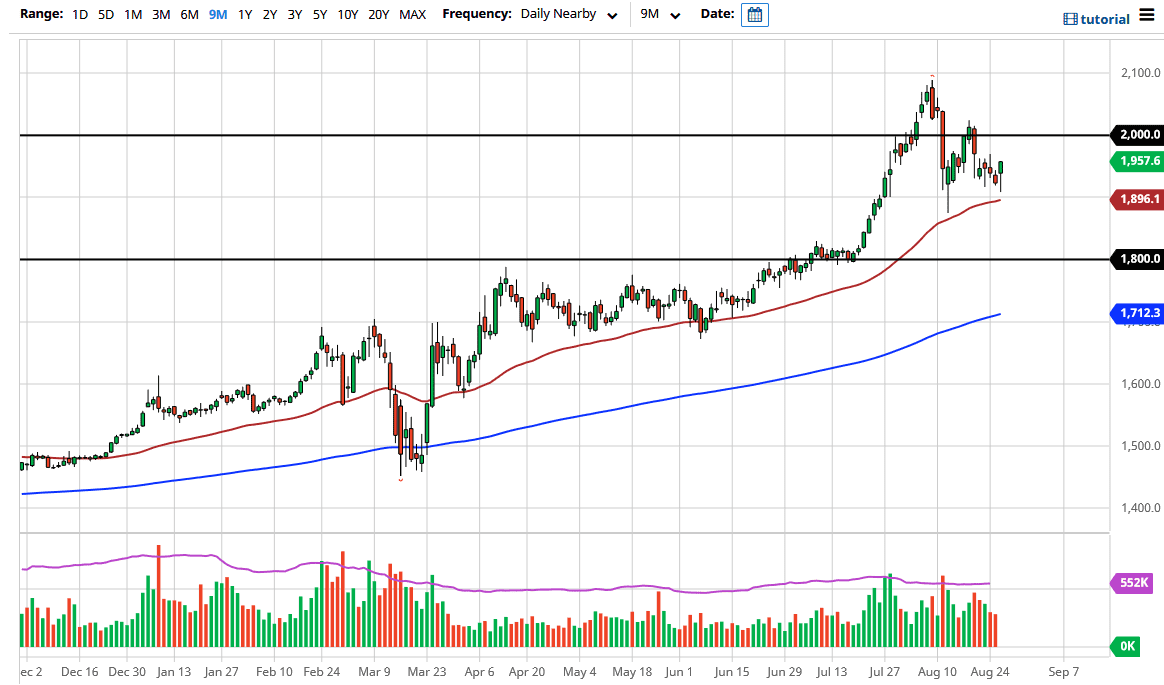

The gold markets have pulled back just a bit during the trading session on Wednesday but then turned around to show signs of extreme strength. By doing so, the market looks very likely to continue going higher, perhaps reaching towards the $2000 level. That is an area that of course is significant psychological resistance just waiting to happen, as we have seen such a selling move at that level. If we can break above there, then it is likely that we could go to the $2100 level as well. Underneath, I recognize that the $1900 level is a support level.

Looking at this chart, not only is the $1900 level a potential support level based upon the structural support and of course the large, round, psychologically significant figure, but we also have the 50 day EMA in that same area. In other words, there is at least three reasons to think that this level will hold if we pull back from here. Looking at this chart, it looks as if we are trying to find some type of footing in this area, and with Jerome Powell speaking during the day on Thursday, it is likely that we will see the gold market react to the speech.

If we did break down below the 50 day EMA, it is likely that the market could go looking towards the $1800 level. That is an area that I think is even more supportive, and I would be much more aggressive about buying in this general vicinity. Looking at this chart, I think that we have plenty of buyers on dips just as we have seen more than once. Ultimately, as long as the US dollar continues to fall, it makes quite a bit of sense that the gold markets will continue to rally. Longer-term, I believe that this market continues to go much higher, and I even have a target of $2500 given enough time.

In general, I think that this is a market that cannot be sold, so even if we break down it is just simply a matter of taking your time to get involved as the market will certainly offer value from time to time, and your job is to take advantage of it when it has offered. Do not over lever, and only add as the market goes in your favor.