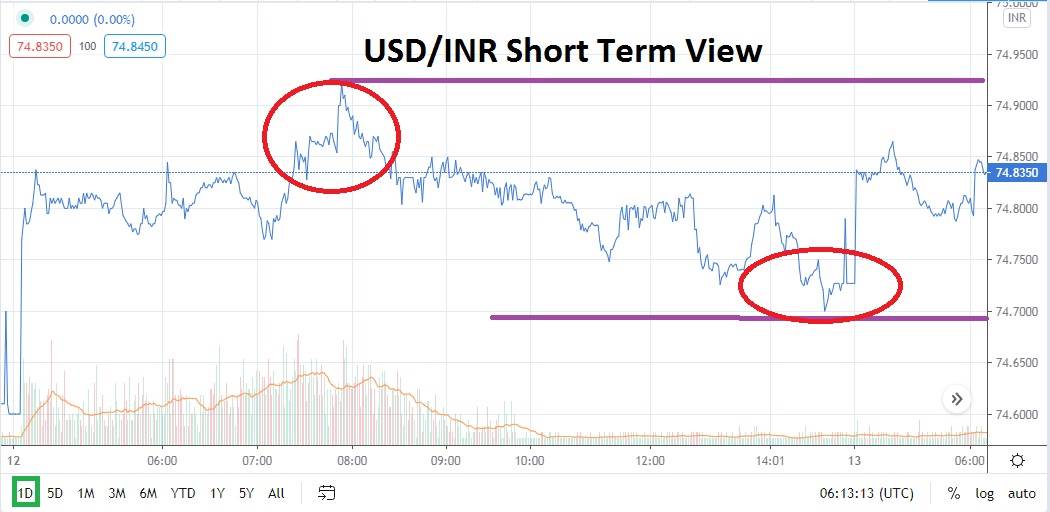

The USD/INR continues to trade within a fairly tight range, but it has not been without drama as the important threshold of 74.9000 was tested and broken slightly higher yesterday. Bullish behavior in the USD/INR continues to be on display as support levels have incrementally increased the past couple of days. Short term the target below appears to be the 74.7000 juncture. The question speculators should be asking themselves is if the appearance of a bullish trend in the USD/INR is a real breakout or a temporary rise?

Keeping in mind the markets are always right regarding the price of assets, betting against the bullish trend may seem foolish. However, speculators can take a look at short term technical charts and come away with the belief resistance has proven capable the past five days. Yes, resistance even higher near the 75.1000 mark was touched a few days ago, but there have been consistent reversals lower when important resistance has been tested. If you look at the last three days of trading from a technical perspective, it is also possible to say that the higher values of the USD/INR have actually been decreasing.

The belief that resistance has held and not allowed a significant bullish trend to emerge also serves as a catalyst for traders who believe selling the USD/INR is the right choice under present market conditions. Selling the USD/INR with limit orders within the higher value band of the forex pair represents an opportunity for traders who believe a bearish trend will reemerge. And one important fundamental factor to consider regarding the possibility of selling the USD/INR is the notion that a large US government ten-year bond auction has taken place and now that its results are largely factored into the financial landscape, international institutions and corporations may again believe the value of the US Dollar will waver slightly as demand in the short term for the greenback weakens.

The current trading vicinity of the USD/INR between 74.8000 and 74.9000 remains high and in bullish territory. Some speculators may believe a buying position which seeks upwards momentum and a retest of short term highs made the past few days is worthwhile.

However, because resistance above has proven adequate and because risk appetite globally appears to be rather strong, traders seeking to sell the USD/INR within its current price range cannot be faulted. A move downwards to support levels below may be the proper calling card and a better risk-reward scenario in terms of potential movement regarding basis points near term for the Indian Rupee.

Indian Rupee Short Term Outlook:

Current Resistance: 74.9300

Current Support: 74.7000

High Target: 75.1500

Low Target: 74.5000