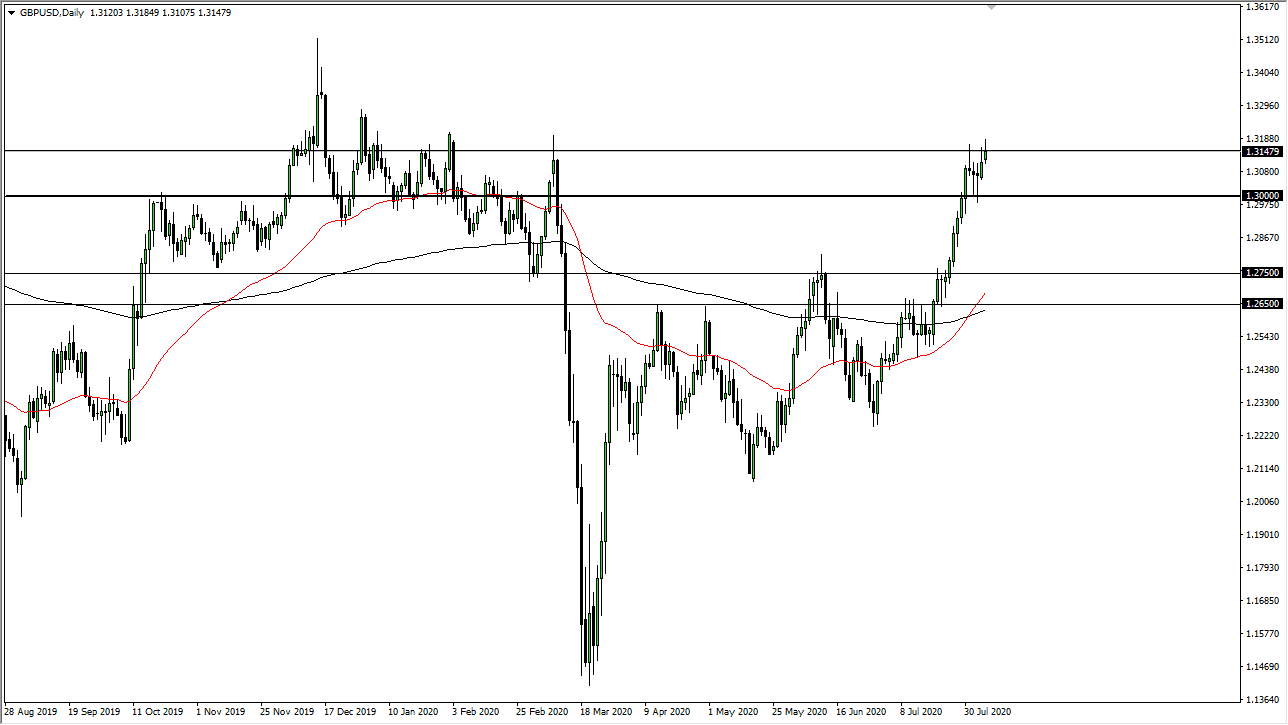

The British pound rallied during the trading session to break above the 1.3150 level. However, we have pulled back from there to show bits of exhaustion, and now it looks like we are ready to go sideways in the short term, before perhaps breaking to the upside. If we can break above the top of the candlestick for the Thursday session it would be a very bullish sign and could send this pair much higher.

To the downside I see the 1.30 level as significant support, as it is a large, round, psychologically significant figure, and we have seen a couple of days try to break down through their earlier during the week only to turn around and rally again. Ultimately, we are either going to “kill time by going sideways”, or we are going to break out. I would be a bit surprised to see this market break down, but if we were to slice down below the 1.30 level, I am not going to be a seller the British pound, rather I would be looking to pick up value at lower levels.

Those lower levels include the area between the 1.2650 level in the 1.2750 level. I think that is a massive zone of support that will hold, and would attract a lot of attention due to the fact that the 50 day EMA is sitting right there, it of course the 200 day EMA was just crossed by the 50 day EMA, forming the “golden cross”, something that a lot of people will pay attention to. With that, I think that longer-term traders are looking to pick up value in the British pound so that pullback will be a welcome the opportunity buy them. With the Non-Farm Payroll announcement coming out we could get the necessary volatility make this pair move again, but do not be surprised if we end up somewhat unchanged. After all, the announcement tends to be accompanied by a severe lack of liquidity, and therefore price bounces around and multiple directions, only to end up where it starts quite often. However, the market still favors the upside due to the Federal Reserve pumping massive amounts of liquidity into the financial system, which of course ways upon the value of the US dollar. Buying dips continues to work but if I am forced to buy a breakout above the shooting star, I would also do that.