Amid a steady decline in the US currency and despite the lack of optimism from the Brexit talks, the GBP/USD price succeeded in moving upward towards the 1.3170 resistance, the highest level for four and a half months, before closing the week's trading around 1.3082 amid an uprising by the bears ahead of the turnout on an important week that includes Bank of England monetary policy decisions and US job numbers. It was surprising that the GBP was doing well despite the recent fall in global stock markets and a clear lack of headlines about Brexit. Commenting on the performance, Joe Manimbo, chief market analyst at Western Union, said: “The British pound has surpassed both the Euro and the USD as it rose to a nearly five-month high with the recent rally. This coincided with a decline in stocks and a weak risk appetite, which made the move more confusing. In general, the pound sterling continues to benefit from the dollar's widespread negativity. A major test of the British pound’s strength will appear in the early days of August when rebalancing evaporates at the end of the month.”

What are the reasons for the recent GBP rise?

GBP gains against the other major currencies may be due to the fact that the economic recovery in the UK is proceeding at a rapid pace, and therefore the country will not lag behind the rest of the European countries in the recovery from pandemic effects, a scenario that has become a very common assumption among analysts. It is also sure to be well compared to the United States as the rise of Covid-19 cases has hindered the US recovery. On the economic front, there is new evidence that the economy has the ability to excel from the latest indicator of the British economic confidence (ESI) which rose from 65.2 in June to 75.5 in July. According to Ruth Gregory, the UK's chief economist at Capital Economics: “This is clearly good news and is in tune with evidence from the high-frequency data that continued to show the recovery that started in May at the beginning of the third quarter.”

On the other hand, the possibilities of post-Brexit trade deal continues to rise, even if the official line of negotiations is that the two sides are still far apart. The Pound's latest optimism was from a press report that confirmed that the European Union's chief negotiator, Michel Barnier, told the European Union ambassadors that he was confident that a trade agreement would be reached after Brexit. "I remain confident that a balanced and sustainable deal is still possible, even if it is less ambitious," Barnier told the gathering, according to a Reuters report, quoting sources present at the meeting.

Barnier's latest comments contrast with his official narration after the official negotiations in London stopped, stressing that time is running out and "no deal" is becoming increasingly likely. In general, given the timetables involved, an agreement is likely to be reached through a meeting of European Union leaders in October, and until then, we expect the official line to be that the two sides are still far apart, even if they are heading towards an agreement behind closed doors.

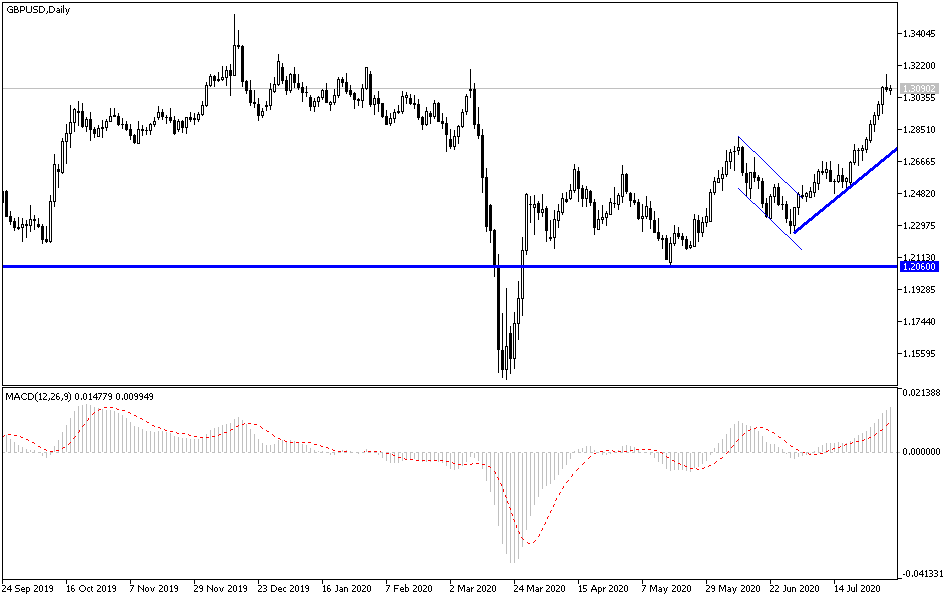

According to the technical analysis of the pair: As long the GBP/USD pair remains stable above the 1.3000 psychological resistance, the general trend will remain bullish and the resistance level 1.3095, 1.3170 and 1.3260 respectively will be important for the bulls' holding on to the performance for a longer period. On the downside, stability below 1.2975 support will bring the pair a negative view about the start of the downward correction. The pair's performance will interact with the announcement of the British PMI reading and then the same sector with the announcement of the ISM Industrial PMI reading.