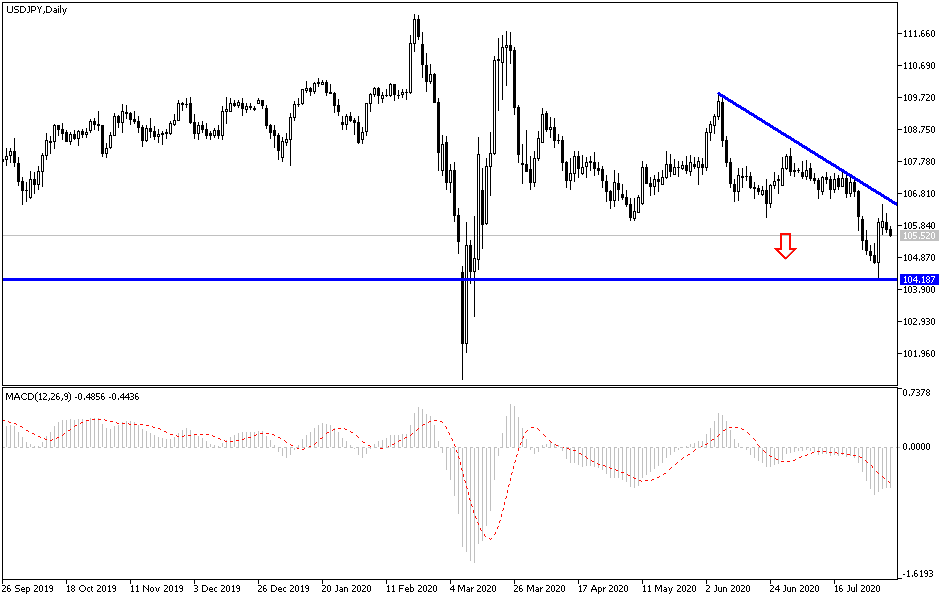

USD/JPY: Will the pair return to the 104.00 support again?

Today’s USD/JPY Signals

- Risk 0.75%.

- Trades may only be taken between 8 am New York time Thursday and 5 pm Tokyo time today.

Short Trade Ideas

- Go short following a bearish price action reversal on the H1 time frame time immediately upon the next touch of 107.00 or 106.25.

- Put the stop loss 1 pip above the local swing high.

- Adjust the stop loss to break even once the trade is 20 pips in profit.

- Remove 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to ride.

Long Trade Ideas

- Go long following a bullish price action reversal on the H1 time frame immediately upon the next touch of 104.40 or 105.20.

- Put the stop loss 1 pip below the local swing low.

- Adjust the stop loss to break even once the trade is 20 pips in profit.

- Remove 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to ride.

The best method to identify a classic “price action reversal” is for an hourly candle to close, such as a pin bar, a doji, an outside or even just an engulfing candle with a higher close. You can exploit these levels or zones by watching the price action that occurs at the given levels.

USD/JPY Pair Analysis

As I mentioned yesterday, the bear's control on the USD/JPY path remains strong, and currency traders totally ignored the movement of technical indicators towards oversold levels. The pressure on the US currency is still the strongest, and it is increasing due to tensions between the US and China and the daily record update of the coronavirus cases and deaths and the lack of consensus this time to pass emergency stimulus plans by Congress. Trump's chance to win the presidential election next November is greatly diminished. Pushing the pair to the 105.25 support level will support a stronger bearish move towards the 104.00 psychological support, respectively.

Price pressures in Tokyo during July were stronger than expected. Therefore, the Core CPI increased by 0.6%, which is twice the average forecast in the Bloomberg Survey by 0.3% in June. Inflation, which excludes fresh food, also doubled to 0.4% from 0.2%. Excluding fresh food and energy, the Tokyo CPI rose 0.6%, which bodes well for national figures (August 20), as the main rate was 0.1%, and the base rate was zero in June.

American politics has shifted to a less supportive position. Although many are still talking about how the Fed bought everything, therefore the fact of the matter is that its balance sheet has fallen for five of the past seven weeks, and has shrunk by about $220 billion. The dollar tended to decline during this period, while the European Central Bank and the Bank of Japan's budgets were still expanding. Now financial support will decrease. Where the federal government spent about $109.5 billion on unemployment benefits last month after nearly $116 billion in June. Almost at the same time, Americans will lose $600 a week, which will be a material loss of income this month, which will have an inevitable impact on US spending.

Regarding the US dollar, ISM services PMI, ADP survey numbers for jobs in the non-agricultural sector, and trade balance data will be announced. As for the Japanese yen, it will be affected by the comments of the Bank of Japan Governor Kuroda.