This weekend, Brazil crossed the 3,000,000 level when it comes to Covid-19 infections, and Latin America’s largest economy registered over 100,000 casualties. The pandemic continues to depress global trade while limiting domestic demand for imports. A silver lining for Brazil is the record trade surplus it records, adding necessary capital to its finances. July exports clocked in at $19.56 billion against imports of $11.50 billion, resulting in the largest-ever monthly trade surplus of $8.06 billion. The USD/BRL extended its advance and is now challenging the strength of its resistance zone.

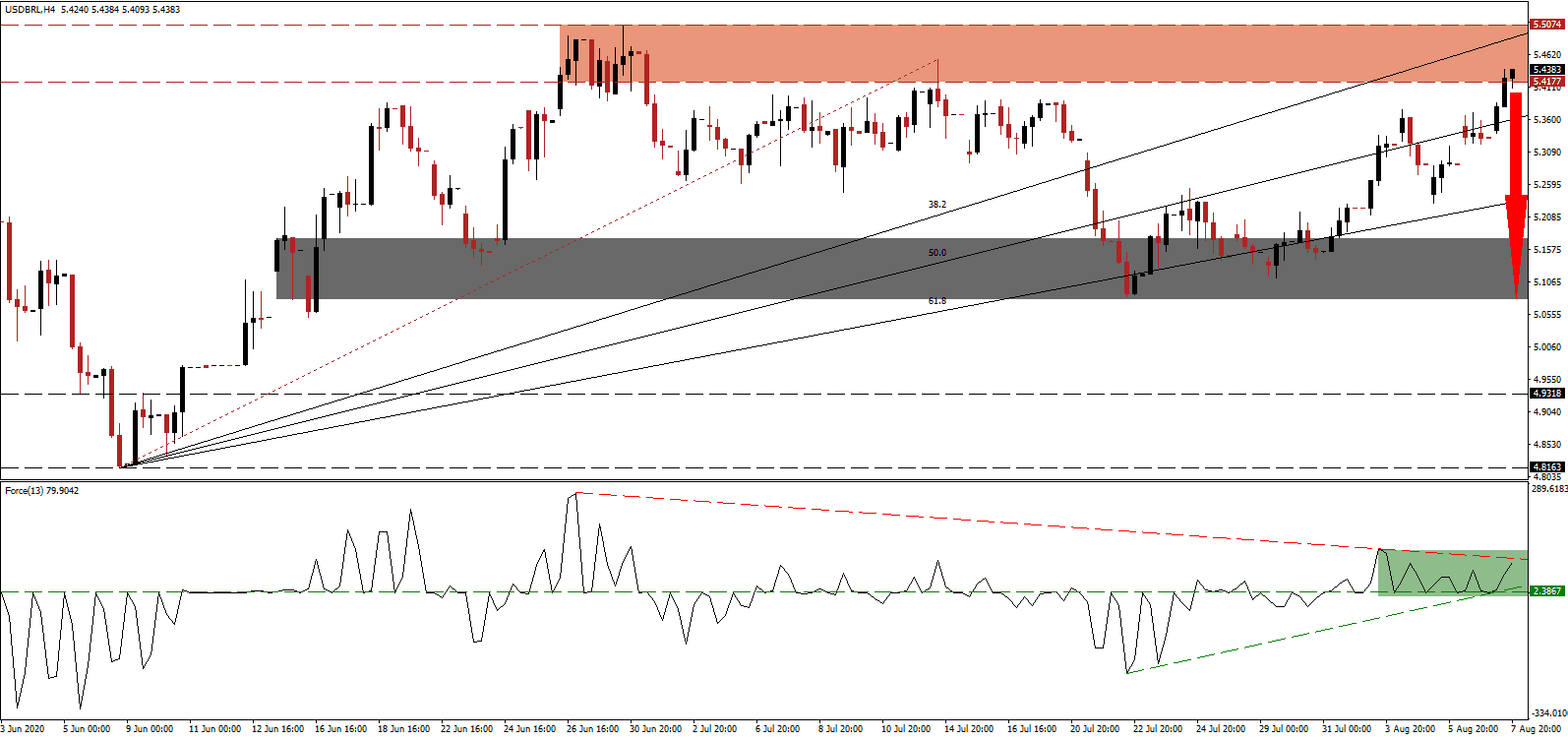

The Force Index, a next-generation technical indicator, reversed off of its horizontal support level after a series of lower highs, as marked by the green rectangle. It remains under downside pressure from its descending resistance level, which is anticipated to reject the most recent bounce and collapse it below its ascending support level. A move in this technical indicator below the 0 center-line will cede control of the USD/BRL to bears.

While the agricultural sector is driving the trade surplus, where exported volumes for July surged by 21.1% due to the weaker Brazilian Real and higher demand from Asia, the rest of the economy continues to struggle. The unemployment rate rose to 13.3% in the second quarter per data from the Instituto Brasileiro de Geografia e Estatística (IBGE), and over 8,900,000 lost their jobs. After the USD/BRL moved inside of its resistance zone located between 5.4177 and 5.5074, as marked by the red rectangle, more upside remains challenging due to worsening economic conditions in the US, adding breakdown pressures.

With more than 5,000,000 Covid-19 infections, the US accounts for over 25% of global cases and recorded over 165,000 deaths. US President Trump signed an executive order extending government subsidies to the unemployed by $400 per week after Congress failed to pass a fifth stimulus package. It represents a decrease from the $600 and will add to economic stress moving forward. The ascending 61.8 Fibonacci Retracement Fan Resistance Level is favored to end the advance in the USD/BRL. A breakdown is expected to initiate a profit-taking sell-off, driving price action into its short-term support zone located between 5.0790 and 5.1742, as identified by the grey rectangle.

USD/BRL Technical Trading Set-Up - Profit-Taking Scenario

Short Entry @ 5.4375

Take Profit @ 5.0800

Stop Loss @ 5.5350

Downside Potential: 3,575 pips

Upside Risk: 975 pips

Risk/Reward Ratio: 3.67

Should the Force Index eclipse its descending resistance level, the USD/BRL could attempt a breakout. Forex traders may consider more upside from present levels as an excellent short-selling opportunity. The US labor market continues to slow down significantly, and tens of millions of jobs remain lost, with economists cautioning against a multi-year recovery. The upside potential is limited to its resistance zone located between 5.7470 and 5.8562.

USD/BRL Technical Trading Set-Up - Limited Breakout Scenario

Long Entry @ 5.6250

Take Profit @ 5.8000

Stop Loss @ 5.5350

Upside Potential: 1,750 pips

Downside Risk: 900 pips

Risk/Reward Ratio: 1.94