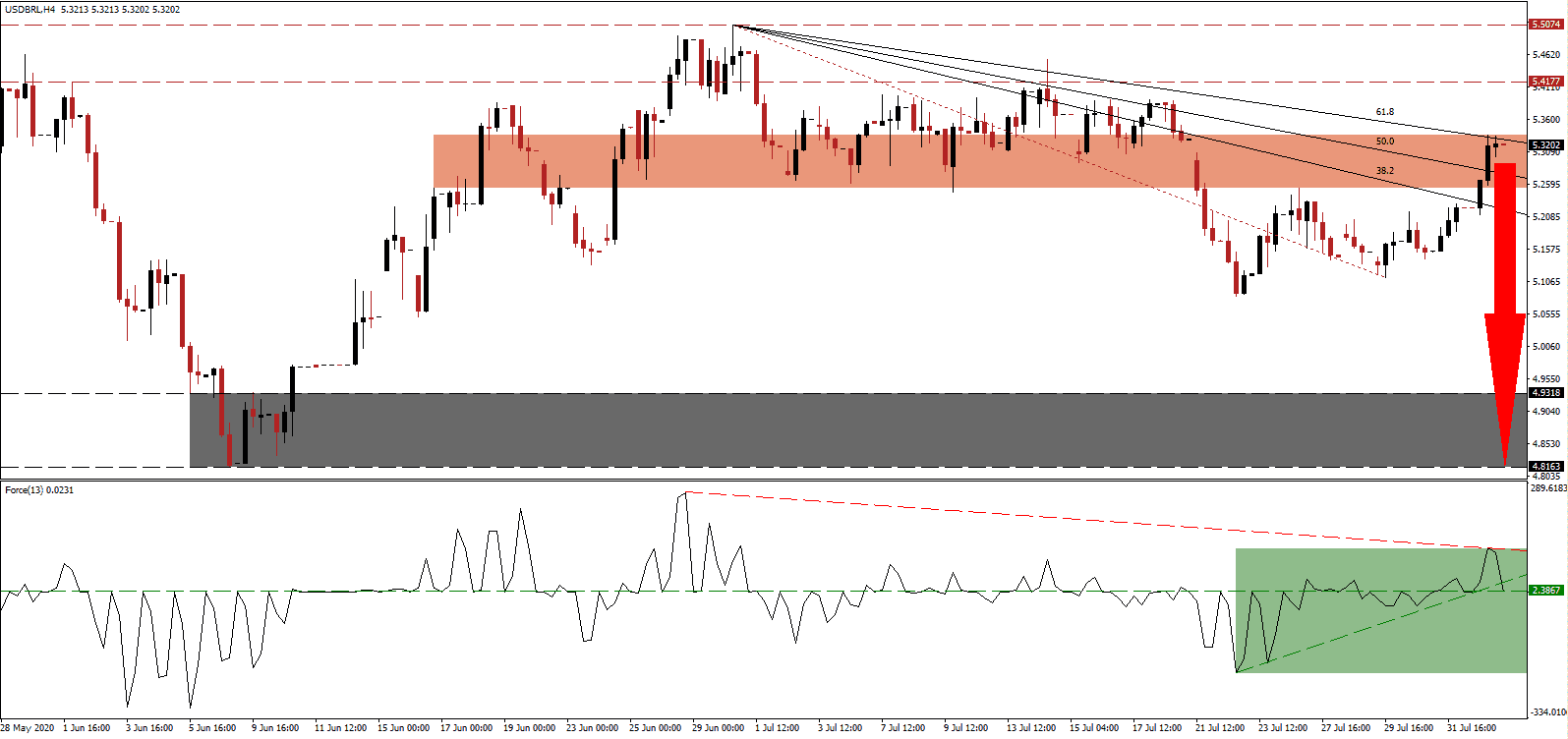

After the Banco Central do Brasil issued a mid-June 2020 GDP forecast calling for a contraction of 6.50%, five consecutive weeks saw upgrades that improved the outlook to a decrease of 5.66%. The 2021 predictions remained the same at a growth rate of 3.5%. Following the positive Covid-19 test of President Jair Bolsonaro, an alarming number of his inner circle has tested positive as well. His chief of Staff Walter Braga Netto is the latest to have contracted the virus. The USD/BRL ascended into its short-term resistance zone from where bearish pressures are expanding, expected to lead to a breakdown.

The Force Index, a next-generation technical indicator, pushed higher together with price action before swiftly retreating below its ascending support level. Adding to downside momentum is the descending resistance level, as marked by the green rectangle, favored to pressure this technical indicator below its horizontal support level and into negative territory. Bears will then regain complete control over the USD/BRL.

Following the positive Covid-19 test by President Bolsonaro, he relied on the anti-malaria drug chloroquine. There is no scientific evidence of the benefits, and the World Health Organization (WHO) removed the drug from its official treatment protocol on June 17th. With seven cabinet ministers infected, President Bolsonaro continues to support its use. Over 4.4 million pills have been distributed by the Ministry of Health and R$ 1.5 million invested. The Brazilian army is responsible for the manufacturing of the drug. After the USD/BRL reached its short-term resistance zone located between 5.2520 and 5.3357, as marked by the red rectangle, bullish momentum collapsed.

Yesterday’s release of the July Brazilian Markit Manufacturing PMI showed a sharp expansion, and the trade surplus expanded. While the US ISM Manufacturing Index rose, the employment sub-component indicates more job losses. Together with the rise in initial jobless claims over the past two weeks, the US labor market remains depressed. The descending 61.8 Fibonacci Retracement Fan Resistance Level is anticipated to spark a profit-taking sell-off in the USD/BRL. It can extend into its support zone located between 4.8163 and 4.9318, as identified by the grey rectangle.

USD/BRL Technical Trading Set-Up - Profit-Taking Scenario

Short Entry @ 5.3200

Take Profit @ 4.8000

Stop Loss @ 5.4600

Downside Potential: 5,200 pips

Upside Risk: 1,400 pips

Risk/Reward Ratio: 3.71

Should the Force Index spike above its descending resistance level, the USD/BRL is likely to pressure for more upside. Forex traders are recommended to take advantage of any advance from current levels with new net short positions, due to the deteriorating outlook for the US Dollar, driven by debt and an out-of-control Covid-19 pandemic. Price action will face its next resistance zone between 5.6233 and 5.7470.

USD/BRL Technical Trading Set-Up - Limited Reversal Scenario

Long Entry @ 5.5600

Take Profit @ 5.7100

Stop Loss @ 5.4600

Upside Potential: 1,500 pips

Downside Risk: 1,000 pips

Risk/Reward Ratio: 1.50