Restrictions implemented to slow the spread of the Covid-19 pandemic continue to be eased, as Canada has a relatively low daily infection count. Economists and business leaders warn that it is premature to give the all-clear, as the total cost to the economy, the impact of permanent changes, and the length of a full recovery are uncertain. The labor market recovery is healthier than most other developed economies, adding a boost to the Canadian Dollar. The USD/CAD faces more downside pressure after being rejected by its short-term resistance zone.

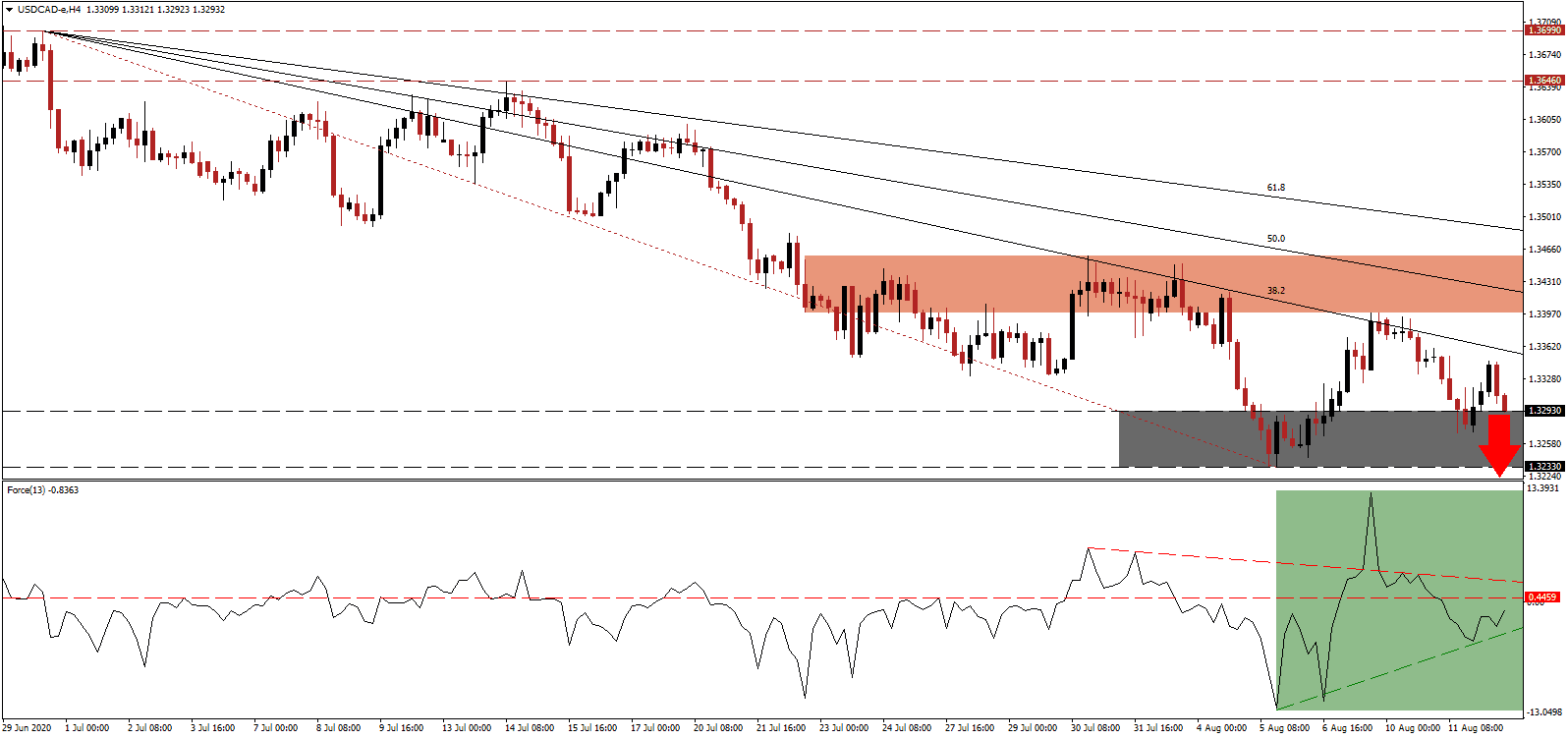

The Force Index, a next-generation technical indicator, reversed off of its ascending support level in negative territory, as marked by the green rectangle. It remains below its horizontal resistance level, with the descending resistance level maintaining bearish momentum, favored to reject any advance. Bears wait for a renewed push lower to take full control over the USD/CAD, extending the well-established bearish chart pattern.

Between February and April, Canada lost over three million jobs, of which 55% were recovered by the end of July. Many jobs are lost permanently, and a slow recovery cannot be excluded. One potential job creator could be US defense company, Lockheed Martin. The Canadian government is in the process of replacing its aging fleet of CF-18 fighter jets. Lockheed Martin vowed to inject C$16.9 into the economy, which will add essential high-paying jobs to the Canadian labor market. The USD/CAD remains under breakdown pressures following the retreat from its short-term resistance zone located between 1.3398 and 1.3459, as marked by the red rectangle.

While the US labor market added more jobs than expected in July, it was on the back of government additions. The private sector missed expectations and is likely to deteriorate further. Job cuts in July surged nearly 600% as compared to June, highlighting ongoing stress in the economy. The descending 38.2 Fibonacci Retracement Fan Resistance Level is anticipated to pressure the USD/CAD below its support zone located between 1.3233 and 1.3293, as identified by the grey rectangle. Price action will challenge its next support zone between 1.3104 and 1.3155.

USD/CAD Technical Trading Set-Up - Breakdown Extension Scenario

Short Entry @ 1.3295

Take Profit @ 1.3105

Stop Loss @ 1.3350

Downside Potential: 190 pips

Upside Risk: 55 pips

Risk/Reward Ratio: 3.46

An extended advance in the Force Index, driven by its ascending support level, may lead the USD/CAD into a short-term reversal. Forex traders are recommended to sell any rallies from present levels, due to the intensifying bearish outlook for the US economy and the US Dollar. The upside potential remains confined to its 61.8 Fibonacci Retracement Fan Resistance Level, favored to enforce the bearish trend.

USD/CAD Technical Trading Set-Up - Confined Reversal Scenario

Long Entry @ 1.3405

Take Profit @ 1.3495

Stop Loss @ 1.3350

Upside Potential: 90 pips

Downside Risk: 55 pips

Risk/Reward Ratio: 1.64