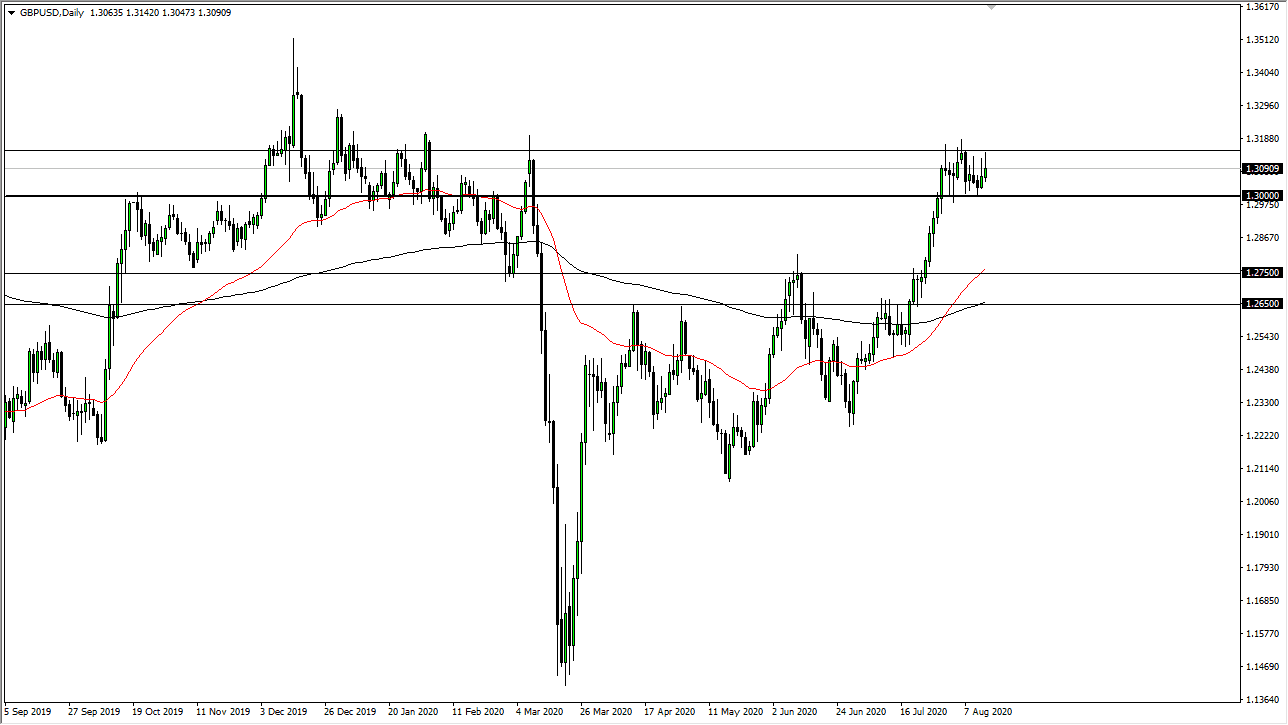

The British pound initially rallied during the trading session on Friday but has found a significant amount of resistance at the 1.3150 level again. We have seen the market pullback to form a bit of the shooting star, but this is not necessarily a negative turn of events. At the moment, the British pound is trading between the 1.3150 level and the 1.30 level underneath and will likely see a lot of chopiness back and forth as the British pound gets used to the idea of being at these high levels. However, the biggest thing that people will be paying attention to will be the Federal Reserve flooding the market with US dollars, which brings down the value of that currency. This is the main driver of the British pound gaining, at least against the greenback.

What I find interesting though is the fact that the United Kingdom introduced more restrictions, so at this point in time it is likely to see a bit of stagnation in its economy. Nonetheless, it looks as if the Federal Reserve is ready to flood the market as long as it takes, so I think the fact that we are forming a little bit of a bullish flag suggests that we are ready to go higher. The bullish flag suggests that we are likely to see a 400 point move, which means just above the 1.35 handle on a breakout.

Looking at this chart, it is very likely that pullbacks will continue to be buying opportunities but if we do break down below the 1.30 level, I have no interest in shorting this market. At this point in time, I believe that the 1.2750 level will be a very interesting area to start buying as it is massive support due to the fact that it was massive resistance previously. Furthermore, the 50 day EMA is sitting in that area, with the 200 day EMA sitting at the very bottom of it. In other words, I would be much more aggressive to the upside at that point. However, the British pound looks likely to go sideways more than anything else, and the fact that we are in the midst of the vacation season, we could see the market simply go sideways as we have seen in other markets already.