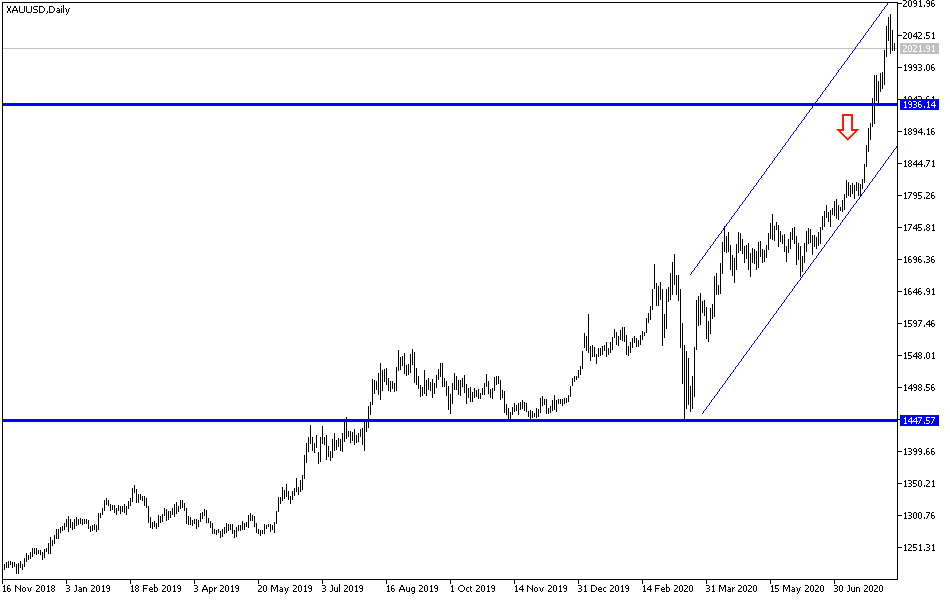

As largely predicted, gold prices reached overbought areas, and technical indicators await profit-taking selloffs for correction. Since Friday’s trading, gold prices are losing its record gains, which pushed it towards the $2073 resistance, the highest level in history. Profit-taking selloffs push it towards the $1990 support before settling around the $2000 resistance at the time of writing. Despite recent movement, demand for gold still stands as a safe haven in times of uncertainty, and we are at perfect times for that amid increasing tensions between the U.S and China, continued worries regarding increasing coronavirus cases, and the global economic expectations.

On the stimulation front, the U.S President Donald Trump signed an executive order on Saturday to resume the partially improved unemployment payment to tens of millions of Americans who lost their jobs during the COVID-19 time. The USD recovered somehow well after dropping to its lowest level in more than 2 years. Silver features ended yesterday’s trading higher by $1.720, or around 6.3% at $29.61 an ounce, before settling around $28.20 an ounce at the time of writing, while copper features for September settled at $2.8615 a pound.

Coronavirus cases in the U.S exceeded the 5 million mark, which means it represents a quarter of the current global count, which is 20 million cases. The global death toll increased to more than 729500.

Meanwhile, investors are closely watching the Sino-U.S. Relationship amid concerns that their trade deal may be in jeopardy. Amid rising tensions between Washington and Beijing, US Health Secretary Alex Azar offered President Donald Trump's strong support for Taiwan. In the same context, China said it would impose sanctions on 11 US officials in response to similar measures by Washington on Chinese and Hong Kong officials.

As for economic news, signs of improvement in Chinese manufacturing activity added to signs of economic recovery in the world's second-largest economy.

According to the technical analysis of gold: Despite the recent correction, the price of gold is still within the range of its sharp ascending channel, and stability above the $2000 historical resistance an ounce supports the move towards new record levels. As I expected before, any decline in gold prices means the formation of a new buying base. The closest support levels are currently 1985, 1960, and 1940, respectively. The factors of record gold gains still exist and are represented in a strong and continuous outbreak of the Coronavirus and the difficulty of reaching a vaccine soon, in addition to the tensions between the United States and China, which are expected to continue until the presidential elections next November, and Trump's victory means they will continue further. The level of the dollar is no less important than what has been mentioned. Continuous US economic stimulus is a must for the stability of the global economy and financial markets.

Today, gold will interact with the announcement of British jobs numbers, wages, and the German ZEW index reading and the U.S producer prices index.