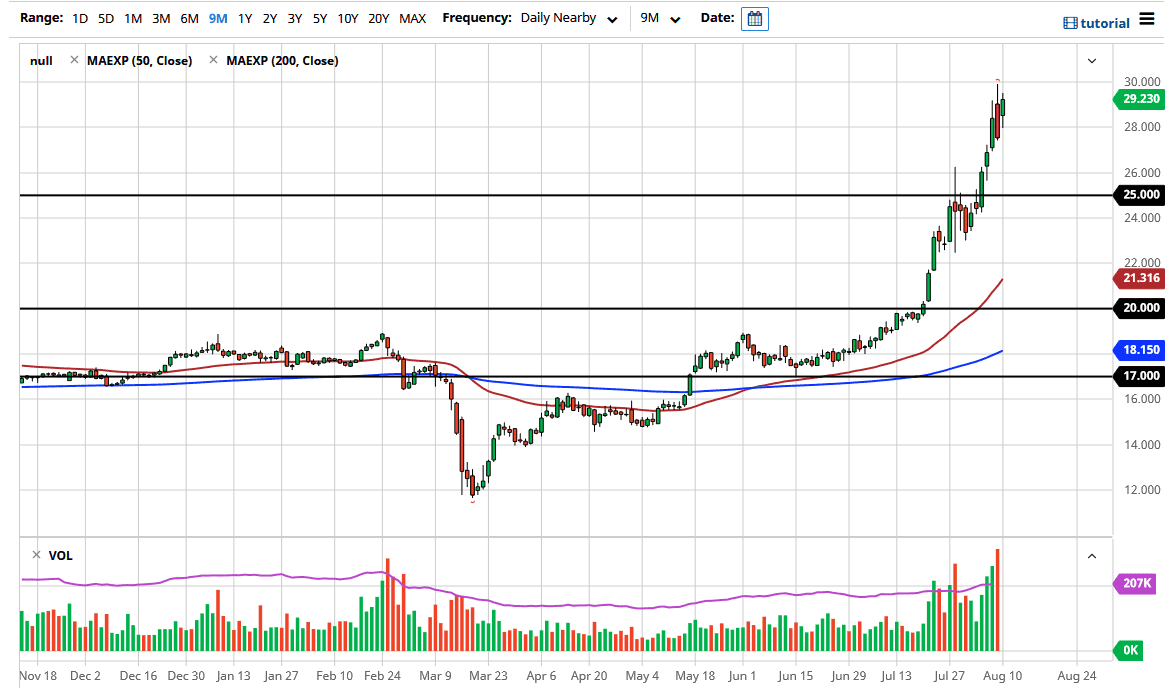

The silver market gapped higher to kick off Monday’s session before pulling back towards the $28 level. However, we have rallied from there and then shot straight through the roof again. Silver is getting dangerously parabolic, but it does not seem to matter to traders at the moment. Things like this always pull back, at least in the short term as there will be a capitulation sooner or later when the selling begins. This is why I am very cautious about buying silver at these high levels, especially as we are testing the $30 level, an area that has a certain amount of psychological importance attached to it. With that in mind, I like the idea of buying on the dips, but we have not dipped far enough.

The $28 level underneath has offered support during the day, but I think we are more likely to see a move towards $26 eventually. That does not have to be today, nor does it have to be this week. However, markets cannot go straight up in the air forever. At the very least this market needs to see a pullback and grind sideways in order to make an offer at least the slight attraction of being fair value. It is difficult to buy silver once it is all the way straight up in the stratosphere like it is now, and only the foolish are jumping in.

Chasing the trade all the way up here after silver has risen 50% in about 2 ½ weeks is like asking someone to take your money. Sooner or later, they will come and take it. With that being said I am very cautious about buying silver, but I do recognize that if we were to break above the $30 level it would probably bring in fresh buying. That is the trick with silver: when it takes off it tends to go parabolic. That makes it very difficult to day trade. If you are more of a longer-term trader, then you are probably still in this trade. However, if you are more of a swing trader, you simply need to wait for value to occur, something that is clearly not happening right now. At this point, all I can do is sit here and watch silver, I know that buying silver at these high levels is extraordinarily dangerous and the fact that my email box is full of people asking me about silver tells me just how close to a short-term top we really could be.