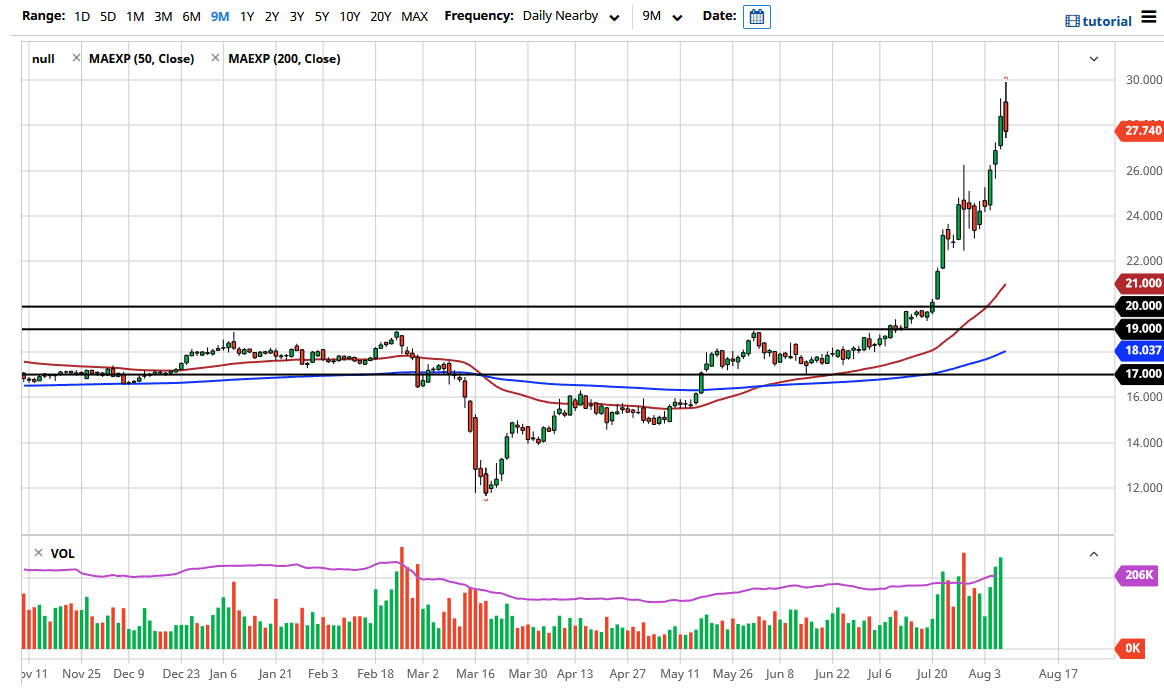

Silver markets have been volatile during the trading session on Friday, initially spiking towards the $30 level before pulling back. In fact, as we are approaching the end of the session, we are below the $28 level, meaning that people that bought at the top are now feeling the heat. This is a market that will continue to see more gravity take place, as it had gotten far ahead of itself. In fact, it looks like we may have a couple of days for the US dollar to strengthen.

Remember, we buy precious metals that you are essentially buying or selling like the US dollar at the same time as they are priced in that currency. That being said, if the US dollar strengthens a bit it makes sense that precious metals may suffer. Ultimately though, this is a market that I think eventually finds buyers underneath, but we need to fall a bit further before that is a viable trade. I think that the $24 level makes quite a bit of sense, as the market has seen an impulsive move from that level. Obviously, people will be willing to take profits, and some are getting absolutely smoked after buying at the top.

All of that into account, you have to keep in mind that the Federal Reserve is going to continue to print greenback, and that works against the value of the US dollar. The market breaking down below the bottom of the candlestick for the trading session on Friday would signify that we are ready to drop, but ultimately this is simply going to be a buying opportunity. Those who try to short the market may find themselves suddenly squeezed in the wrong direction, and clearly there will be some of you out there that are looking to “short a market that is too expensive.” That is something that you can only do with the pockets, something retail traders simply do not have. Ultimately, when we pull back, I think there will be plenty of value hunters looking to get involved or people who have been short trying to get out of a very bad situation and buying silver in order to reverse shorts. No market can go in one direction forever, so I think that it is only a matter of time before you have to get one of these corrections. Look at this correction as an opportunity though if you can be patient enough.