Thursday Sterling...is what today’s trading session is called. All focus will be on the announcement of the Bank of England’s monetary policy content, in what may be an extraordinary meeting as expectations are increasing to the possibility of approving negative interest rates. Before this important event, the GBP/USD exploits the weakness of the US currency and achieves gains pushing it to the 1.3161 resistance, near its highest level since last March, and is settling around 1.3126 at the time of writing. Markets are not expecting The Bank of England to have any change in quantitative easing or interest rates, especially given the quantitative easing that was strengthened by another 100 billion pounds in June, which raised the total value of the program, in which the bank buys government and corporate bonds, to 745 One billion pounds.

With no major decisions due to the announcement, the focus in the currency markets will be on what the bank indicates regarding future policy decisions. Investors are waiting to see whether the policy statement will have a pessimistic tone on the economy and warn that more action may be needed, or will cling to confidence in the recovery. “More importantly, it will be policy signals moving forward, based on a balance of risk to the economy. For the monetary policy committee, the risks remain biased downward, so the key message that the Bank of England is likely to repeat is that it will do everything in its power to support the recovery” says Robin Wilkin, global asset strategist at Lloyds Bank

The pessimistic signal is likely to weaken the British Pound, while a more reliable assessment that may indicate that there are probably no further quantitative expansions in the coming months could contribute to the sterling's gains.

"Investors are preparing to update the possibility of a negative interest rate policy and whether hopes for a" V-shaped recovery "are still on the right track. If the BoE delivers a more optimistic message, the British Pound might rise today. It could challenge the dollar at its highest level in 5 months, near $1.32, while the GBP/EUR could extend towards 1.12 Euro”, said George Vessey, Western Union currency analyst. Forex experts at TD Securities are adopting the base case scenario - given the 55% probability - that the bank will move to a “more realistic macro forecast, with slower recovery in the second half of 2020 and beyond and GDP to the 2019 level in 2022/23.”

This will require an unemployment rate of around 8% to be expected by the end of 2020, in line with economists' estimates. Inflation expectations keep rates for 2-3 years below the 2% target and the bank says it is "ready" to do more.

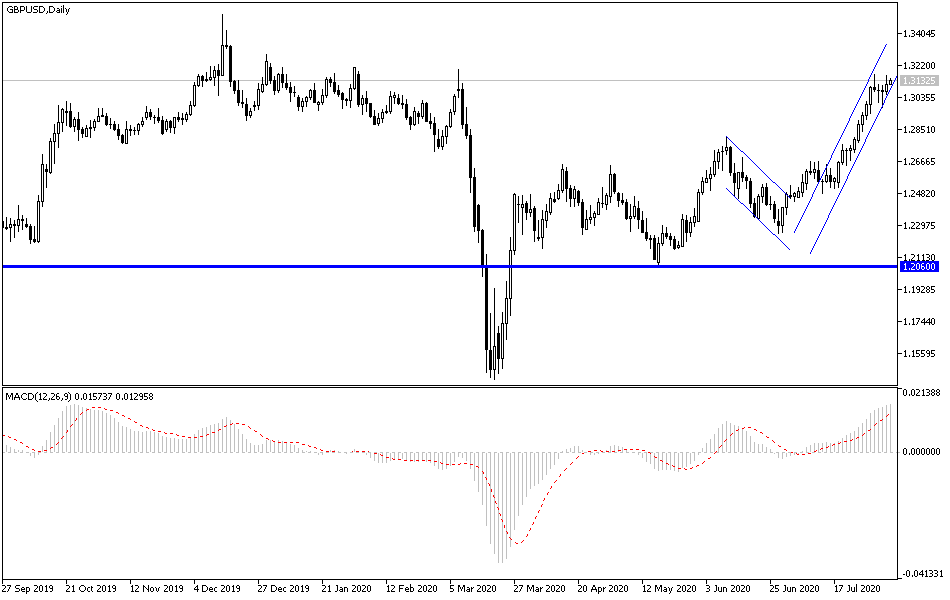

According to the technical analysis of the pair: As I mentioned before, the stability of GBP/USD pair, above the 1.3000 psychological resistance, will continue to support the bulls' control of performance. Pair gains exceeding the 1.3200 resistance, where it the closest to now, will support the movement of technical indicators to overbought areas awaiting profit-taking sell-offs. Any negative update of the Brexit negotiations, as usual, will support the trading strategy of selling from each upside level. There will be no real reversal of the current trend without the pair moving below the 1.2980support.

As for the economic calendar data today: First, all interest will be in the Bank of England announcing its monetary policy decisions, then the governor’s comments. From the United States, the weekly jobless claims numbers.