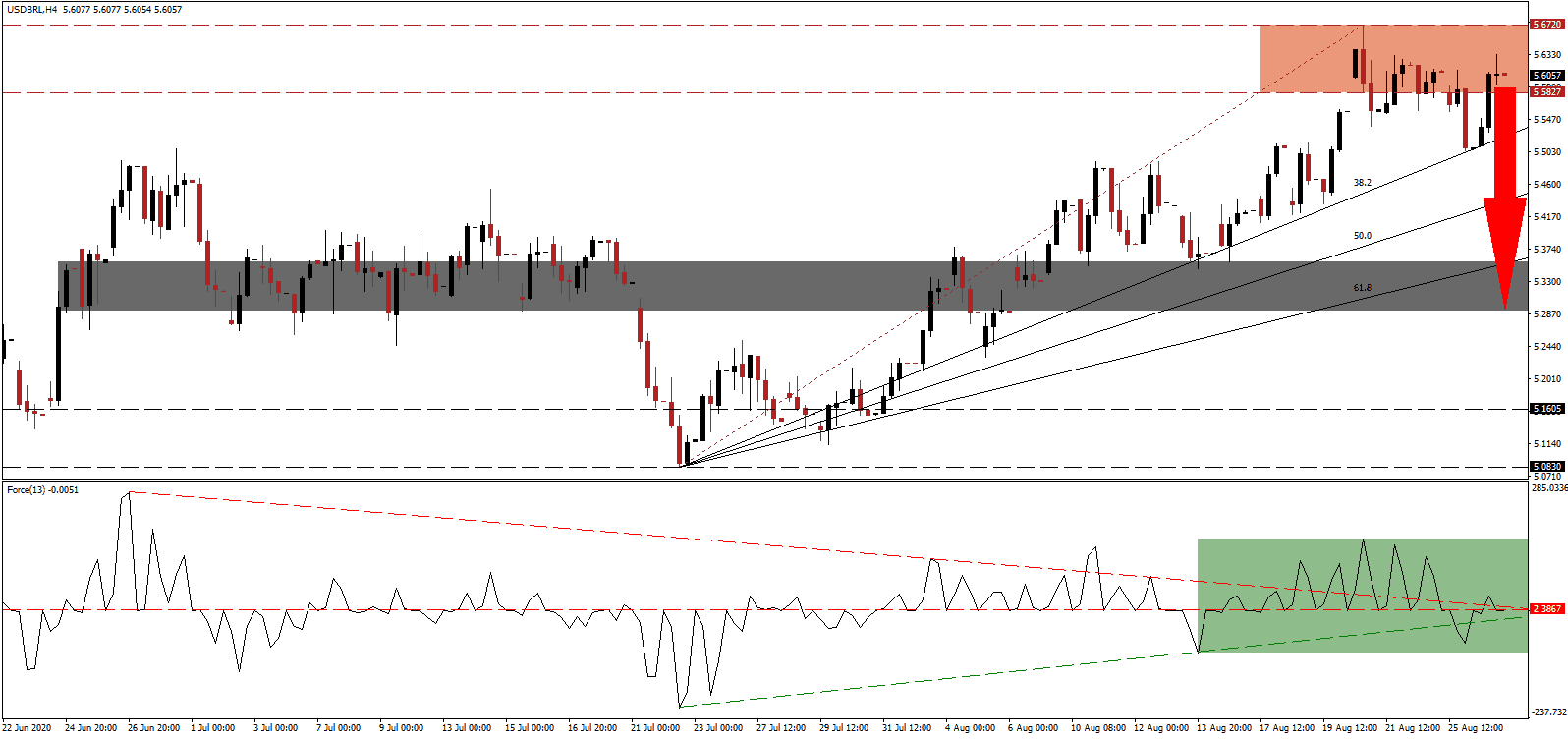

Brazil continues to record over 40,000 new Covid-19 infections daily, trailing only the US in the total count, which recorded over 6,000,000 cases. With millions of informal workers struggling day-to-day, assisted by a R$600 monthly government subsidy, President Jair Bolsonaro rejected a new support package labeled Renda Brasil, proposed by Economy Minister Paulo Guedes. It would cut other social programs, and widened the rift between President Bolsonaro and Economy Minister Guedes, who was rumored to be replaced, which he denies. The USD/BRL accumulated bearish pressures inside of its resistance zone, from where a profit-taking sell-off may materialize.

The Force Index, a next-generation technical indicator, formed a series of lower highs above its horizontal resistance level before correcting below it. A brief dip below its ascending support level was reversed, as marked by the green rectangle, but the descending resistance level maintains dominant bearish momentum. This technical indicator crossed into negative territory, granting bears greater control over the USD/BRL.

With million dependent on the R$600 monthly government assistance, Economy Minister Guedes proposed a cut to just R$200. Over 30 million households, or 44% of the total, benefit from the payments known as corona vouchers. Without them, the economy faces deeper long-term problems, but the cost of R$50 billion per month is pressuring public finances. The USD/BRL revered an initial breakdown below its resistance zone located between 5.5827 and 5.6720, as marked by the red rectangle, but bearish pressures remain elevated, favoring a secondary attempt.

President Bolsonaro stated cutting other social programs, taking money from struggling households to redistribute to others in need, is not an option. While the disagreement applies short-term bearish pressures on the currency, the long-term outlook remains favorable. With high-frequency indicators rising, and demand for agricultural exports elevated, Brazil is likely to find an alternative way of funding necessary social projects. A breakdown in the USD/BRL below its ascending 38.2 Fibonacci Retracement Fan Support Level will accelerate price action into its short-term support zone located between 5.2919 and 5.3565, as identified by the grey rectangle.

USD/BRL Technical Trading Set-Up - Profit-Taking Scenario

Short Entry @ 5.6000

Take Profit @ 5.3000

Stop Loss @ 5.6800

Downside Potential: 3,000 pips

Upside Risk: 800 pips

Risk/Reward Ratio: 3.75

In case the ascending support level pushes the Force Index into positive territory, the USD/BRL may attempt a temporary breakout. With the US labor market under ongoing stress, and subsidies being cut, the economy risks a double-dip recession. Forex traders should consider any advance as a selling opportunity with the next resistance zone awaiting between 5.9210 and 5.9900.

USD/BRL Technical Trading Set-Up - Reduced Breakout Scenario

Long Entry @ 5.7800

Take Profit @ 5.9200

Stop Loss @ 5.6800

Upside Potential: 1,400 pips

Downside Risk: 1,000 pips

Risk/Reward Ratio: 1.40