The GBP/USD is trying to avoid breaching the 1.3000 support, in order not to increase selling and a shift in the general direction that is still bullish. Today, the Pound will be on a date with the first important economic releases, as British jobs and wages numbers will be released. Before that, the pair is steady at around 1.3085. In general, sentiment has improved towards the British pound recently amid a broad recovery in global stock markets which tends to support the British currency against the dollar and the Euro. While the last major policy update of the Bank of England on August 6 confirmed that the bank is in no hurry to cut interest rates to 0% or below, the forecast was a major headwind for the UK currency during the “COVID-19 crisis” period.

Accordingly, forex strategists at two of the leading investment banks on Wall Street told clients that the outlook for the British pound had improved amidst the more supportive BoE policy stance and the potential for a Brexit deal in the fall. This call comes with the pound continuing to trade above the 1.30 level against the US dollar and the 1.10 level against the Euro, an improvement from the lows of 1.22 and 1.0913 that we saw for the GBP/USD and GBP/EUR in late June. Zach Pandl, the chief economist at Goldman Sachs, said: “The Bank of England gave a clearer message that quantitative easing is its preferred policy for the current set of conditions, so negative interest rates should remain “in the toolbox ”, perhaps in the bottom level, unless things change dramatically. This makes UK policy good, and this particular headwind looks less threatening for the time being. “An explicit negative outlook for the British pound requires a more bearish macro background,” Pandl added.

Support for the British currency is likely to extend over the next week as there are unlikely to be any headlines related to Brexit, or new policy directives from the Bank of England making the currency more vulnerable to Euro and US dollar movements. At the same time, "bullish surprises" could come in the fall for the British pound in the form of a breakthrough in the Brexit negotiations, which is expected to culminate in the October meeting of the European Union leaders where the final details of the agreement will be agreed upon.

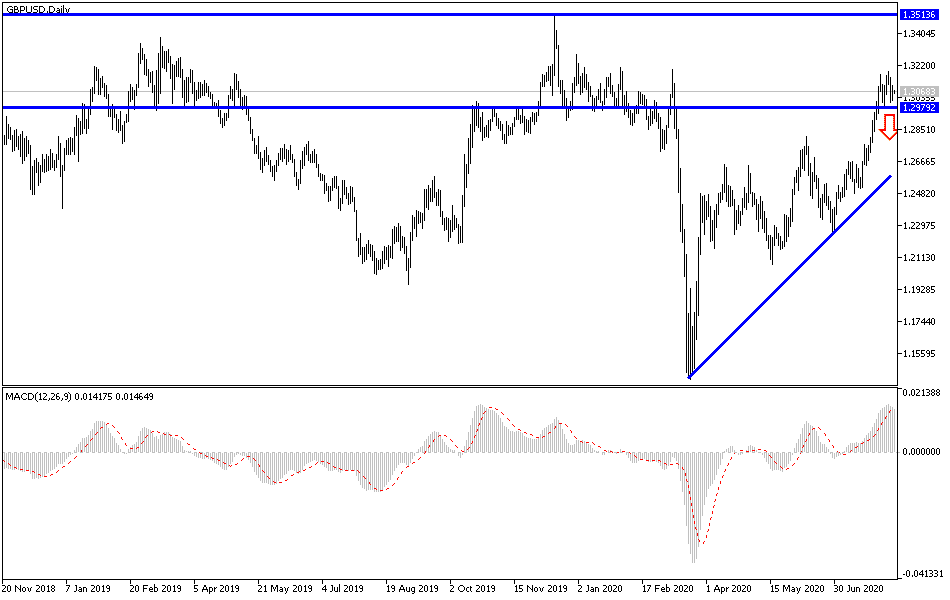

According to the technical analysis of the pair: As I mentioned before, the general trend of the GBP/USD pair will remain supported upward by stability above the 1.3000 resistance, which will increase the bullish momentum to retest the resistance levels at 1.3130 and 1.3200, respectively. Bearing in mind that any negative update for the future of Brexit negotiations will increase the bearish momentum for the pair and affect the current bullish optimism. As the Brexit file, the Bank of England policy, in addition to the Coronavirus, are the most important influences on investor sentiment towards the pair. On the downside, stability below the 1.3000 level will give bears a chance to control the performance for some time.

As for today's economic calendar data: The beginning is from Britain with the announcement of the rate of change in the number of jobs, the unemployment rate and average wages. From the United States, the producer price index will be announced.