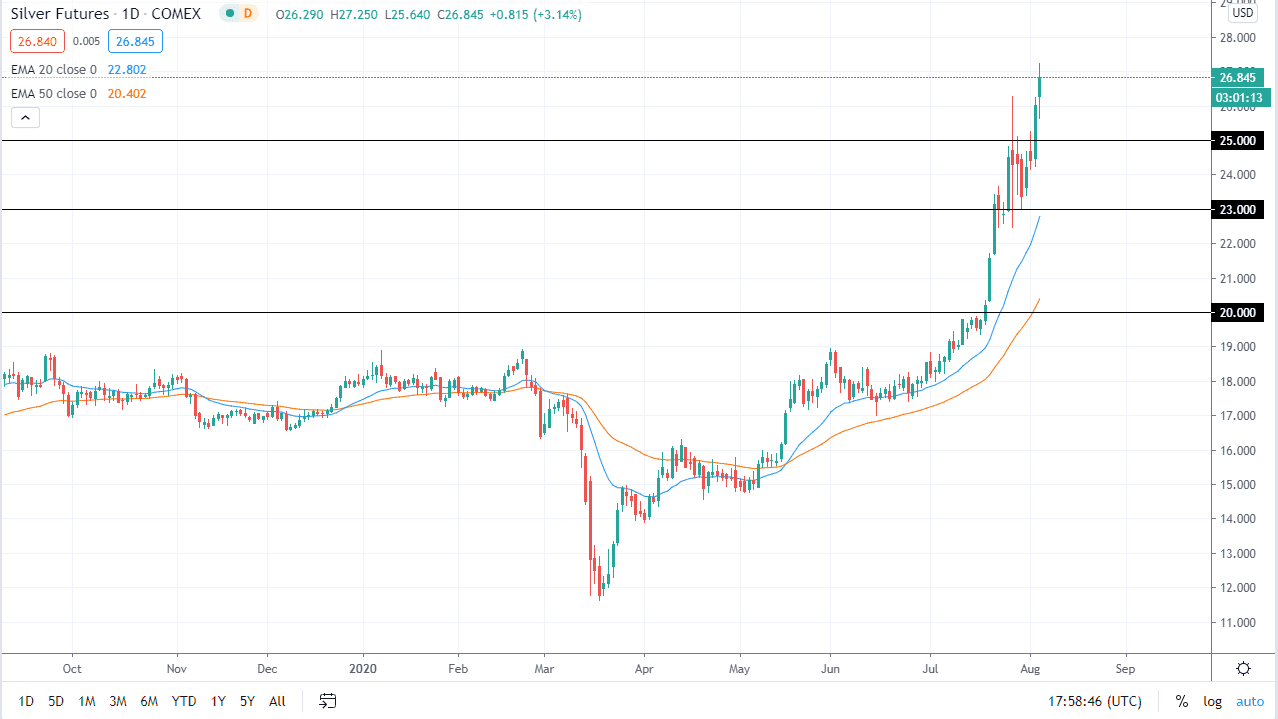

The silver market gapped higher to kick off the trading session on Tuesday then pulled back a bit to fill the gap and go below there. After that, the market turned around to shoot straight to the upside, breaking above the $27 level. That being said, we are starting to see a little bit of a give back at the end of the day so it makes sense that we would be looking a little less enthusiastic. Longer-term, we are clearly in an uptrend so if we get a nice pullback it should be a nice opportunity to pick up value in what is a very positive trend overall. Quite frankly, we desperately need to see some type of pullback so that we can pick up silver “on the cheap”, instead of paying up for it.

To the downside, I see the $25 level as the initial support level, but I think underneath the $23 level is an even better place to start buying. Underneath there, the market goes looking at moving averages in finally the $20 level. I do not see the market going back to the $20 level, but I look at that as the absolute “floor” in the uptrend. One thing is for sure, we have gotten a bit ahead of ourselves so this pullback will be welcomed. Think of it this way: there are people who have just started to buy silver at $27 an ounce. Those traders are probably going to have a very uncomfortable couple of sessions, perhaps waiting for quite some time to get back to breakeven.

If you can get some type of value on the pullback that gives you an opportunity to take advantage of what is clearly a trend that is just starting to get fired up. Having said that, markets do not go straight up in the air forever, and it is truly foolish that people are out there buying silver at this point, even though I think eventually they will be okay. Timing is everything, and that is especially true when you are talking about the futures markets or anything that has any type of leverage whatsoever. Silver markets do tend to be very erratic, so you need to be especially careful when you get involved in this market. Shorting obviously is no thought at this point in time as we have seen so much buying.