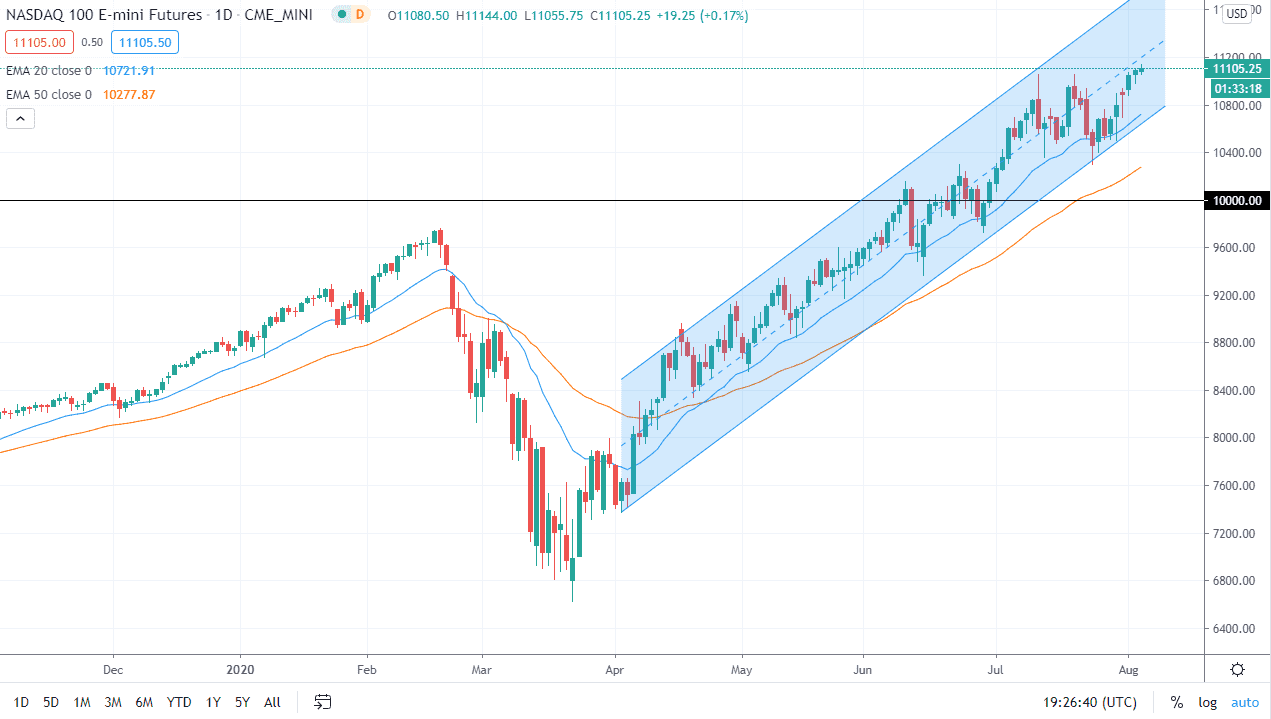

The NASDAQ 100 has gone back and forth during the trading session on Tuesday as we continue to see a lot of money being thrown into the marketplace overall. However, the market has slowed down a bit so it looks likely that we may have to pull back in order to find more buyers. Ultimately, we are at the midpoint of the overall channel that we have been following, and we are in the midst of the earnings season so there could be a lot of erratic momentum, but at this point in time I think that the trend is very obvious, and the Federal Reserve is the only game in town. As long as there is liquidity, it is likely that the NASDAQ 100 will continue to rally due to the fact that you cannot own currency.

Pullbacks to the 10,800 level will attract a lot of attention as it is the bottom of the channel and of course a large, round, psychologically significant figure. The 20 day EMA sits right about there as well, so I think that also could come into play. However, we could break down a bit and still find plenty of buyers underneath. The 10,000 level underneath would be a major support barrier due to the fact that it is a large, round, psychologically significant figure and will attract a lot of attention. However, if we were to break down below there then we may need to “reset” for a little bit, and simply sit on the sidelines in order to take advantage of value once we get lower. After all, if you pay attention to the stock markets for any length of time, you begin to understand that the Federal Reserve comes in and saves it every time it loses about 7%.

The NASDAQ 100 is also comprised mainly of the largest technology stocks out there and that continues to drive everything higher. This includes Google, Microsoft, Facebook, Amazon, and Apple. As long as those stocks continue to be the darlings of Wall Street, then it is simply easier to buy the NASDAQ 100 than it is to try to find a reason to sell it. Yes, markets break apart rather rapidly at times, but that is what stop losses are for. Buying dips works longer-term, and the Federal Reserve is certainly going to do everything that they can to keep things afloat.