GBP/USD bearish correction attempts succeeded for a short time in breaching the 1.3000 support down to the 1.2980 level. The pair soon returned to rebound higher and was stable around 1.3070 at the time of writing. The British pound performance is dependent on the Bank of England announcement and inflation report this week. Although the bank will acknowledge that the initial recovery in activity from the April low is somewhat stronger than expected, and therefore the focus will be on risk on performance in the future. It is possible that the Bank of England will repeat its commitment to take further measures when necessary, and the only fear for Forex traders is that the bank will hint to the possibility of establishing negative interest rates.

Last Thursday's announcement of new restrictions affecting approximately 4.3 million people in Britain and talk of closure in London still prevails. Boris Johnson government officials claim it is just a worst-case scenario, but the very idea of placing new restrictions on one of the world's most important financial capitals is negatively affecting the GBP. Prime Minister Boris Johnson's comments about slowing the reopening in response to the rise in the number of cases, was shocking to investors.

The cable also suffers from a lack of progress in the Brexit talks, or in trade negotiations with the United States. Whereas, International Trade Secretary Liz Truss is in the United States for talks with US Trade Representative Robert Lighthizer. Expectations are still low about the opportunity of reaching an agreement between the two.

Sino-U.S. Relations are experiencing unprecedented tensions, as the recent dispute focuses on TikTok and its ability to preserve sensitive information of Americans. ByteDance, the owner of the famous Chinese social media company, is likely to have to sell TikTok to Microsoft. The differences between the world's largest economies are also contradictory to dealing with Hong Kong, as Britain cares about what is going on there. Any further deterioration of the relationship between Beijing and London could affect the pound.

June's US factory orders were interesting, yet investors are looking with more interest to the nonfarm payroll numbers to be released on Friday. Before that, the ISM Manufacturing PMI exceeded expectations and reached a 16-month high in July, and the employment component remained low, indicating a weak labor market.

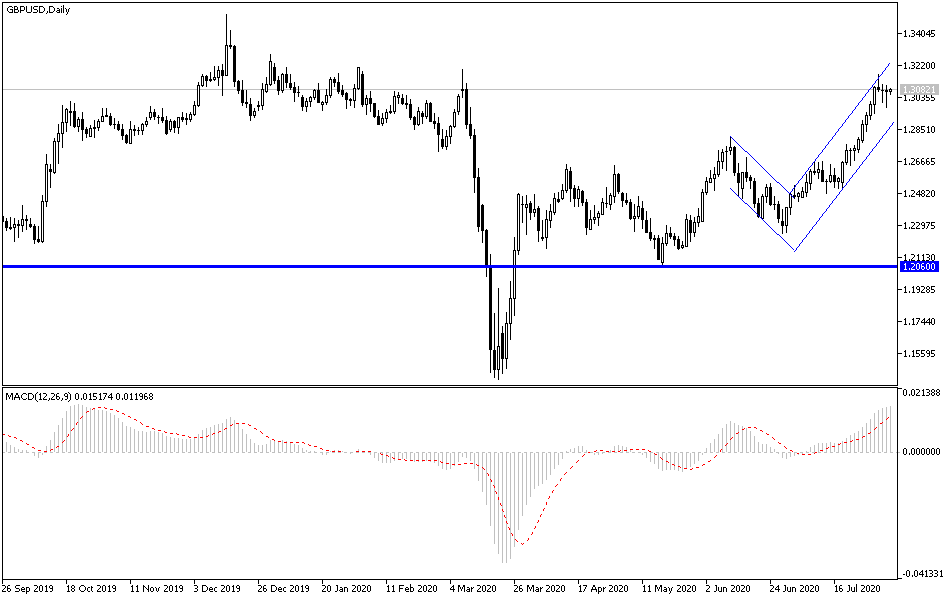

According to the technical analysis of the pair: The GBP/USD pair has the opportunity to make an upward correction as long as it remains stable above the 1.3000 resistance. Despite going beyond that, it failed to achieve meaningful recovery. In general, the momentum is still positive and the pair stabilizes above the 50, 100, and 200 simple moving averages. The bears are in the foreground, but bulls still have a chance. We await the 1.3110 resistance, daily high, followed by 1.3170, last week's high. The next levels to watch are 1.32 and 1.3270. Support is located at a daily low of 1.3050, then Monday's low is 1.3005. It is followed by 1.2975, 1.29, and 1.2845, respectively.

As for the economic calendar data today: From Britain the services PMI will be announced. From the United States of America, the ADP survey will be announced to measure the change in US employment in the non-agricultural sector, then the ISM PMI for the services sector will be released.