The NASDAQ 100 rocketed to the upside during the trading session as Apple gave it a bit of a boost. However, we have to worry about the Non-Farm Payroll announcement coming out on Friday, so that of course will add a bit of volatility to this market. At this point, I like the idea of buying pullbacks and the 8:30 AM announcement in the United States could of course make this market move quite drastically. Typically, the Asian session before the Farm Payroll Announcement tends to be very quiet, mainly because Japanese and Chinese traders have no way to react the potential announcement and putting on a huge position into the weekend is very reckless.

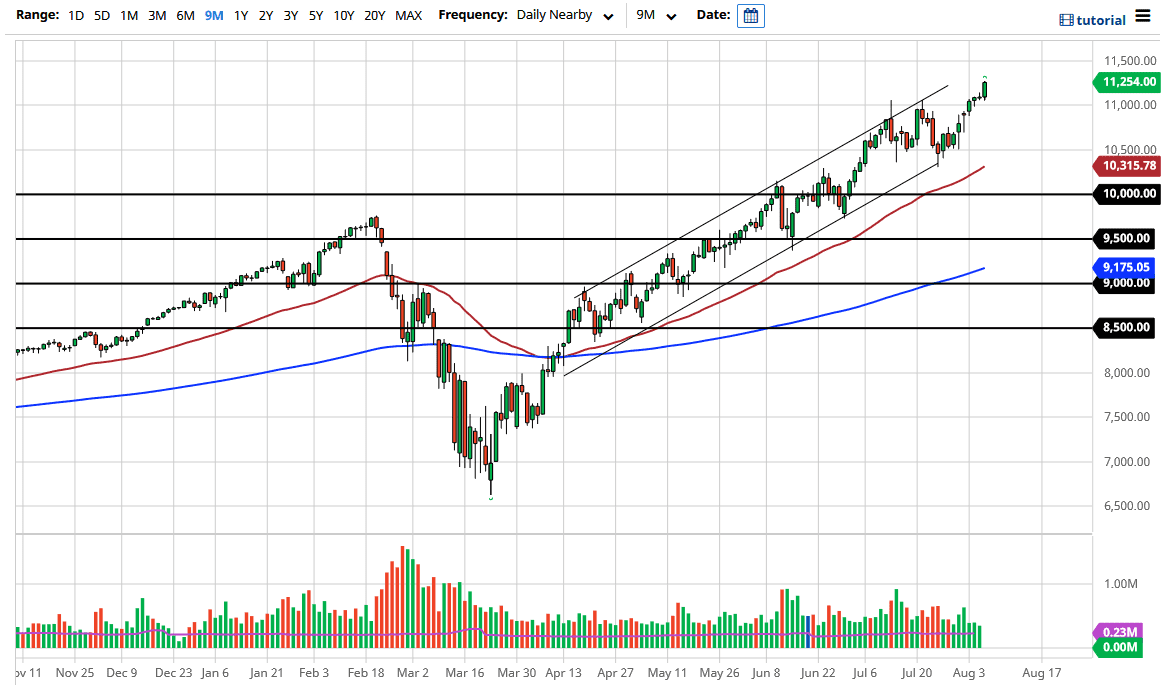

When you look at the chart, it is obvious to see that we are in a massive channel and getting towards the top of it. Because of this, it is possible that we may see a bit of a pullback, but that should be thought of as plenty of value. After all, the 11,000 level is a large, round, psychologically significant barrier that we just broke out of, and now it looks like it could end up being very supportive. Even if we break down below there, the 10,500 level would then be the next support level as it is not only another round figure, but it is also dissected by a nice uptrend line from the channel.

As long as the Federal Reserve continues to liquefy the markets, and keep loose monetary policy, stock traders will continue to buy assets as they watch the value of the US dollar plummet. Ultimately, you should also take a look at the candlestick to see how bullish it is and how many people are looking to get long of this market. I have no interest in shorting this market, because not only do we have that 10,500 level underneath, the trendline, but also the 50 day EMA which sits just below there. In other words, this is a “long only” market, but like with all things you will be looking to find value through signs of volatility. It is not until we break down below the 10,000 level that I would be slightly concerned. At this point though, it looks like the liquidity continues to be the main driver of everything in all markets, the NASDAQ 100 included.