The pair rebounded to the threshold of the 1.3000 support after its gains last week, which were topped in the testing of the 1.3170 resistance, it’s highest since the beginning of last March’s trading. The pair is holding around the 1.3030 level at the time of writing.

Final data from IHS Markit showed that the UK manufacturing sector experienced greater growth in more than a year during July, as production growth recorded its highest level in 32 months due to further easing of closing conditions due to COVID-19 disease. Accordingly, the Manufacturing PMI rose to a 16-month high of 53.3 in July from 50.1 in June. However, this was below expectations of reading at 53.6. Respondents noted that manufacturers either restarted or raised production in response to reopening customers. Although this is a positive start, it will take several months for the output growth to fully recover its losses since the beginning of the pandemic.

Production has been maximized since November 2017, driven by domestic demand, and new orders have grown for the first time since February. Meanwhile, the export business declined for the ninth month in a row. The survey showed that sentiment among manufacturers reached their highest levels since March 2018.

Employment declined for the sixth consecutive month in July, albeit to a significantly less noticeable level since March. Purchasing activity raised for the first time since last October. Average input prices increased for the eighth month in a row, at the fastest pace in more than a year. The high costs passed another increase in production fees. Commenting on the results, Rob Dobson, director of IHS Markit, said, "Despite the strong start of the recovery, the path to a complete recovery is still long and unstable." Dobson added that there is a high risk of additional repetition and the failure of anonymous workers to return to work unless demand and confidence are in a more fundamental and long-term recovery phase in the coming months.

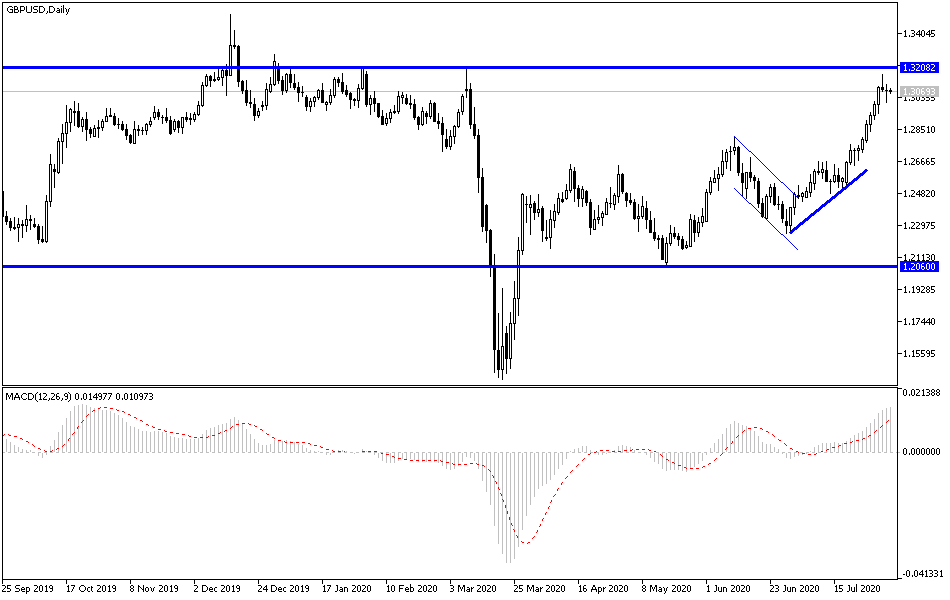

According to the technical analysis of the pair: In the short term and according to the GBP/USD performance on the hourly chart, the pair is trading within a steady upward curve, and this indicates a strong short-term bullish bias in the market sentiment. This pair crossed to the overbought levels of the 14-hour RSI, and accordingly, the bears will target short-term decline profits at 1.3067 or less at 1.3002. On the other hand, bulls will look to extend current gains towards 1.3200 or higher at 1.3261.

In the long-term, and according to the performance on the daily chart, it seems that the GBP/USD pair is on the way to return to full recovery after a massive decline in March. It has now risen above the 76.40% Fibonacci level. The RSI overbought levels have also exceeded 14 days. Thus, bulls will look to extend current gains towards full recovery at the 1.3339 resistance or higher at the 100% Fibonacci level at 1.3500. On the other hand, bears will target the long-term decline in profits at around 1.2902 or less at 1.2704.

As for the economic calendar data today: There are no significant British economic releases today. From the United States, factory orders will be announced.