Continuous USD/JPY bearish momentum is pushing it towards the 105.31 support. Increasing pressure on the US currency ahead of the announcement of the US jobs report details tomorrow, Friday, as well as waiting for developments on the ground regarding stimulus plans to revive the US economy, which suffers from setting records of COVID-19 cases and deaths. US companies cut employment sharply last month, indicating that a re-emergence of a COVID-19 infection slowed the economic recovery as many states closed parts of their economies again and consumers remained cautious about spending.

During the month of July, US companies added just 167,000 jobs, according to the ADP survey, which is well below the June gain of 4.3 million and the May increase of 3.3 million. In general, the limited employment in July means that the US economy still has 13 million fewer jobs than in February before the outbreak.

ADP figures indicate that the labor market recovery is stalled and is likely to fuel concerns that the government jobs report, due to be released on Friday, will show a similar slowdown. Economists expect the government to announce that employers have added 1.8 million jobs, according to a survey by the data provider, FactSet. This is usually considered a big gain, but in this case, it would be somewhat disappointing after employment reached 4.8 million in June and 2.7 million in May. Recruitment between companies of all sizes and virtually all industries collapsed. A category that mostly includes restaurants, bars and hotels added just 38,000 jobs last month, after earning more than 3 million jobs in May and June combined.

There are other signs that the spread of the Coronavirus in July has caused a setback for the economy and the job market. As the number of people applying for unemployment benefits increased during the past two weeks, after a steady decline for three months. Credit and debit card data indicate that consumer spending has stabilized last month.

On the other hand, activity in the services sector, where most Americans work, reached its highest level in 17 months in July, economists fear that this is not sustainable due to the US failure to contain COVID-19 cases. The Institute for Supply Management announced that the ISM service sector index rose to 58.1, up from 57.1 in June. July represents its highest level since the index reached a reading of 58.5 in February 2019. As is well known, any reading above the 50 level means that the services sector is growing.

June saw the largest percentage point gain in the history of the services index, which dates back to 1997, after the largest record drop in April. These extreme fluctuations came after more than a decade of continuous growth. Earlier this week, the ISM reported that its index that tracks the manufacturing sector rose to a reading of 54.2 in July, up from June's reading of 52.6. The advance in the services index in July was driven by strong gains in new orders and business activity which helped offset the decline in the employment measurement index.

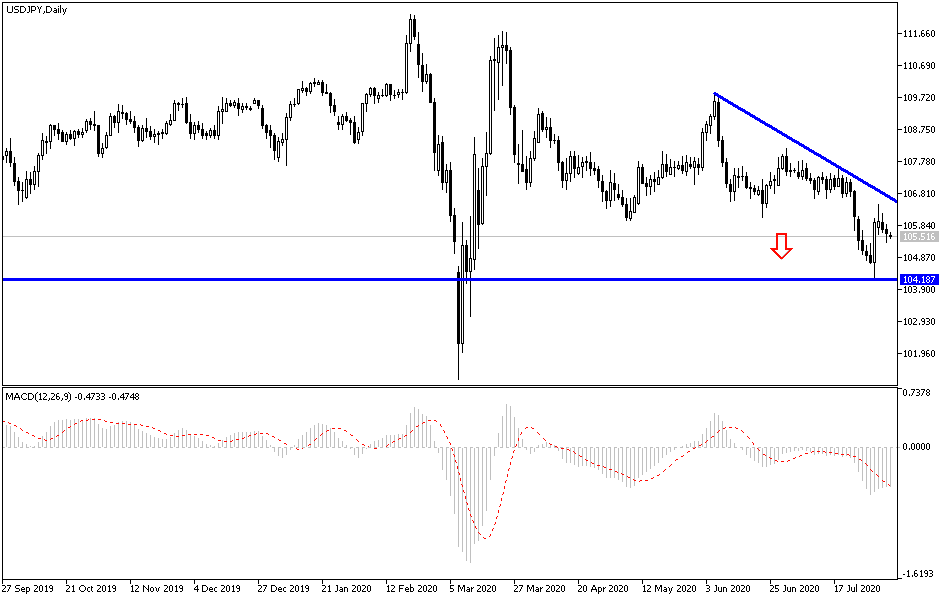

According to the technical analysis of the pair: The general USD/JPY trend is still downward, and despite the pair reaching strong oversold areas, the pressure on the dollar is still strong and continuous. It may take a lot of time for the return of confidence, as the tensions between the United States and China are present and increasing and the COVID-19 virus is not over and political anxiety is expanding with the approaching presidential elections. The closest buying levels for the pair are currently at 105.20, 104.40, and 103.75 respectively. The 108.00 resistance remains the key to the upside reversal. The pair will react to the announcement of the weekly jobless claims numbers.