The strength of the US dollar was a good reason for the gold price to drop to $1911 support during last week's trading and began this week's dealings around the $1938 per ounce, where it is stable at the time of writing. During the current month, the gold price jumped to $2075 per ounce and the highest level in its history. Gold price is stable below the 100-hour and 200-hour simple moving average lines on the hourly chart. Yellow metal bulls still have factors that give them the strength to quickly recover recent losses. Tensions between the two largest economies in the world still exist and increasing, and the Coronavirus is still reaping more global human and economic losses. The economic stimulus of global governments and central banks did not stop. Political anxiety in the United States is increasing with the approaching date of the US presidential elections.

Weekly US jobless claims exceeded expectations by 925K, with 1.106M claims registered. On the other hand, continuing claims for the previous week exceeded 15 million with a record of 14.488 million. The Philadelphia Fed Manufacturing Survey for August missed expectations of 21 with a reading of 17.2. Before that, the number of building permits and housing starts for July was announced, which exceeded expectations. Also from the US, Markit's preliminary manufacturing PMI for August beat expectations at 51.9, with a reading of 53.6. The Services PMI beat expectations, with a reading of 51 with a reading of 54.8, while the composite PMI - which includes manufacturing and services together - came in at 54.7, up from a reading of 50.3 from the previous release. On the other hand, July's Existing Home Sales exceeded the expected figure (on a monthly basis) at 5.38 million with a record of 5.86 million. Existing Home Sales outperformed expectations by 14.7%, with a rate of 24.7%.

Taking a closer look at the future, it remains unclear whether Jerome Powell, the chairman of the US Federal Reserve and other heads of global central banks, will present anything new at the Federal Reserve’s latest economic symposium in Kansas City in Jackson Hole this week, the most influencing event on financial markets, with members agreeing that the central bank was interested in using a wide range of tools to fully support the US economy in these difficult times. On the other hand, the Fed symposium may show the same for the upcoming meeting, and the current market environment may keep gold prices steady with the continuation of the USD downtrend in the remainder of August.

According to the technical analysis of gold: In the near term, it appears that the gold price is subject to slight short-term downward pressure in the market sentiment. Accordingly, it appears that the yellow metal price has recently bounced off the limits to oversold levels of the 14-hour RSI. It is still holding below the 38.20% Fibonacci level. Accordingly, the bulls will target short-term profits by 50% and 61.80% Fibonacci levels at $1.969 and $1999 respectively. On the other hand, the bears will target profits at 23.60% Fibonacci at $1.912 or less at $1877.

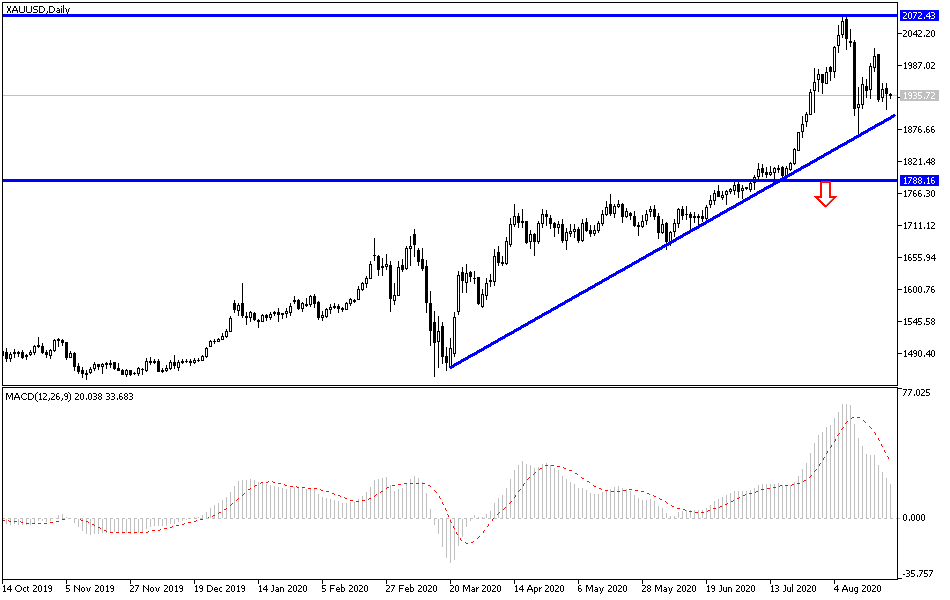

In the long term, and based on the performance on the daily chart, it appears that the XAU/USD pair is trading within a bullish channel. This indicates a long-term bullish bias in market sentiment. Gold has recently retreated to move towards trendline support. It has since returned to its normal 14-day RSI trading territory, away from overbought levels. Accordingly, bulls will target profits for a stronger rally at around $2025 or higher at $ 2077. On the one hand, bears will be looking for long-term profits around $1,860 or less at $1799.