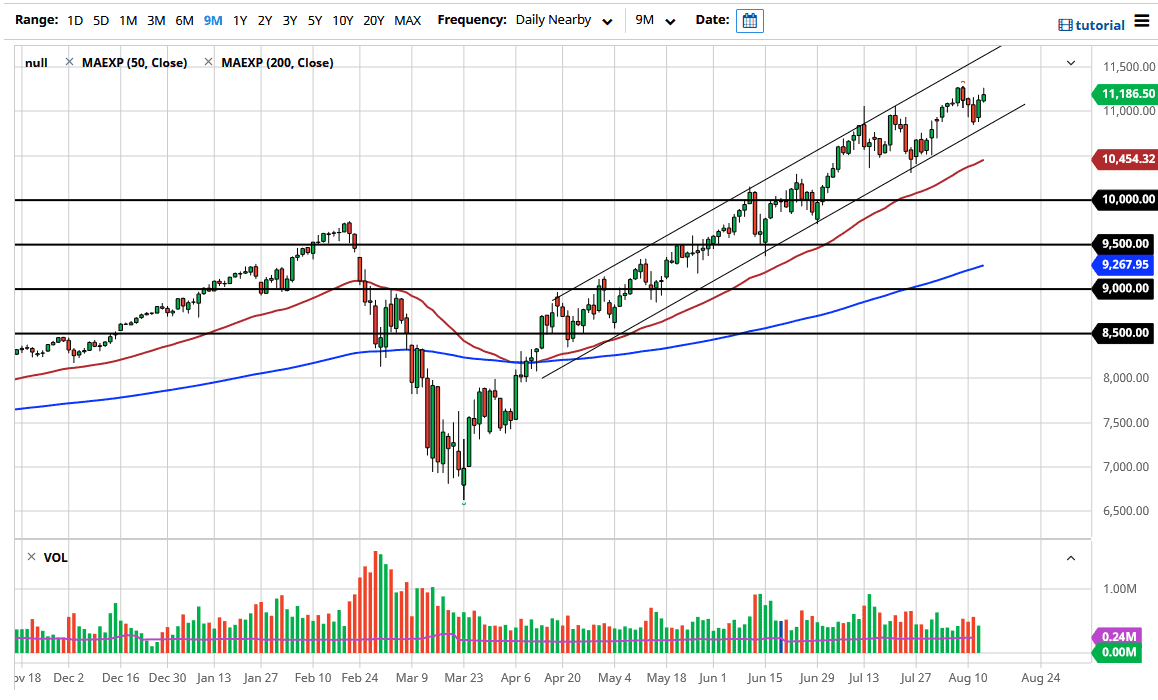

The NASDAQ 100 rallied a bit during the trading session on Thursday but gave back about half the gains. By doing so, the market shows that it is going to struggle little bit, but as we head into the weekend it is not a huge surprise to see this market go back and forth overall, and therefore grind its way into the weekend. Nonetheless, this is a market that is bullish and therefore I have no interest whatsoever in trying to short this index. The 11,000 level should be rather supportive, mainly because of the large, round, psychologically significant figure and of course the uptrend line from the bottom of the channel.

The shape of the candlestick is a bit of a shooting star, but at the end of the day we are still very much in a large uptrend and it is not at an extreme high. If we were to break down below the uptrend line, then it is likely that the market could go to the 10,500 level underneath, especially near the 50 day EMA just below. All things being said, I think it is only a matter of time before the buyers return so I would welcome some type of breakdown. In fact, I would really love to see the NASDAQ 100 drop down towards the 10,000 level, but I do not see it happening anytime soon.

As long as the Federal Reserve continues to flood the market with liquidity, it makes quite a bit of sense that the stock markets will continue to be one of the main beneficiaries as there is plenty of cheap money out there for large Wall Street firms to take advantage of. All things being equal, I do believe that we go looking towards the 11,500 level eventually, but it may take several days to get there. I have no interest in shorting this market because as you know it is highly levered and influenced by a handful of stocks that everybody loves. This of course includes Microsoft, Alphabet, Apple, Facebook, and of course Netflix. That being said I think it is only a matter of time before we go higher, and any dip should be thought of as a potential opportunity for value to show itself. I do believe that we are looking at a scenario where the longer-term trend should continue to reassert itself