Gold prices recorded their first weekly loss in more than two months, following the rise of the US dollar and the increase in US yields after tepid demand in a long-term US government bond auction last Thursday. The price of gold fell to $1863 an ounce before bouncing back up to $1966 and closed the week’s trading around the $1944 an ounce, heading for a weekly loss of about 4 percent, registering its first weekly decline since early June and the largest weekly percentage decline since early March. .

The dollar held steady as upbeat numbers on US employment and lacklustre economic data from China curbed the global reserve currency. Official data by the end of the week showed that Chinese industrial production grew by 4.8% year on year in July, the same growth rate as seen in June and weaker than the expected rise of 5.1%. Retail sales were down 1.1% from a year ago, confusing expectations for a 0.1% increase. During the January-July period, investment in Chinese fixed assets decreased by 1.6 percent, compared to a decrease of 3.1 percent in the January-June period.

On the other hand, the Eurozone economy contracted at a record rate in the second quarter, as initially expected, due to the containment measures taken by member states to control the spread of the Coronavirus, according to an estimate from the European Statistics Agency, Eurostat. GDP slowed by -12.1 percent in the second quarter in a row, after slowing by -6 percent in the first quarter. It was the largest drop seen since the series began in 1995. On an annual basis, GDP fell by -15% compared to a decline of 3.1% in the previous quarter. This was also the largest drop since 1995.

In terms of the US-China dispute, which greatly supported gold gains, last Friday, US President Donald Trump gave the Chinese company ByteDance 90 days to strip itself of any assets used to support the popular TikTok app in the US. Trump's executive order stated that there is "credible evidence that leads me to believe that ByteDance may take action that threatens to harm the national security of the United States." Trump last week ordered a blanket but vague ban on dealings with the Chinese owners of TikTok and the messaging app WeChat, saying they pose a threat to US national security, foreign policy and the economy.

It remains unclear what TikTok requests mean to the 100 million US users, many of them teens or young adults who use it to post and watch their short videos. Trump also ordered ByteDance to strip itself of “any data they are obtaining or obtained” from TikTok users in the United States.

With the recent measures, it is clear that the conflict between the two largest economies in the world will continue as long as Trump is in power, and will increase if he wins the presidential elections, which will be held next November. This guarantees the continuation of gold gains for a longer period.

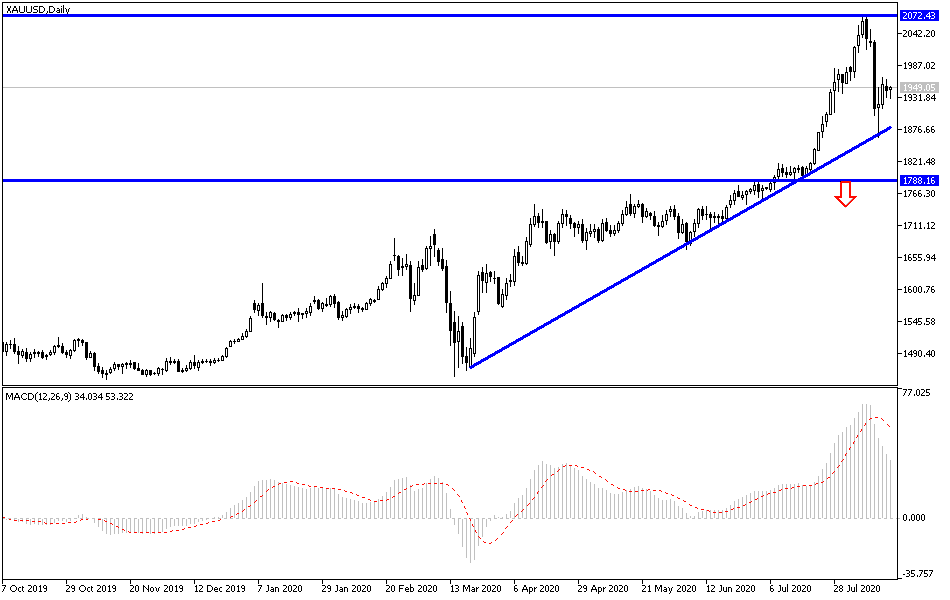

According to the technical analysis of gold: The general trend of the yellow metal is still bullish, and the $2000 psychological and historical resistance is still the closest target to the extent of bulls controlling performance. Recent news that the review of the US-China trade agreement has been postponed by six months may benefit gold buyers, because if true, they well confirm the strength of the dispute between the two. The long-term outlook does not exclude the next historical resistance levels at 2100 and 2400 dollars an ounce in the medium term and the $3000 hight on the long term. On the downside, the most important support levels for gold will be 1925, 1895 and 1855 respectively, and the last level is a threat of a strong and real reversal of the current upward trend.

Gold prices will interact today with the announcement of the Japanese economy growth and the extent of investor risk appetite.