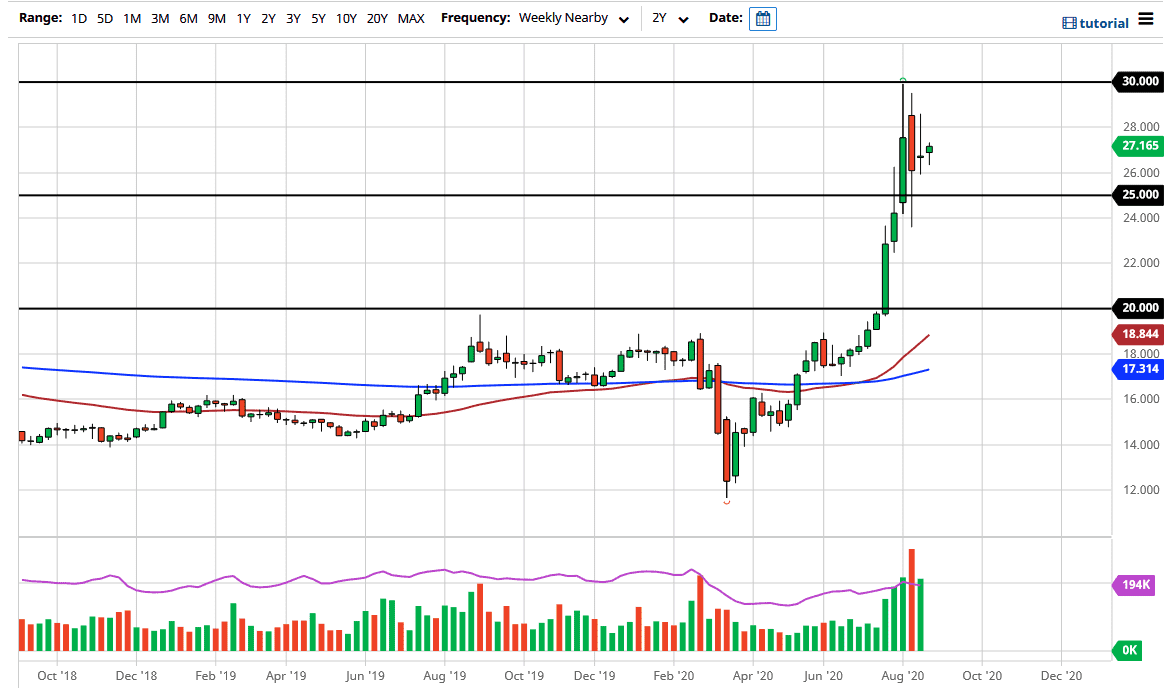

The silver markets should continue to be very volatile into the month of September, because there are a massive amount of reasons why this market is moving at the same time. The first, biggest, and perhaps the most obvious reason of course is the fact that the Federal Reserve is looking to loosen its monetary policy. Having said that, this should devalue the US dollar, and the fact that other central banks around the world are doing the same thing certainly does not hurt the argument for higher silver prices either. With that in mind, I do think that is the longer-term trajectory in this market.

Having said that, silver may be a little overdone at this point. It is a little bit more difficult to discern whether or not the silver market is overbought, because silver tends to be very erratic to say the least. It will do almost nothing for weeks on end, and then suddenly shoot straight up in the air. As far as major breakouts and macroeconomic events are concerned, it will literally blast into the stratosphere.

This is perhaps a function of the fact that the contract is relatively thin at times, and it is kind of its own monster. Silver of course reacts to central bank policy and what central bankers are doing, but they also are very sensitive to the industrial scenario. What I mean by this is that silver tends to do well when industry is chugging along, and struggle when it is not. It is because of this in the fact that the global economy is almost certainly slowing down, is the fact that I believe that this is more US dollar driven than anything else.

With all that in mind, I do anticipate that we will see some type of short-term pullback in the silver market early in the month, followed by value hunters coming back into pick it up. The problem of course is that we will need to see some type of daily hammer or the like to get involved. Do not be surprised at all to see silver down $2.00, or even more in a single day. That being said, I believe that there is supported $25, $22, and most certainly at $20.00. I have no interest in shorting silver, rather I am looking to pick it up “on the cheap” as it is offered during the month of September.