For three trading sessions in a row, the USD/JPY has been trying to correct to the upside, but gains did not exceed the 106.20 level, now the pair remains stable around that level at the time of writing. Hampered economic stimulus plans to revive the world's largest economy in the face of the pandemic and the sharp tensions with China, are supporting the JPY gains, as it is the currency of choice for investors in times of uncertainty. As of late Monday, the number of confirmed COVID-19 cases in the United States has reached more than 5 million, with the number of deaths exceeding 163,000, the highest in the world, according to a tally by Johns Hopkins University. The confirmed number of Coronavirus cases in the world has exceeded 20 million, with about 734,000 deaths.

Nancy Pelosi, the Democratic leader of the US Congress, is negotiating a deal with the White House to save the US economy, but the lessons learned from the Great Recession now permeate the Coronavirus talks. With Republicans once again rejecting major government bailouts, Democrats believe they have influence, US President Donald Trump has been forced into a politically risky confrontation over helping millions of Americans. On Monday, there were no new talks between the Trump team and negotiators on Capitol Hill as the president tries the strategy to act alone. Over the weekend, he's unleashed a flurry of executive actions that give the White House the appearance of taking charge but may end up providing little help to ordinary Americans.

The president's orders seek to reverse the devastating ramifications of unemployment aid, eviction protection measures, and other expired aid. But there are legal limits and obstacles in trying to put an end to the legislative circumvention. Pelosi rejected Trump's proposals on Monday, calling them an "illusion" in an interview on MSNBC.

Meanwhile, countless Americans are already feeling the pressure. Gone is what was once a $600 weekly payment of unemployment benefits, as well as federal eviction protection. Schools that had looked for federal aid now face the prospect of reopening their doors with shrinking budgets. At the same time, the virus shows no signs of abating, with more than 5 million infections and 163,000 deaths recorded nationwide, and amid stark new evidence that many Americans' jobs may never return. Amid the administration's efforts, Treasury Secretary Stephen Mnuchin said in a conference call with state governors on Monday that Congressional action remains the administration's "first choice". Mnuchin and Vice President Mike Pence urged state governors to reach out to congressional leaders and push for legislation.

The Federal Reserve, led by Jerome Powell, and the US government have introduced several intense and continuous stimulus plans since the start of the crisis, but the length of the disease’s survival requires more, especially since the United States tops global figures of COVID-19 cases and deaths, and the possibility of obtaining a vaccine that eliminates the disease remains elusive.

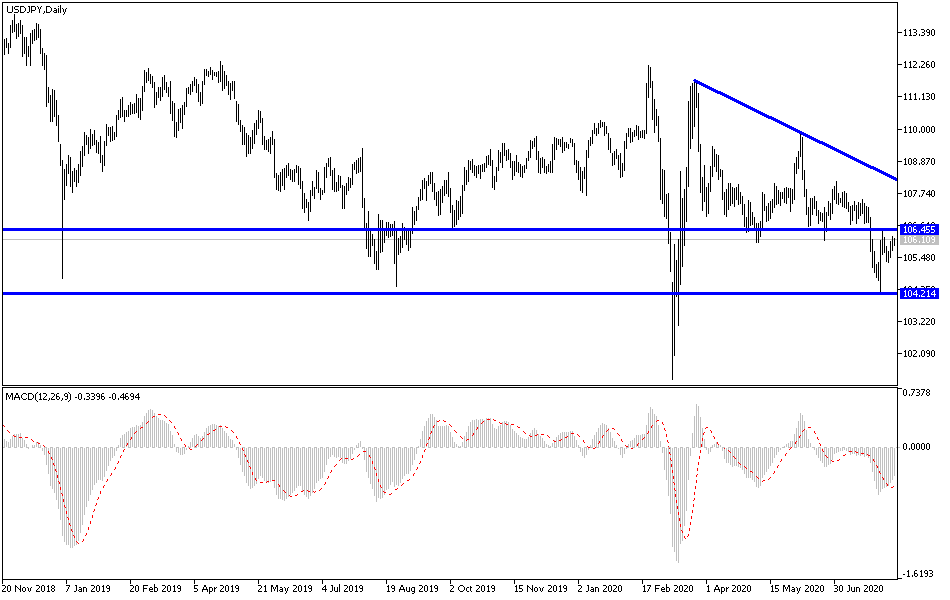

According to the technical analysis of the pair: The general trend of the USD/JPY is still downward, and what supports this outlook is the pair's move below the 106.00 level. Accordingly, the closest support levels for the pair are currently 105.75 and 104.80, respectively, which are levels that reinforce the strength and control of bears on the performance. As I mentioned before, I now confirm that the first opportunity to reverse the trend will be moving above the 108.00 resistance, and US/Chinese tensions, the path of the Coronavirus, and economic stimulus will remain the main drivers of the pair in the coming days. After the release of the Japanese data, the pair will react to the announcement of the US producer price index reading, which is one of the tools for measuring US inflation.