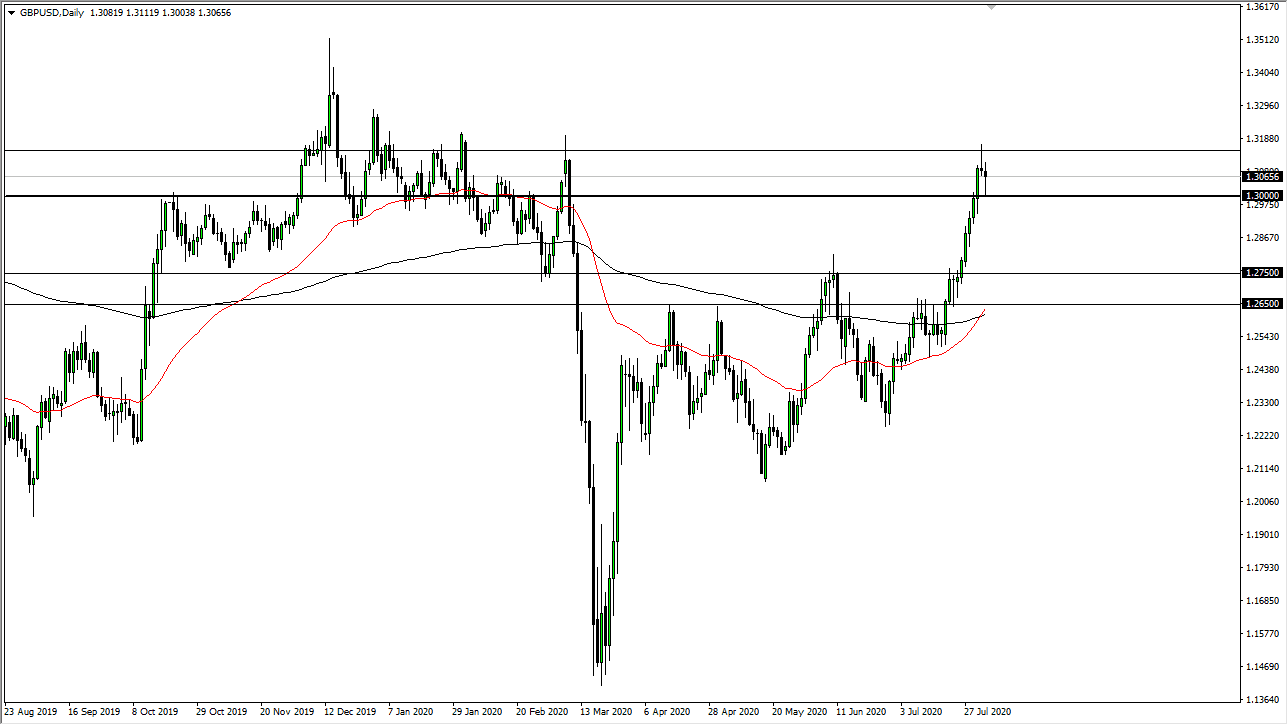

The British pound initially fell on Monday looking towards the 1.30 level, an area that I have mentioned previously as being important. It was the first support level that I was watching, and now we have seen buyers step in and pick up the pound in that general vicinity. The fact that we ended up forming a bit of a hammer after the shooting star on Friday tells me we are likely to build a range here, perhaps deciding where to go next. This is relatively common, and I love this pattern when you get a shooting star followed by a hammer or vice versa. This means that the short-term market is trying to consolidate and build momentum for the next big move.

The way to play this is relatively simple. You can simply go back and forth as a short-term scalping environment, and a lot of my friends do that. However, when we break either above or below this range, then the swing traders get involved. In fact, some of my best trades are based upon this toolbar pattern. I will tell you this though, I am much more likely to buy a breakout than I am to sell some type of break down simply because of the momentum building up. For what it is worth, we have also just had the “golden cross”, which is something that longer-term traders tend to focus on, although I think it very rarely works out for them.

If we do break down from here, I anticipate that there is plenty of support near the 1.2750 level to start buying down there. That is roughly a 100 pips zone of support, so therefore I think you would have plenty of interest in trying to catch the market there. On the other hand, if we break above the Friday highs, it is likely that we will go racing higher again, perhaps trying to reach towards the 1.35 level. Keep in mind that this is a Non-Farm Payroll week, so we might get a bit of consolidation heading into Friday, and then perhaps some type of movement-based upon that session. Nonetheless, I think it is obvious that the US dollar is on its back foot against most currencies, so at this point, you have to ask why the British pound would be any different?