Paulo Guedes, the Minister of the Economy of Brazil, reiterated views that the country will face one or two more challenging months due to the Covid-19 pandemic. He added that the government would debate extending the emergency aid to the poorest Brazilians as a result of the lasting economic damage. Over 65 million Brazilians receive R$600 per month, and already extended by two months in July. Thanks to the widespread success, it could be implemented to the end of 2020. The USD/BRL faces a rise in bearish pressures inside of its short-term resistance zone from where a breakdown is anticipated.

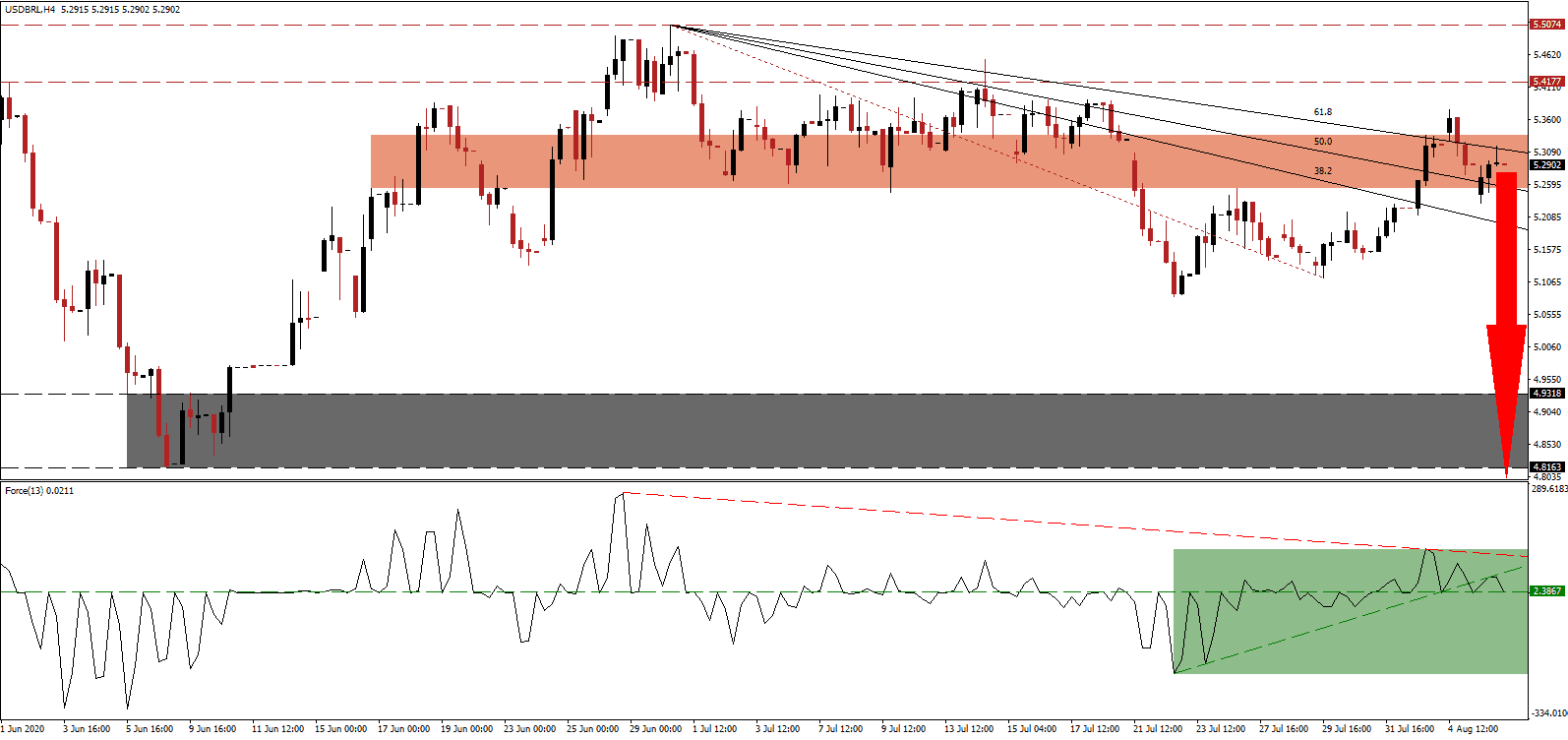

The Force Index, a next-generation technical indicator, formed a series of lower highs, confirming the accumulation of bearish momentum. Following the breakdown below its ascending support level, as marked by the green rectangle, the descending resistance level is expected to pressure this technical indicator below its horizontal support level. Bears wait for a move below the 0 center-line to regain complete control over the USD/BRL.

Fitch Ratings cautioned that Brazilian banks would face a severe risk of a spike in impaired loans. While capitalization increased before the Covid-19 pandemic related to compliance with Basel III requirements, deterioration of credit quality due to the recession resulted in a downgrade of the banking sector to negative. High default rates are expected from retail loans and small-to-medium enterprise (SME) lending. After the short-term resistance zone located between 5.2520 and 5.3357, as identified by the red rectangle, ended a minor short-covering rally, breakdown pressures are expanding.

President Jair Bolsonaro, under international pressure, banned forest fires during the four-month dry season. He also approved military operations against deforestation, in an attempt to entice foreign investors to remain in Brazil. Protecting the Amazon is also a requirement to sign a trade deal with the European Union (EU) and to join the Organization for Economic Cooperation and Development (OECD). The descending 61.8 Fibonacci Retracement Fan Resistance Level is favored to guide the USD/BRL into its support zone located between 4.8163 and 4.9318, as marked by the grey rectangle.

USD/BRL Technical Trading Set-Up - Breakdown Scenario

Short Entry @ 5.2900

Take Profit @ 4.8000

Stop Loss @ 5.3800

Downside Potential: 4,900 pips

Upside Risk: 900 pips

Risk/Reward Ratio: 5.44

A sustained advance in the Force Index above its ascending support level, serving as resistance, may lead to a second push higher in the USD/BRL. The upside potential is confined to its resistance zone between 5.4177 and 5.5074, and Forex traders should consider this a secondary short selling opportunity. Yesterday’s ADP data for July showed a sharp deterioration in the two-month labor market recovery amid a surge in Covid-19 cases, adding to bearish pressures on the US Dollar.

USD/BRL Technical Trading Set-Up - Confined Breakout Scenario

Long Entry @ 5.4200

Take Profit @ 5.4900

Stop Loss @ 5.3800

Upside Potential: 700 pips

Downside Risk: 400 pips

Risk/Reward Ratio: 1.75