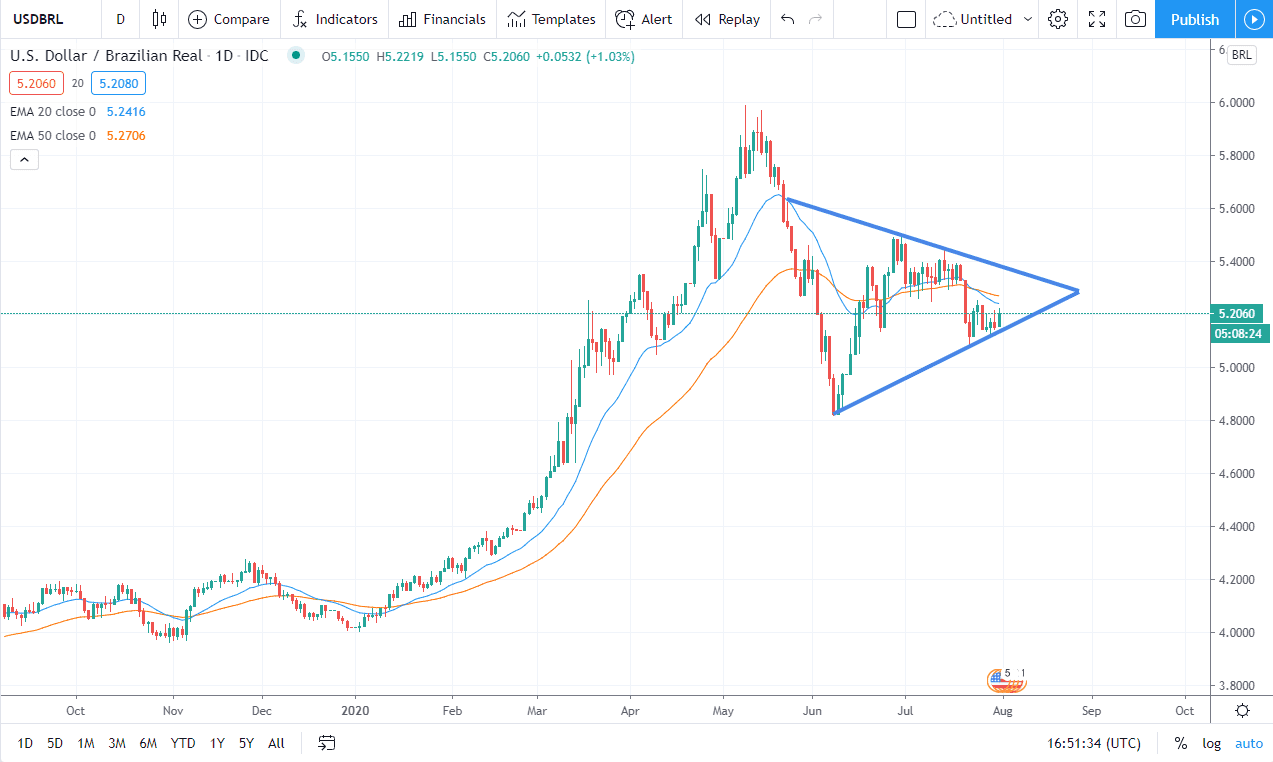

The US dollar has rallied a bit against the Brazilian real, and it is likely that we will continue to see a lot of noise back and forth. When you look at the longer-term picture, we are in the midst of a massive triangle, and as a result it is likely that the market is trying to build up enough momentum to make some type of significant move, but right now we simply do not have the catalyst. The US dollar rallied quite nicely against most currencies, so the Brazilian real was not going to be any different. However, there is still significant noise in both directions.

Underneath, we have the uptrend line from the triangle that is offering support, so if we were to break down below it is likely that the market goes down towards the 5.00 real level. To the other side if we were to break above the 50 day EMA colored in orange, then the market could go looking towards the 5.40 real level and as a result we would have a fight on our hands as it could send the market to the upside, perhaps reaching towards 5.5 real and then 5.6 real. All things being equal though, this is a market that is building up for a bigger move and the implied move could be rather large.

Remember that the US dollar is an instrument that people use for an expression of safety, while the Brazilian real is an expression on emerging markets and of course risk appetite. At this point, the Federal Reserve continues to flood the markets with greenback so therefore it is not a huge surprise to see this market break down. After all, the Federal Reserve is not going to stop until it gets a devalued US dollar and at this point, we could see a move down to the 4.50 real level. On the other hand, though, if we were to break to the upside and some type of “risk off” type of situation, the market will then go looking towards the 6.00 real level over the longer term to complete the entire move. I think the next couple of weeks are going to be crucial as to what happens with the US dollar, and then by extension the Brazilian real itself. In general, the volatility will continue to be nauseating to say the least.