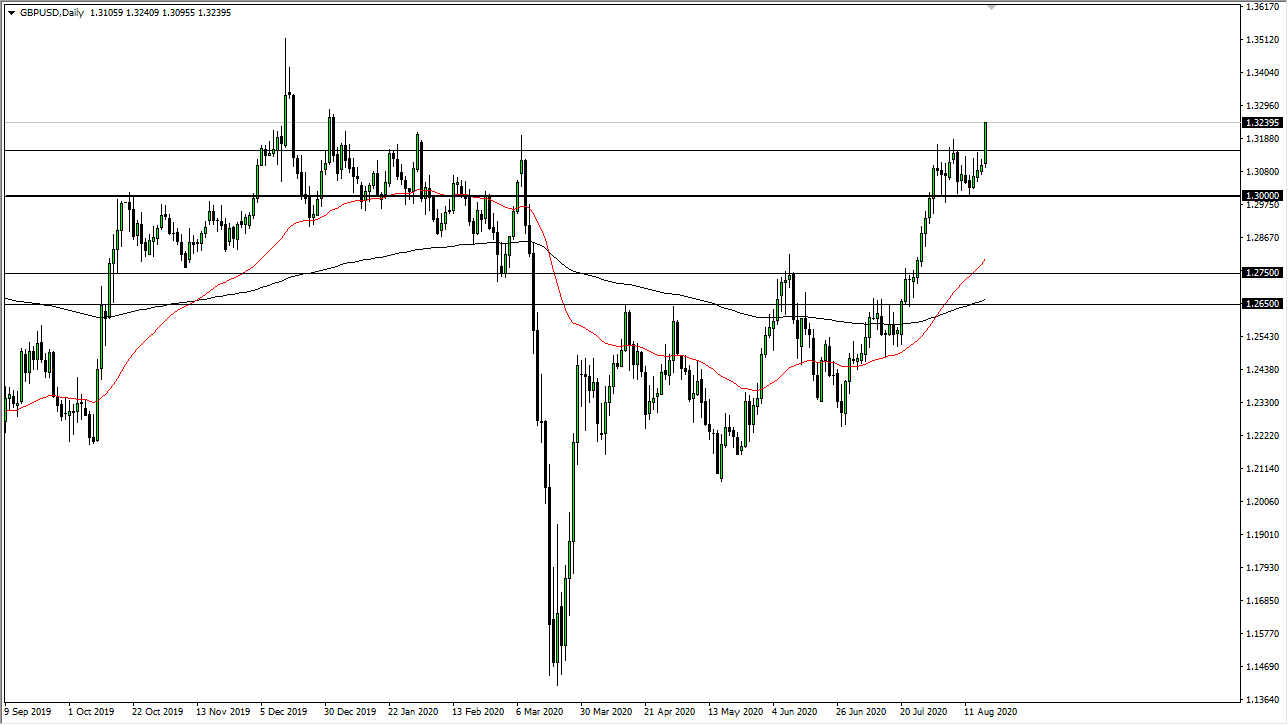

The British pound has broken out to the upside during the trading session on Tuesday, clearing the 1.3150 level. This is an area that had acted as significant resistance, as we had pierced it a few times but pulled back at the end of the day each time it happened. However, when you look at the candlestick for the trading session on Tuesday, the main fact that stands out should be the fact that the market is closing so close to the highs. That is a very bullish sign and typically suggests that we are going to see follow-through.

Looking at this chart, you can make an argument for a bullish flag being broken, and that could send this market towards the 1.35 level at the very least. That would be a major high being tested, and it seems to make quite a bit of sense. I believe that the 1.30 level is now the “floor” in the market, so there is no point whatsoever in trying to get too cute with this pair until we break down below that level. All things being equal, this is a market that I think will continue to show buying opportunities on dips, as the Federal Reserve continues to flood the market with greenbacks. In other words, this is a move that is probably more about the US dollar than anything going on in the United Kingdom. In fact, you can make a very strong argument for a lower British pound due to Brexit issues coming out. However, it seems like nobody is paying attention to that right now. In fact, I am willing to state that the Federal Reserve is the only game in town right now.

I do believe that there will be the occasional pullback. However, the short-term pullback should be thought of as buying opportunities, as this is a market that is historically cheap. Now that it is obvious that Brexit is not going to completely induce the next zombie apocalypse, you can make a strong argument for the fact that the United Kingdom was unfairly punished. Yes, the economy is going to take a hit but a lot of people forget the fact that currency trading is a relative game. In other words, things may be better in the United Kingdom than in the United States. Coronavirus infections have in a strange way flattened the relative underperformance in the UK compared to the rest of the world.