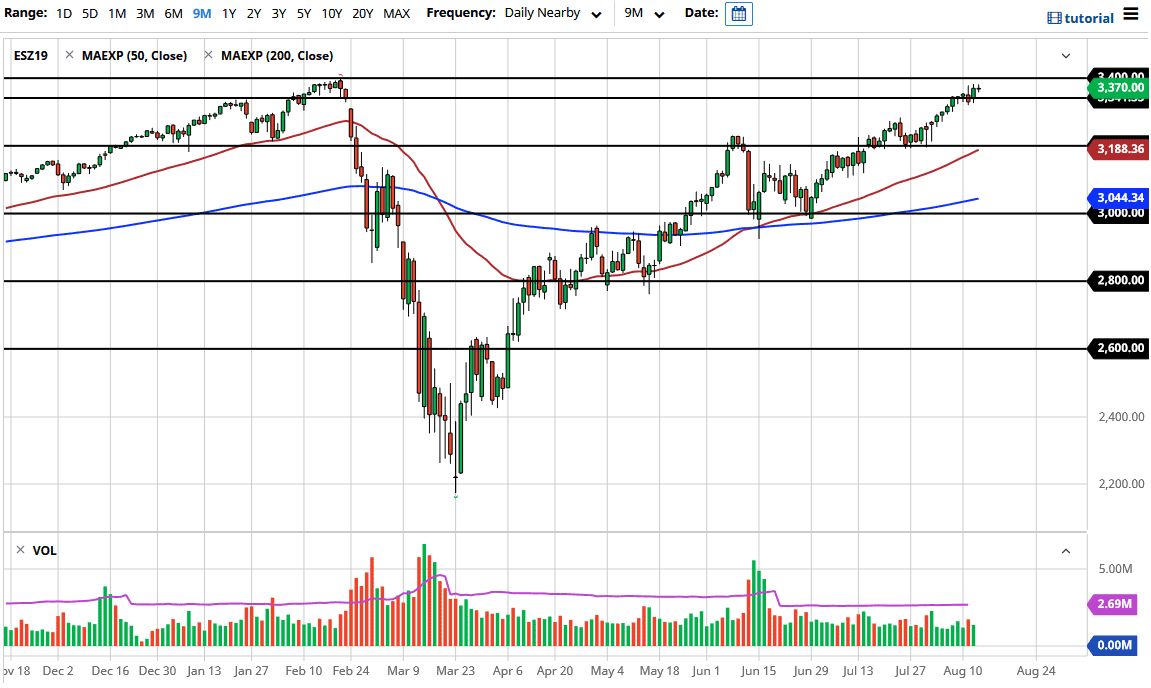

The S&P 500 and a quiet session on Thursday, as we are starting to see a lot of issues with trader interests. After all, most of whom are focusing on holidays right now, as this is typically the vacation season. This being the case, we may struggle a bit to continue moving to the upside, however some traders will look at any pullback as a potential buying opportunity. For myself, I do believe that pullbacks are buying opportunities as the all-time high just above makes a juicy target for a lot of traders to go reaching towards. This of course is the 3400 level, and the NASDAQ has already broken the highest several times, so the S&P 500 should more than likely follow given enough time.

Looking at the neutral candlestick for the trading session, I would not read too much into it, because the market certainly has a lot of reasons to go higher, not the least of which of course is the number one reason why the markets have rallied for the last 12 years or so, the Federal Reserve. As long as the Federal Reserve is going to flow of money into the markets, it makes sense that stocks will continue to gain due to the fact that the purchasing power of the greenback continues to fall, so people are starting to buy assets. The most common asset to buy of course would be stocks.

We have gotten through the earnings season relatively unscathed, so at this point I think it is only a matter of time before we do break out above the all-time highs, and once we clear that psychological barrier it is likely we go looking towards the 3500 level which in and of itself is a relatively juicy target. It is a large, round, psychologically significant figure and therefore most money managers will look at that as a potential area that the market goes to. I would expect a bit of trouble getting above there in the short term, but ultimately, we probably go above there as well. As long as the US dollar continues to get hammered by the central bank, I do think that this is essentially a market that you cannot short on the whole, although we may get the occasional pullback. I look at those pullbacks as value and would be especially interested in the S&P 500 closer to the 3200 level as it would show a lot of previous support, and of course the 50 day EMA underneath there.