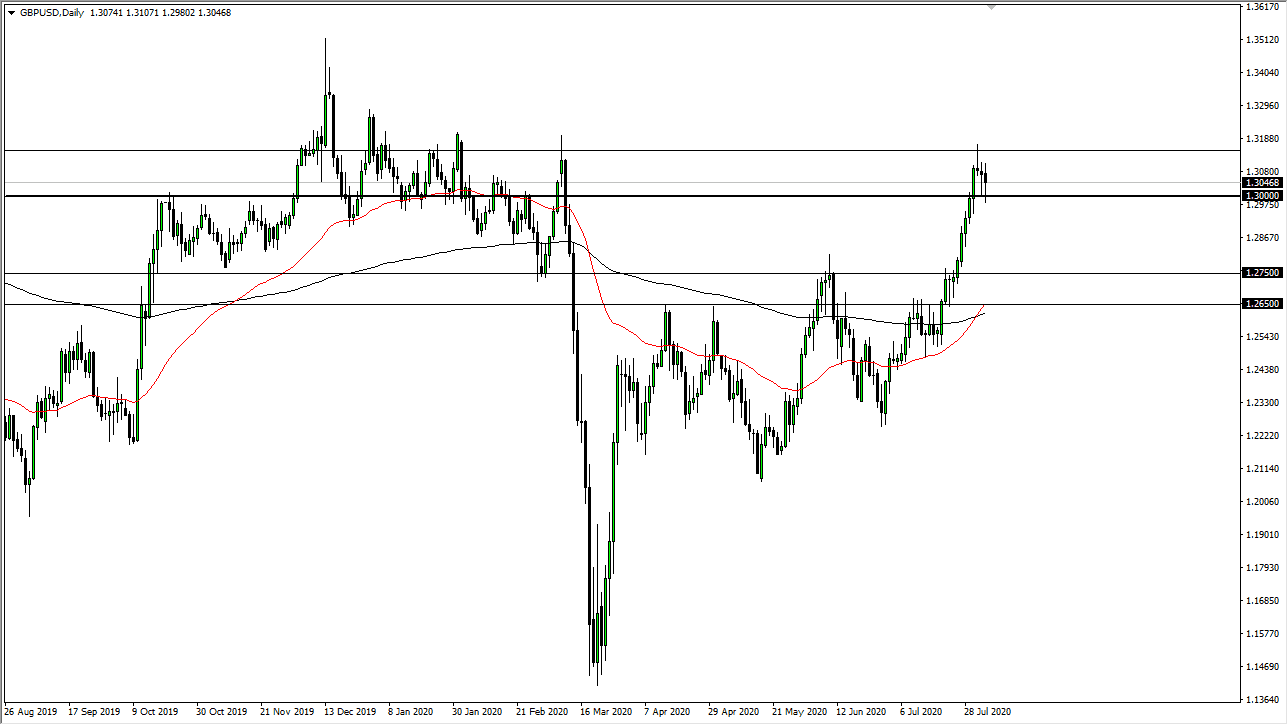

The British pound pulled back a bit during the trading session on Tuesday, reaching down towards the crucial 1.30 level. We then bounced which is a very bullish sign and it looks to me like we are more likely to see consolidation and a digesting over the recent gains than some type of major breakdown. At one point, I figured we could probably drop back down towards the 1.2750 level, where there would be plenty of buyers. However, there is also the possibility that we simply grind away to the side in order to have people get a bit comfortable with the idea of being above the 1.30 level.

Now that we have seen the 1.30 level offer so much in the way of support of the last couple of days, it is likely that we will see more sideways action than anything else. If we can break above the top of the shooting star from the Friday session, then it is likely to send the British pound much higher, perhaps as high as the 1.35 handle. That is my target right now, but the question is not so much as to whether or not we can get there, but whether or not we get there with or without some type of major pullback.

The Federal Reserve looks very likely to continue seeing massive amounts of liquidity measures being needed, and that should continue to bring down the value of the greenback. It is not so much a matter of British pound strength as it is a matter of complete weakness when it comes to the greenback. The couple of hammers that have been formed on the daily chart is a good sign, so I think we may be gearing up for some type of big move later this week, perhaps after the Non-Farm Payroll announcement, or after the stimulus measures are passed in the United States. It really comes down to the size of printing that the Americans will be going as to where this currency pair goes. Again though, it is not so much the direction that I am cautious about but rather the path to get to with higher levels. The markets continue to be very agitated and I think that the volatility will be a continuing theme and not only the FX markets but also all of the other ones.