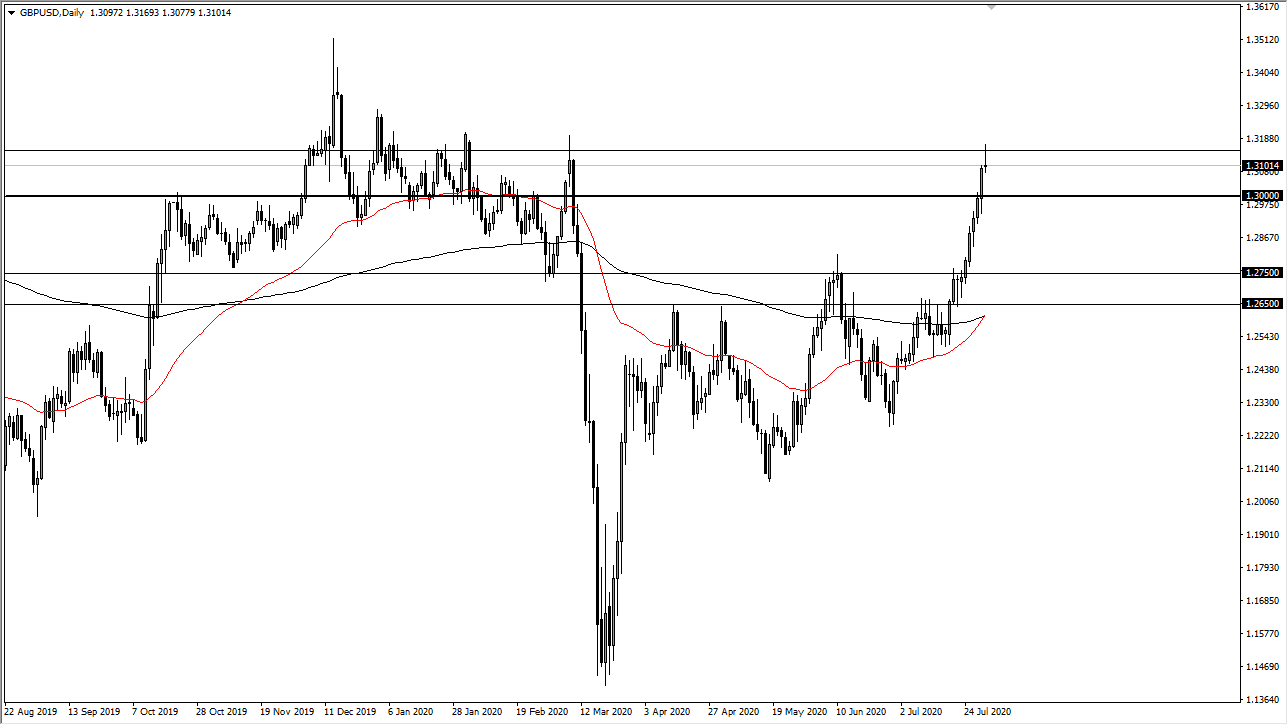

The British pound rallied a bit during the trading session on Friday, reaching towards the 1.3150 level before pulling back again. At this point in time, the market is forming a bit of a shooting star that suggests that we are going to run into enough resistance to perhaps turn this market to the downside, at least for the short term. However, looking at that as a potential buying opportunity, I recognize that there are several places where we could see buyers step into the marketplace.

The first area of interest for me is going to be the 1.30 level, an area of psychological and structural importance, and I think that there will be a bit of a reaction there. However, if we were to break down below there, the 1.2850 level would next be targeted for support. Underneath there, we look at the 1.2750 level for support. The support area down there runs about 100 pips, and it would be a retest of a major breakout. I do think that the market will try to make a significant move lower, but it is not something that I am willing to sell at this point. The US dollar seems to be recovering a bit, and therefore I think it will show up over here as well.

If we were to turn around and break above the top of the shooting star from the Friday session, it would obviously be a bullish sign but only for the short term. Breaking above there would be a bit of a “blow-off top”, which keeps the market even less stable, as we have gotten a little bit overdone from what I can see. To the downside, I am looking for plenty of opportunities and I think that given enough time we should have the ability to trade-off of a nice supportive candlestick or at least a bounce. When I look at this chart, it is something that we have seen more than once, so I am looking at this as a potential buying opportunity to the downside, only to turn around and rally again. Nonetheless, the British pound has been like a juggernaut over the last several weeks, and it is difficult to imagine that the attitude will change based upon some simple pullback. Being patient will provide enough opportunity as it is.