The gold markets fell a bit during the trading session on Tuesday as we continue to see a lot of noisy action in the markets. The US dollar has been all over the place so it would not surprise me at all to see the gold markets get tossed around as well. With the massive amount of fiscal stimulus out there, it does make sense that the precious metals will continue to attract a certain amount of attention as not only the US dollar falls in purchasing power, but so does the Euro, Pound, and so on. At this point, the gold markets will move in the same direction, but the Federal Reserve is going to open up a massive bazooka full of liquidity, so the main futures contract will be the place to be overall.

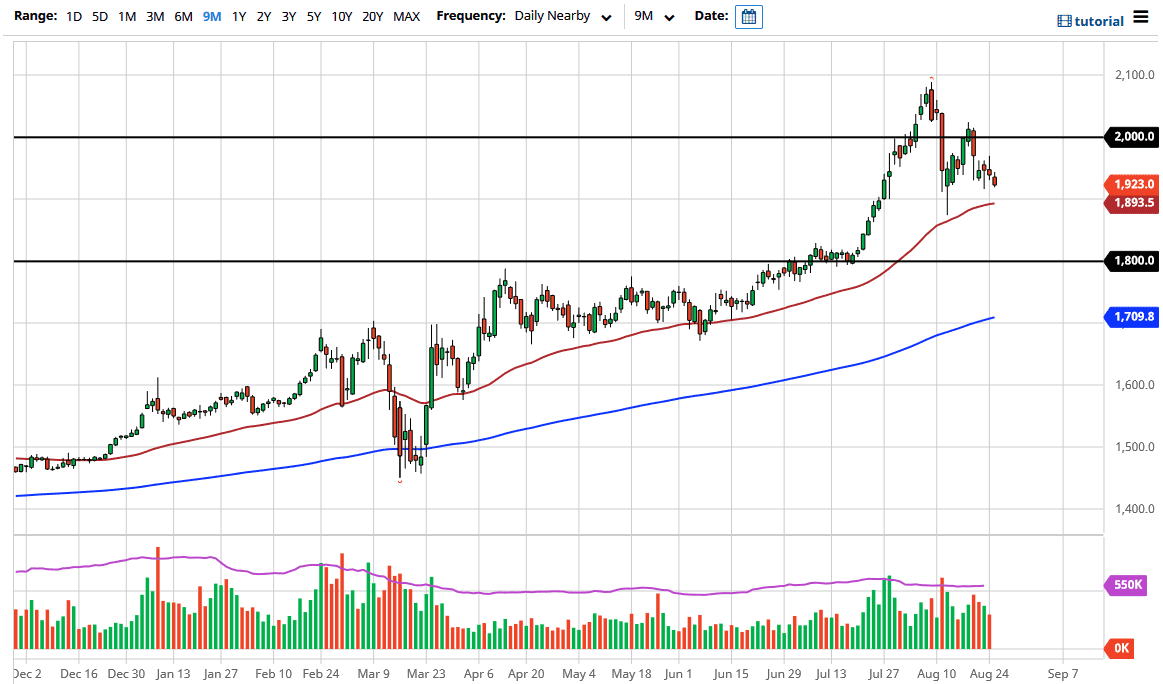

As long as the US dollar continues to lose value, the gold market will continue to go higher. The 50 day EMA is just underneath at the $1893 level, sitting just below the psychologically and structurally important $1900 level. The 50 day EMA is of course a technical analysis signal that a lot of longer-term traders will pay attention to and does tend to cause a bit of reaction in this market. If we can get a bounce from the $1900 level, then it is likely that we could go towards the $2000 level. On the other hand, if we were to break down below the 50 day EMA then I think we are going to go looking towards what I think is the “absolute value area” that is worth paying attention to, the $1800 level. That is an area that we had broken out of previously and has not been tested since. Yes, we have seen the area offer support just after breaking above it, but I think it does make sense that we go lower to find more buyers.

To the upside, the $2000 level course is going to be psychological resistance, and difficult to break above. However, if we were to break above there it is likely that the market goes looking towards the $2100 level, and beyond. Longer-term I do think that it is only a matter of time before we do that, but now it is simply a matter of waiting for the right daily candlestick to get involved. We do not have that right now, so I am sitting on the sidelines and waiting for the signal.