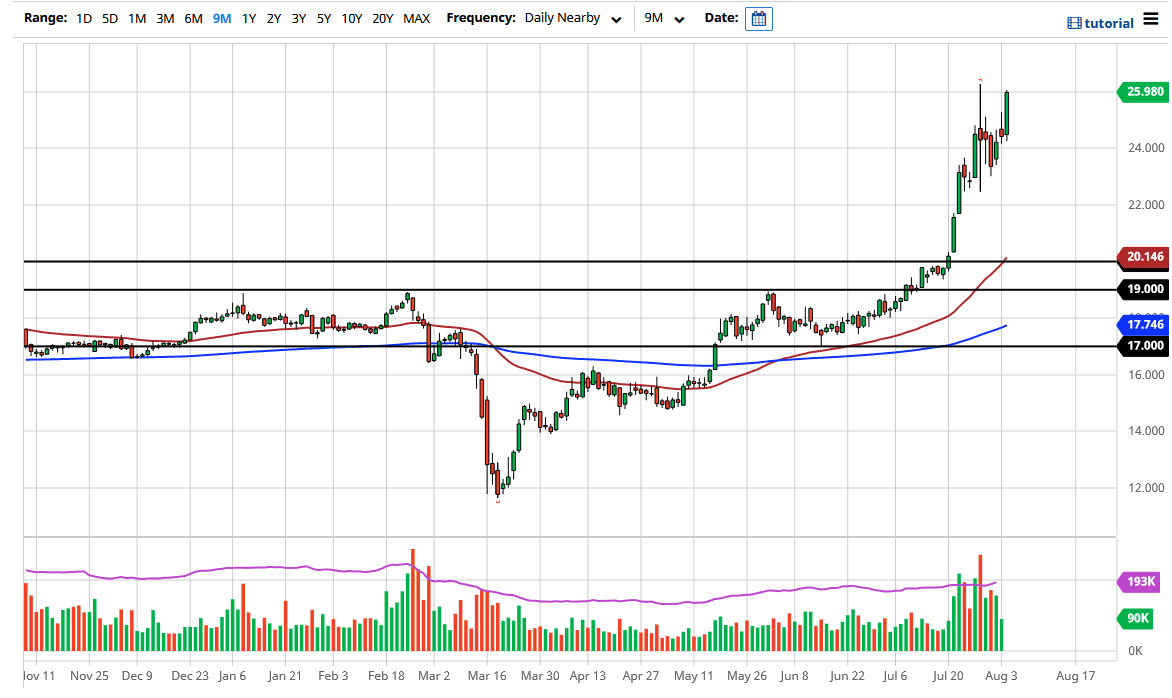

The silver market has shot straight up in the air during the trading session on Tuesday as we continue to see bullish pressure in the precious metals sector. It is worth noting that the gold market also rallied at the same time, breaking out to a fresh high. With that being the case, it looks like gold is going to drag silver higher with it. We are testing the massive candlestick from last week, and if we can break above there it is likely that we continue to go much higher. In the meantime, you have to look at pullbacks as potential buying opportunities and clearly you have not been able to sell silver for quite a while.

There are three levels that I am paying attention to right now, the $22 level to the bottom, the $24 level as a medium point, and the $26 level as resistance. If we break above the $26 level, then I think that puts another $4 into the market based upon the potential accumulation phase that we are just now breaking out of. Pullbacks at this point obviously are buying opportunities and you clearly cannot sell this market as long as the Federal Reserve continues to flood the market with US dollars. This is a market that is a bit parabolic, but obviously is bullish so the only thing you can do is wait for a decent price or another break out for the market to tell you it is time to go long again.

The size of the candlestick is rather impressive, and the fact that we are closing at the top of it also suggests that we are going to go higher given enough time. Silver is a very volatile and dangerous market though, so you need to be cautious about your position size as it can move rather rapidly. In fact, I have been telling a lot of my friends that it might be better to simply short the US dollar than it is the buyer precious metals right now as they are so overdone. That being said, silver does have a long history of going parabolic every time something like this happens, so it looks like it is more of the same. Longer-term, I would not be surprised at all to see this market go looking towards the $50 level, but clearly, we have to get through a lot of real estate before that happens.