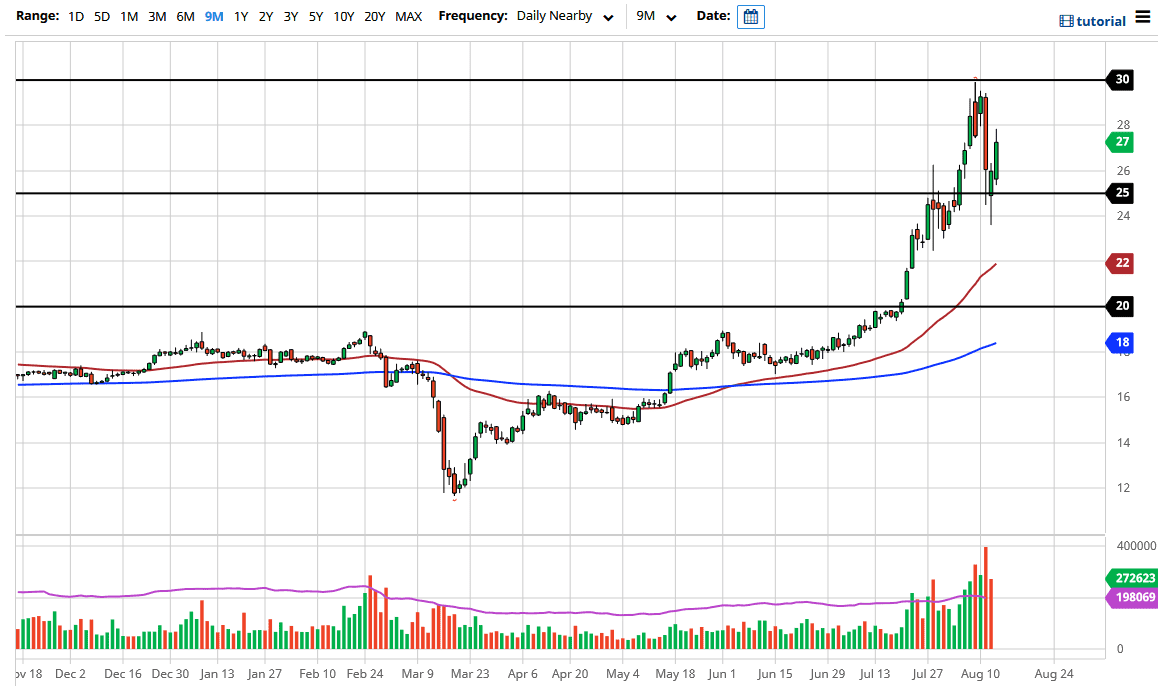

After a brutal session on Tuesday, the Wednesday session was quite nice as it formed a hammer in the silver market. Now that we have had Thursday put into the books, we can see that there was a continuation of the bullish pressure and therefore I do believe it is only a matter of time before this pair reaches the highs again. However, I do not like the idea of silver shooting straight up in the air. After all, we have already seen what an unstable market will do, and therefore I would be cautious if this market found itself at $30 rather quickly. I think the best thing that can happen is that we get short-term back-and-forth action with a slight upward bias. That is much more sustainable than what we had seen previously.

The $25 level is an obvious support level that is going to continue to be paid attention to, so keep your eyes open for any type of buying opportunity down in that general vicinity. However, I do not know that we get all the way down there anytime soon. Short-term pullbacks will more than likely be bought as the trend is decidedly bullish. Furthermore, the Federal Reserve will continue to loosen monetary policy and flood the market with greenbacks, so therefore it is going to take more of those greenbacks to buy an ounce of silver. This is simple math, which continues to be one of the easiest ways to trade a market. Having said that, that does not mean that you simply buy with both hands, rather you look for value.

If we do break above the $30 level, and I think we will eventually, the market could go all the way to the $50 level by the time this is all said and done. When silver breaks out the way it has, that seems to be a magnet for price over the longer term. However, you should be very cautious about trading silver because it can be extraordinarily volatile. At this point you cannot be a seller. It is a question of whether or not you are on the sidelines, or if you are buying silver. It is a one-way trade, and that should continue to be the case. Looking at the size of the candlestick for the Thursday session, it does still look relatively strong, but not overly done quite yet. Keep in mind that a lot of traders are away for vacation so volatility could be a bit surprising at times.