Forex traders ignored fears of a bleak outlook for Brexit, and the US dollar’s decline was exploited. Therefore, the GBP/USD currency pair moved up towards the 1.3356 resistance, its highest in six months, and closed last week’s trading stabilizing around those gains. The pair continues to trade within a slightly bullish channel on the hourly time frame. It has since risen several levels above the 100 and 200 hours simple moving average lines.

The main reason for the decline in the US dollar was Federal Reserve Chairman Jerome Powell's announcement that the policy change reflects the fact that high inflation - once the biggest threat to the economy - no longer poses a risk, even when unemployment is low and the economy is growing strongly. Instead, Powell said, the economy has changed in a way that allows the Federal Reserve to keep interest rates much lower than it would otherwise without triggering price pressures. “The economy is always developing,” Powell added, “Our revised statement reflects our appreciation of the benefits of a strong labor market, especially for many in low- and middle-income societies, and that a strong labor market can be sustained without causing an unwanted increase in inflation.”

Powell noted that the Fed's pre-pandemic decision to keep rates low has finally helped improve the fortunes of low-income workers, who previously shared a few of the benefits of economic growth for a record period.

On the economic data front, the US core PCE price index for July came in below expectations on a monthly basis of 0.5% with a reading of 0.3%. The general personal consumption expenditures price index came in below expectations by 1.2% with a change of 1%. On the other hand, income for US citizens increased by 0.4% compared to the expected decline of 0.2% while personal spending exceeded expectations by 1.5% with a rate of 1.9%. The core PCE price index for the month beat expectations (year over year) by 1.2%, with a record 1.3%.

On the other hand, the Chicago PMI for August missed expectations at 52 with a reading of 51.2, while Michigan Consumer Confidence outperformed expectations by 72.8, with a reading of 74.1. Preliminary US GDP growth for the second quarter exceeded expectations (on an annual basis) but missed an estimate (quarterly). Both initial and continuing jobless claims came in below expectations while durable goods orders for July beat expectations by 4.3%, with a record 11.2%. Non-defense capital goods orders from aircraft reached expectations of 1.9%.

Last week was completely free of important and influential British economic releases.

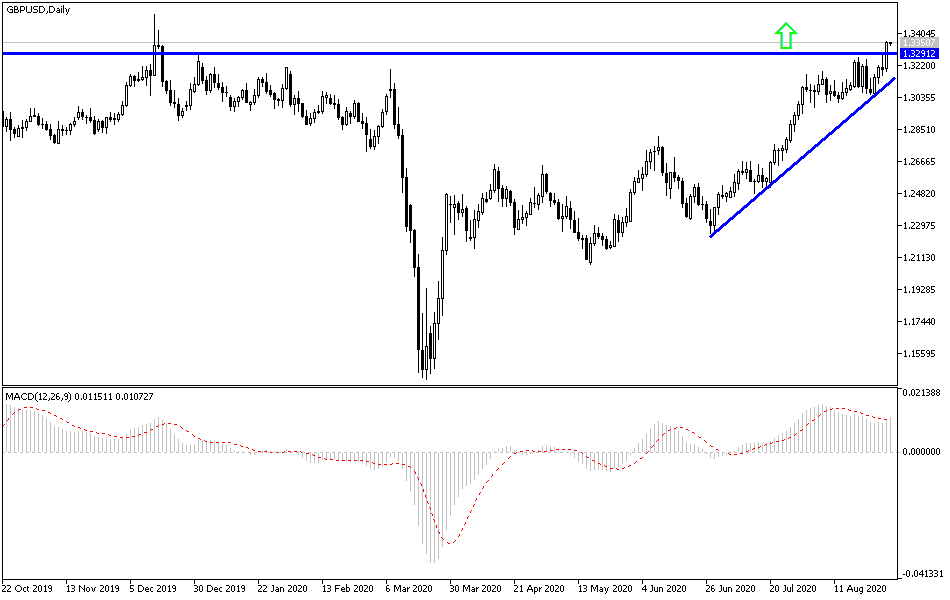

According to the technical analysis of the pair: In the near term, it appears that the GBP/USD is facing a slight short-term bullish bias in market sentiment. The pair is still stuck inside a slightly bullish channel on the hourly chart. Accordingly, bulls will target short-term gains around 1.3350 or higher at 1.3400. On the other hand, bears will be looking to pounce on the gains for a decline at around 1.3250 or below at 1.3200.

In the long term, and based on the daily chart performance, it appears that the GBP/USD is trading under strong upward pressure. The pair maintains its bullish outlook since hitting a new multi-year low in March, it has recovered more than 90% of losses since then. Accordingly, bulls will target long-term gains around 1.3453 resistance or higher at 1.3629. On the one hand, bears will be looking to pounce on long-term pullbacks around 1.3174 or below at 76.40% Fibonacci at 1.3013.

Today is a UK bank holiday and there are no significant US economic releases today.