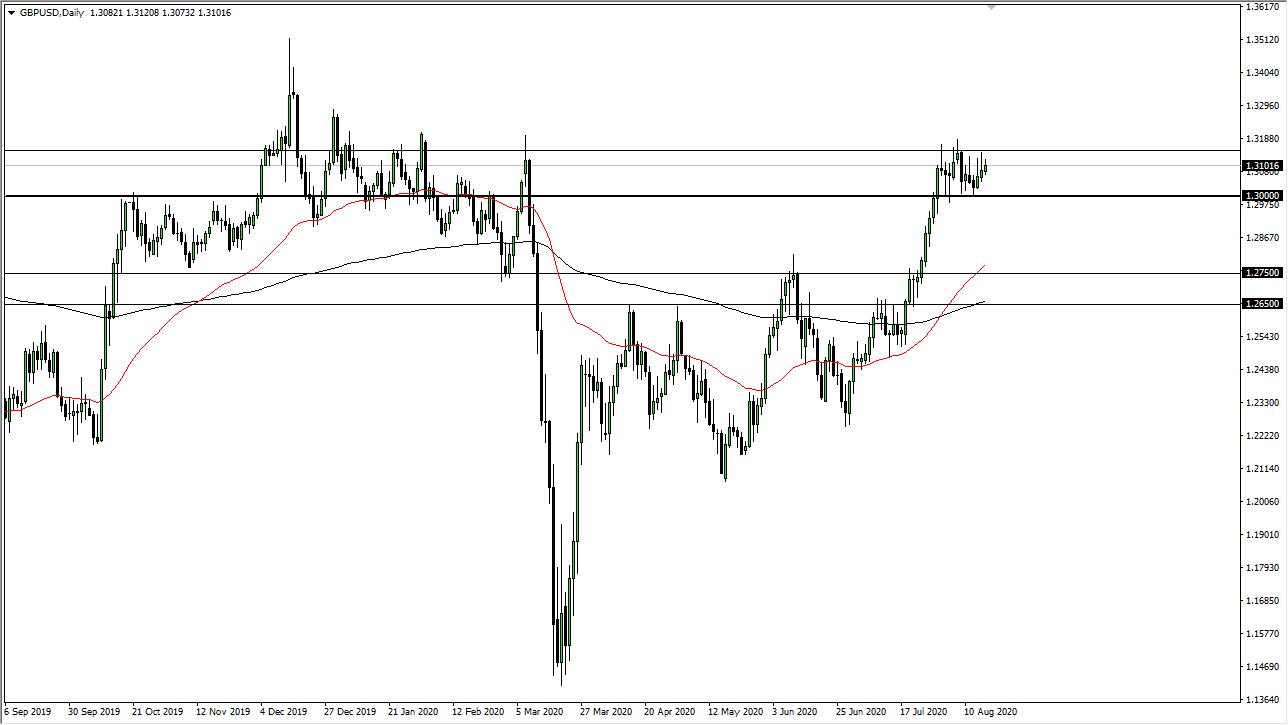

The British pound has rallied a bit during the trading session on Monday, reaching above the 1.31 level. We have not exactly hung onto all of the gains, but enough that we need to be paying attention to the fact that the real body of the candlestick is going higher. Because of this, it looks like we are gradually working our way towards a potential break out, and if we can get above the 1.3150 level, it is likely that we would go looking towards the 1.35 handle after that.

The short-term pullback should continue to attract a certain amount of attention, and I believe that the 1.30 level will continue to be a massive support. As we continue to consolidate, and the more time we spend up here, the more likely that we are going to see the breakout as people become much more comfortable at these elevated levels. Furthermore, the Federal Reserve is doing absolutely nothing to dissuade the idea of currency devaluation, so that is something worth paying attention to as well. As long as the Federal Reserve is looking to work against the value of the US dollar, it makes quite a bit of sense that this pair will continue to go higher. After all, and it is working against the value of the greenback, and that one could make an argument that we are forming a bullish flag. As long as we can stay above the 1.30 level, it is a good sign that we are going to go much higher.

If we do break down below the 1.30 level, then it is likely that we will go down towards the 1.2750 level where I expect to see even more buyers. In that scenario that was significantly resistant in the past that it is the scene of the 50 day EMA now, so that would make sense as it would be a technically bullish level. That level extends down to the 1.2650 level, based upon previous structure, as a massive support zone. It is not until we break down below the 200 day EMA, pictured in black on the chart that I would consider selling. I think we are in the midst of trying to form some type of bullish flag and therefore could really start to take off to the upside. That being said, it is the middle vacation season so it may take a little while to get going.