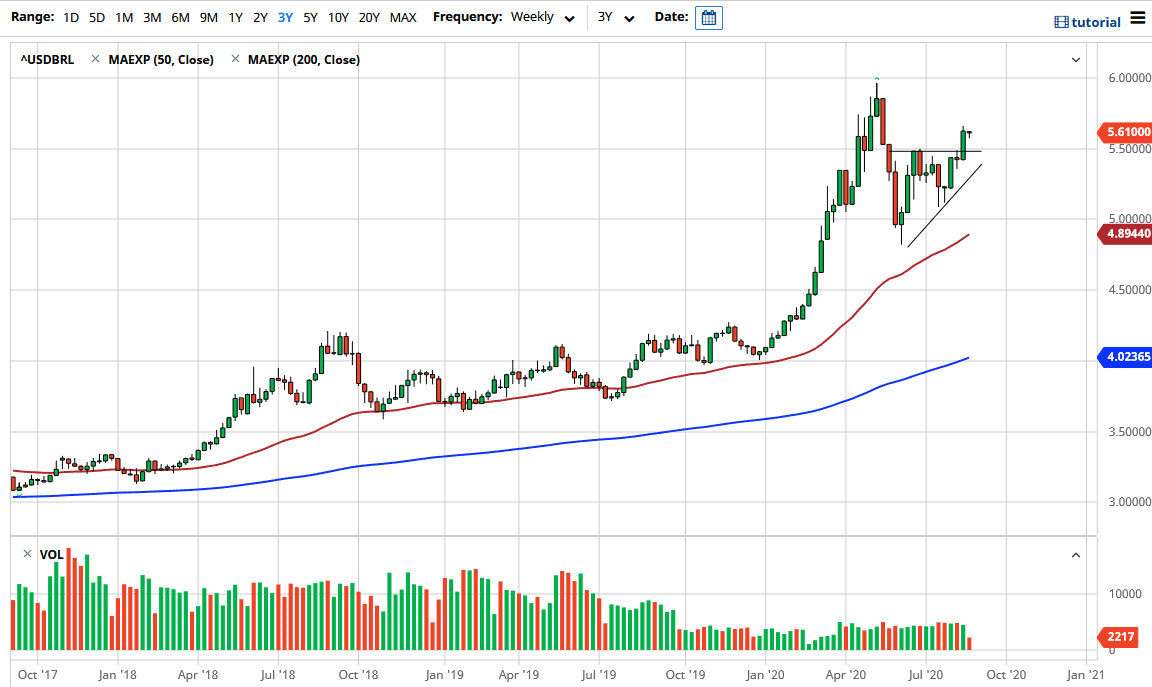

The market measured against the US dollar is literally a comparison between safety and extreme risk-taking, and right now it does not appear that the markets are willing to take a ton of risk on. In fact, as I prepare of the analysis for the month of September, the US dollar has just broken out against the Brazilian real after a significant pullback. We had been in an ascending triangle, and then the fact that we have broken above the 5.50 real level shows a continuation of strength.

Pullbacks at this point in time will probably be thought of as buying opportunities when it comes to the US dollar, unless there is a huge “risk on rally” coming. Even if that is the case, it is worth noting that the US dollar has been holding its own against the Brazilian real, even as it has been crushed again some other currencies. The fact that the Brazilian real could not capitalize on this overall sentiment shows just how negative traders are on Brazil, and perhaps Latin America as a whole, as the infection is rampant not only in Brazil, but further out beyond that.

Going forward, I fully anticipate that the US dollar will probably make a fresh, new high against the Brazilian real, or at least test the 6 BRL level. Breaking above their opens up the possibility of a move towards 6.20 retail, which is the measured move of the ascending triangle. That being said, if we do pull back within the triangle, then we may see some choppiness, but I would not be overly concerned about shorting this market right now. If you are looking to short the US dollar, you will not be doing it against emerging market currencies, especially this one. You would be shorting the US dollar against other currencies such as the Euro, the Pound, the Australian dollar, and so on. It is not until the infection rate drops drastically worldwide that I feel most emerging markets get any type of traction, including this one. I would anticipate significant support at the 5.50 level, and perhaps even more at the previous uptrend line. The 5.00 level obviously will be supportive, as the 50 week EMA is sitting just below there. If we were to break down below there, then I would be convinced of a stronger move in the BRL. Until then, I remain skeptical.