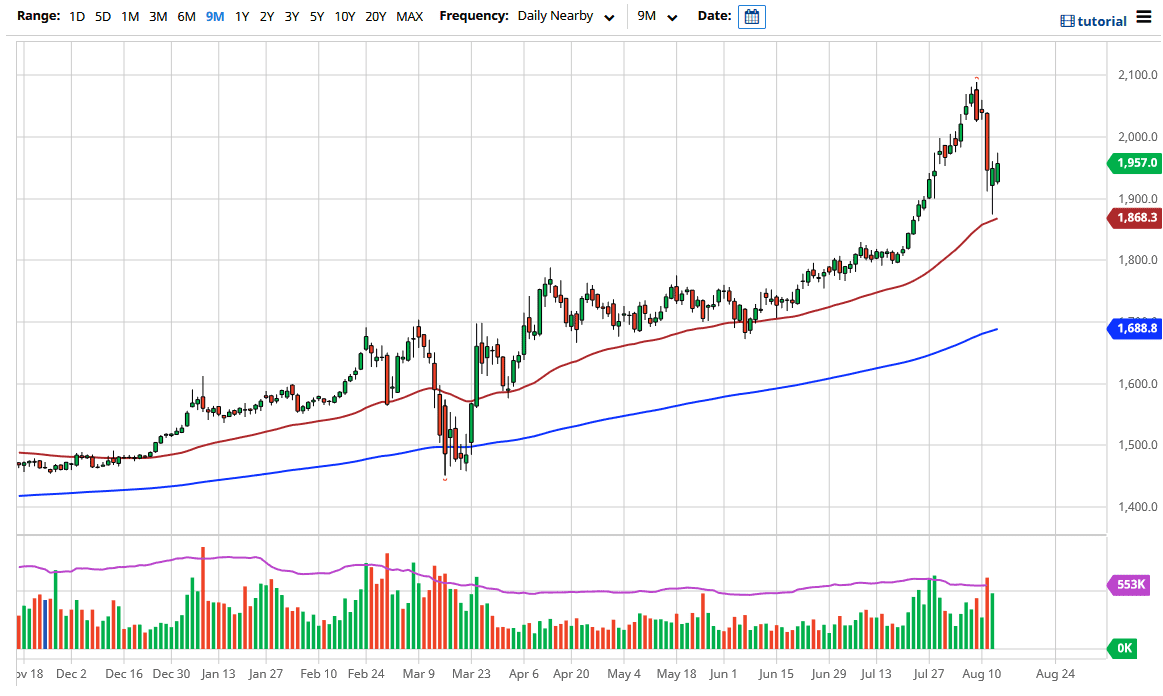

Gold markets have formed a nice-looking candlestick on Thursday after initially gapping lower. We have turned around to fill the gap and go beyond it as the market closes above the $1950 level. The hammer that formed during the trading session on Wednesday was the first sign of strength, or at least stability. Stability is probably the most important thing this market can find right now, because the selloff will have shaken a lot of traders. As we shook out the “weak hands” in the market, that is a healthy thing because quite frankly we had gotten too parabolic.

I really like the candlestick on Wednesday as the hammer is a very bullish sign. Furthermore, I like the idea of the fact that we have rallied since there as well, showing signs that we are going to continue to find buyers. The 50 day EMA being just below the candlestick of course is a strong sign and therefore I do believe that we are going to challenge the $2000 level sooner rather than later. As the Federal Reserve continues to flood the market with US dollars, it makes quite a bit of sense that we will see gold markets rally, as people try to protect their purchasing power. Furthermore, the gold market is priced in US dollar so it makes sense that we will see more of these US dollars needed in order to buy an ounce of gold.

If we were to break down below the 50 day EMA, that would be a negative sign but I think there is even more support down at the $1800 level. I would be even more aggressive the by gold in that general vicinity because it would suddenly become very cheap. It would be like having gold go on sale for “10% off.” To the upside, I believe that the $2100 level will of course offer some resistance, but it will be temporary, because quite frankly it does not change the fundamentals. In fact, there is absolutely no fundamental reason why gold should continue to be bullish as central banks around the world continue to loosen monetary policy and race to the bottom as far as the value of currency is concerned. It is very likely the gold will continue to attract inflows for the foreseeable future.