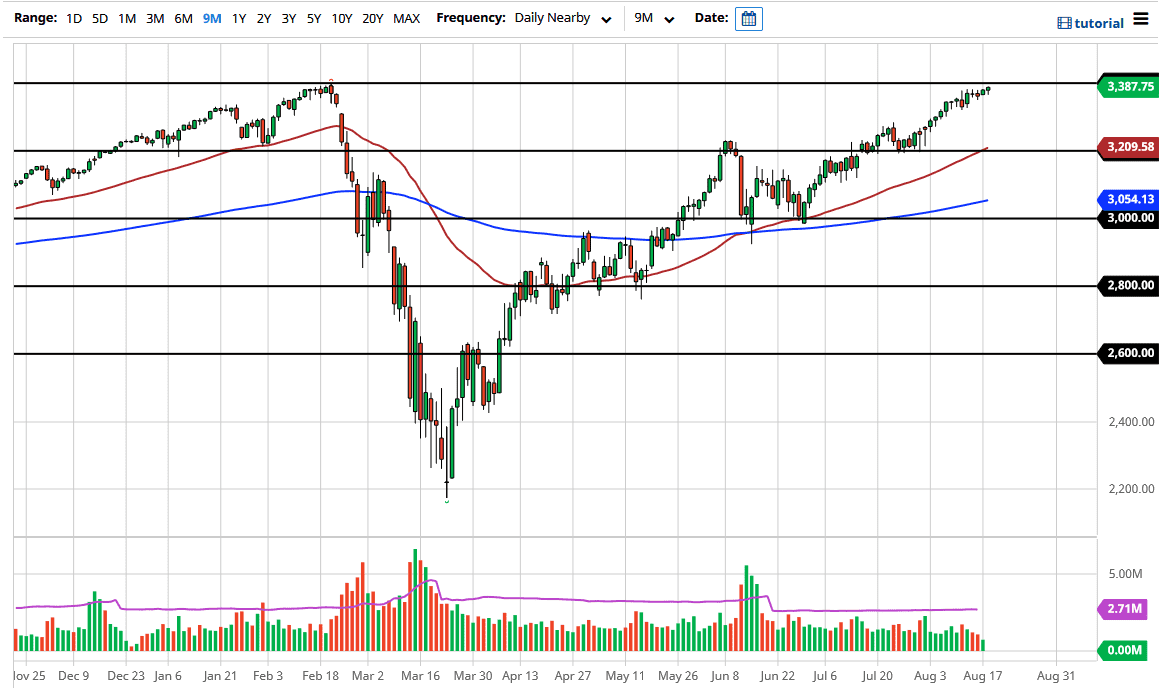

The S&P 500 has initially pulled back during the trading session on Tuesday but then turned around to show signs of life again. Ultimately, this is a market that should see plenty of bullish pressure and I think that we will eventually break out above the 3400 level. By doing that, then the market is free to go towards the crucial 3500 level, which is a large, round, psychologically significant figure. At that point, I would anticipate that there could be a bit of psychological resistance.

Underneath, I think there are plenty of buyers and simply waiting for some type of value on pullbacks is a viable strategy as well, as short-term traders will continue to jump into the market and take advantage of the market every time it dips. The market has been in a relentless Drive higher, so it should not be overly surprising that we would continue the uptrend. If we can break above the 3400 level it will be a lot like a “beach ball being released from underwater.” It will pop higher, and then we will continue to go to the upside. After all, it was the all-time highs so there is a certain amount of psychological concern as we have gotten this time.

To the downside, I believe that the 3200 level would be massive support, as the 50 day EMA is right there as well, and we have seen that area offer a significant amount of pressure as well. Ultimately, I think that a move to that level would be very healthy as it would continue the overall uptrend with the idea of value jumping into this market at the same time. Having said that, it does not look like we are going to get there because every time we pull back just the slightest, there seems to be plenty of people jump in and try to take advantage of those dips. The Federal Reserve continues to flood the market with currency, and therefore people are trying to pick up bits and pieces of assets in order to preserve wealth overall. Ultimately, this is a simple function of liquidity being crammed down the throat of every trader out there. Shorting the market has been a great way to lose money most days, so therefore simply looking for pullbacks or breakouts is the only way I have been able to trade it for some time.