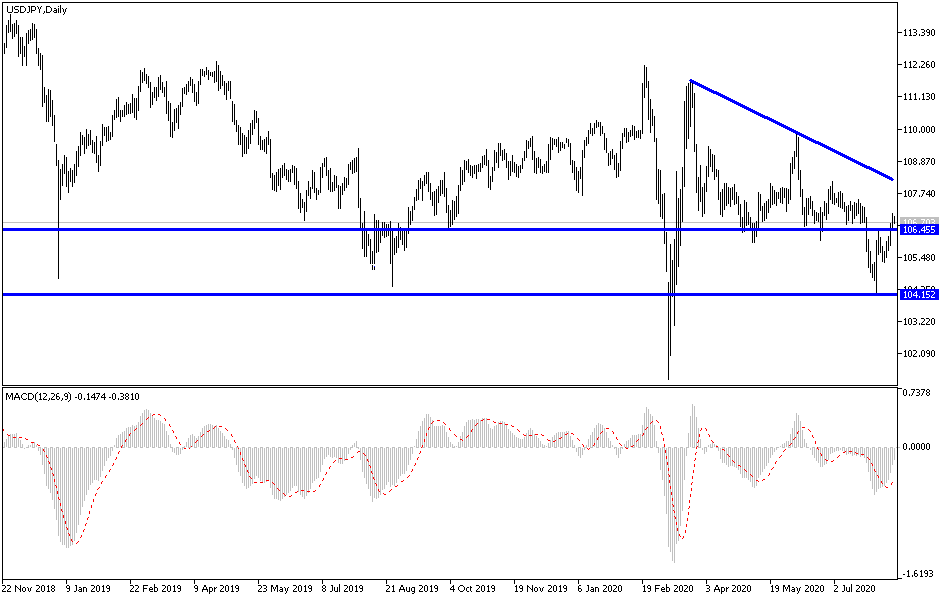

For the fifth day in a row, the USD/JPY pair is trying to correct upward, but gains did not exceed the 107.01 resistance before settling around 106.85 at the time of writing. Technically, the upward correction is still in need of momentum to breach the 108.00 resistance, the most important leg of the bulls. Despite the higher than expected rise in US inflation levels, the US currency did not get stronger gains, as the inflation in the country is still very far from the Federal Reserve’s target, and therefore bank policy results did not change anything.

The US Labor Department reported that last month's increase in the Consumer Price Index coincided with a 0.6% rise in June. The rise was about twice what economists had predicted. But inflation is still under control. Consumer prices increased by only 1% over the past year. Gasoline prices rose by 5.3% from June to July but have decreased by -20.3% in the past 12 months as the recession of the Coronavirus has prevented many Americans from driving. Food prices fell 0.4%, the first decline since April 2019. Groceries fell 1.1% while the cost of eating out increased by 0.5%.

Excluding volatile food and energy prices, consumer prices rose 0.6% last month compared to June - the largest monthly increase since January 1991. However, the so-called core inflation rose only 1.6% from the previous year. Consumer spending rebounded strongly in June as states began easing lockdowns - despite the recent surge in coronavirus cases forcing some companies to delay or cancel plans to reopen.

"July data confirmed that US inflation followed a sharp recovery in consumer spending this summer, stabilizing the downtrend in prices," said a research note from Continent Macro Advisors. They added, "This report was not sufficient to turn the direction of inflation upward, but it helped alleviate concerns in the near term about deflation scenarios for the economy." Deflation and lower prices can hurt the economy by inducing consumers to delay spending because they believe prices will fall in the future.

According to the technical analysis of the pair: I do not see any change in my technical view for the USD/JPY, despite recent gains, the general trend remains to the downside as long as the pair is stable below the resistance levels AT 108.00 and 110.00, respectively. The bears' control over the performance may be strengthened if the pair moves towards the support levels at 105.90 and 104.80, respectively. The pair will react to the Japanese producer price announcement and the number of US jobless claims. This is in addition to the extent of investor risk appetite with the interaction with the course of US-Chinese tensions and the economic stimulus plans of the United States, in addition to the anxiety of the US presidential election, which began to appear through the results of recent opinion polls, which indicate a threat to Trump's future.