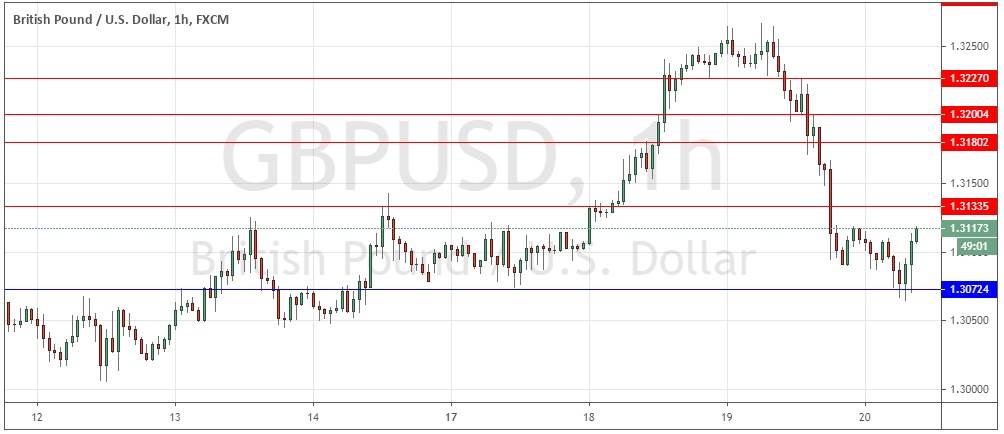

GBP/USD: Finding support at 1.3072?

Yesterday’s signals were not triggered as there was no bullish price action when the support levels at 1.3180 or 1.3134 were hit.

Today’s GBP/USD Signals

Risk 0.75% per trade.

Trades may only be taken between 8 am and 5 pm London time today.

Short Trade Ideas

- Go short following a bearish price action reversal on the H1 time frame immediately upon the next touch of 1.3134, 1.3180, or 1.3200.

- Put the stop loss 1 pip above the local swing high.

- Move the stop loss to break even once the trade is 25 pips in profit.

- Remove 50% of the position as profit when the price reaches 25 pips in profit and leave the remainder of the position to run.

Long Trade Ideas

- Go long following a bullish price action reversal on the H1 time frame immediately upon the next touch of 1.3072.

- Put the stop loss 1 pip below the local swing low.

- Move the stop loss to break even once the trade is 25 pips in profit.

- Remove 50% of the position as profit when the price reaches 25 pips in profit and leave the remainder of the position to run.

The best method to identify a classic “price action reversal” is for an hourly candle to close, such as a pin bar, a doji, an outside or even just an engulfing candle with a higher close. You can exploit these levels or zones by watching the price action that occurs at the given levels.

GBP/USD Analysis

I wrote yesterday that all the signs were bullish, and that if the support level at 1.3229 held, the price would be likely to advance further.

Being bullish was not a great call as we saw a considerable strengthening in the USD yesterday in a deep counter-trend retracement. USD strength was increased even further by the pessimistic minutes of the FOMC released yesterday, which boosted flow into the USD as a safe have and out of riskier assets such as stocks.

The British Pound was one of the main losers against the stronger USD.

The technical situation is less bullish after the price fell strongly from the new 1-year high made just a few days ago. However, we are now seeing the support level at 1.3072 holding very firm and it seems to have provided strong support, with the price rising firmly from there.

Despite the strong bullish short-term momentum, the price may struggle to rise above 1.3134 / 50.

I will take a bullish bias only if we get two consecutive hourly closes above 1.3134 today with the second close above 1.3150.

There is nothing of high importance due today regarding either the GBP or the USD.