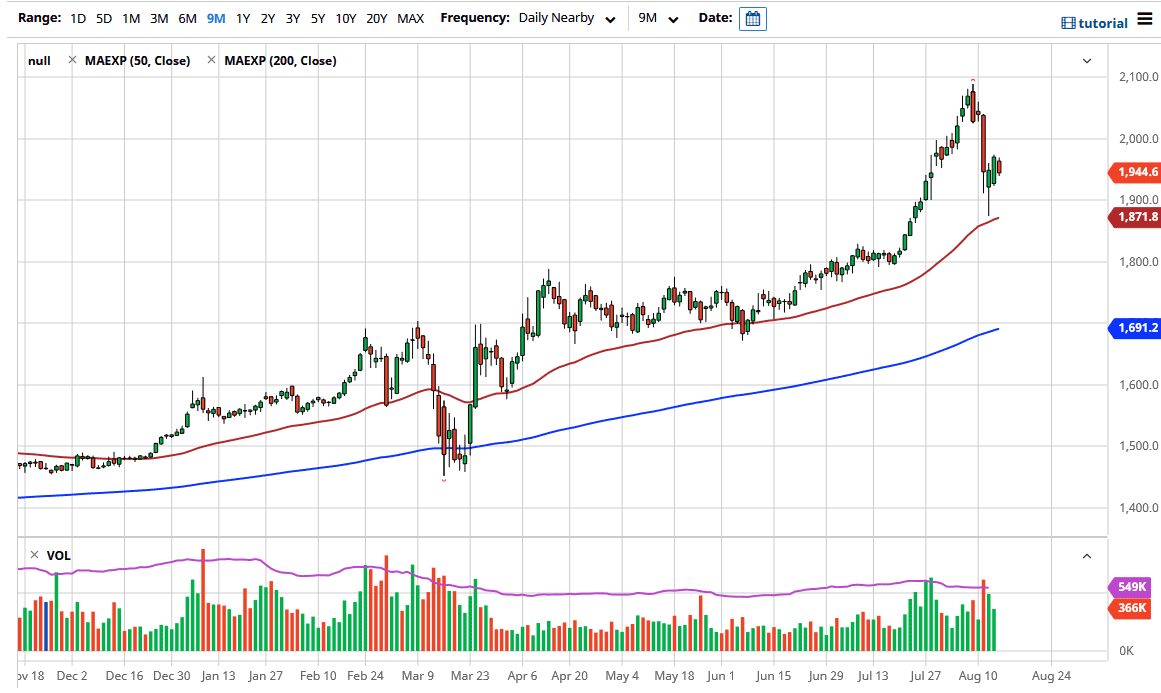

Gold markets have gapped a little bit lower to kick off the trading session on Friday and then fell a bit from there as well. That being said, we are right in the midst of the consolidation and bullish pressure that we have seen since the recovery on Friday, so I think we are simply turning the market right now in order to find some type of base to rally from.

Last Tuesday scared a lot of traders out there that are not used to volatility. Losing $100 in a day is not necessarily rare in this market. Do not get me wrong, it does not happen often, but it is not rare. It is because of this that you need to be somewhat cautious when buying so although we have formed a nice-looking hammer based upon the 50 day EMA on Wednesday, that does not necessarily mean you jump into the market with both feet. This suggests that you should be adding on little bits and pieces, building up a larger position for what could be the longer-term move higher.

Looking at the area between here in $1900, I think there will be plenty of support, and we have plenty of reasons to think that gold goes higher over the longer term. After all, the Federal Reserve is doing everything it can to loosen monetary policy, typically something that is extraordinarily good for gold. Beyond the Federal Reserve, other central banks around the world are flooding the markets of liquidity as well, gold will continue to be one of the favored currencies around the world. Although some people will argue the point, gold is actually a currency and not necessarily a commodity.

If we can break above the highs of the Thursday candlestick, that opens up the pathway to the $2000 level. Otherwise, I like buying dips and little bits and pieces and adding. It is not until we break down below the $1800 level that I would be concerned about the uptrend, something that we are not anywhere near doing right now. However, you need to keep an eye on the US dollar itself, possibly the best shown in the US Dollar Index, or if you do not have access to live data for that market, the EUR/USD pair. If you see the US dollar getting much stronger all of a sudden, that is going to be bad for gold. However, if we continue to see the greenback sell-off, that should send this market towards the highs again.