At the beginning of this week's trading, the bears tried to move the price of gold down to $1929 an ounce. With increasing global geopolitical tensions and the announcement of a historic contraction for the third-largest economy in the world, the yellow metal got a new momentum, along with the weakening of the US dollar. The opportunity was ideal for gold bulls to push prices towards $1991 per ounce, before settling around the $1982 at the beginning of Tuesday's trading. The US administration has returned to highlight the risks of the Chinese company Huawei, in light of the US fierce campaign against everything from China. In addition to the old points of disagreement between them, the Coronavirus - of Chinese origin - came as a more powerful factor for a greater move by the US administration.

On Monday, the United States added 38 Huawei subsidiaries to its current list of companies banned from receiving certain sensitive technologies and ended an exemption that allowed some Huawei customers in the United States to continue using its devices and software. Washington has combined its economic sanctions on Huawei with a pressure campaign prompting allies in Europe and elsewhere to exclude the company from its planned next-generation wireless networks.

Trump referred to Huawei as an "espionage method" while speaking with "Fox and Friends" hosts and took credit for Britain's recent move to roll back plans to give the company a role in the UK's new high-speed mobile network. Trump said, "We said we love Scotland Yard very much, but we will not deal with you because if you use the Huawei system, it means they are spying on you. This means that they are spying on us."

Gold prices gained additional momentum amid news that Warren Buffett has bought shares in Barrick Gold Corp, in addition to the drop in the US dollar. The US dollar index DXY, which measures the performance of the greenback against a basket of other major currencies, fell by 0.27%, to below the 93.00 level. From the beginning of the year 2020 to date, the DXY index has declined nearly 4% after a gap of about 7% over the past three months. A lower dollar is a good thing for dollar-denominated commodities, as it makes buying cheaper for foreign investors.

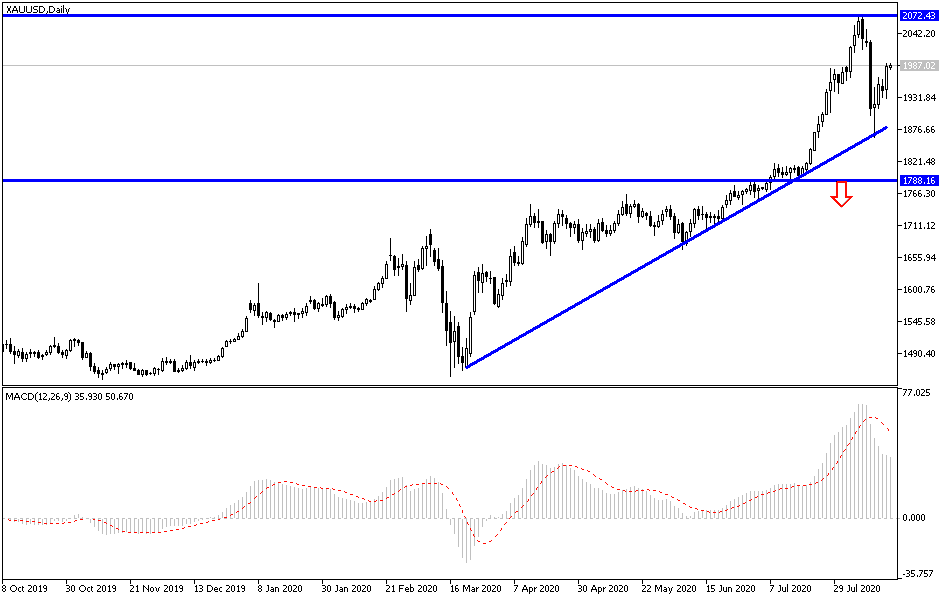

According to the technical analysis of gold: The bullish momentum of the gold price continues to increase and the best opportunity now is to retest the $2000 historical resistance, which may pave the way again to test new record levels. After the recent shift, we confirm that the stability of the gold price below the $1900 support is the most important for the possibility of a real and strong breakout of the current bullish trend. With the persistence of global geopolitical tensions and the Coronavirus, buying gold at every lower level will remain the best trading strategy.

As for today's economic calendar data: The agenda is almost empty, so we have nothing aside from the announcement of the minutes of the last Reserve Bank of Australia’s meeting, then the US data: building permits and housing starts.