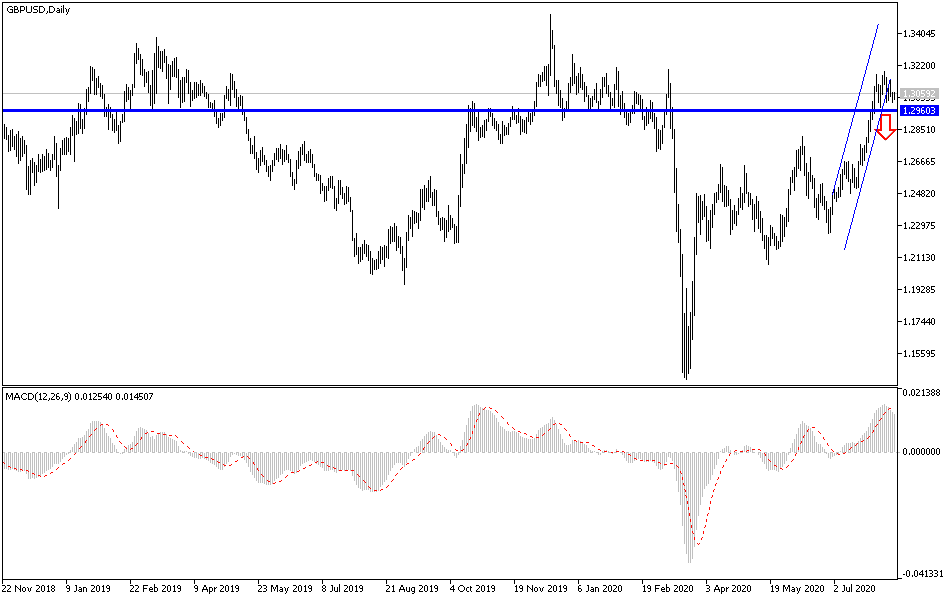

The pound is making strong efforts to avoid moving below the $1.30 support so that recent hopes of a real reversal of the GBP/USD does not evaporate during yesterday's session. Moving towards the 1.3004 support after the announcement of a historical slowdown of the British economy in the second quarter of 2020, in which the British economy witnessed the closure to contain the Coronavirus outbreak. The pair is stable around 1.3035 at the beginning of Thursday’s trading. The United Kingdom suffered the deepest recession of any advanced economy in the first half of 2020 as strict lockdown measures left large sectors of the economy unable to function, however, the reopening of activity that peaked in early July and saw the re-opening of the hospitality and entertainment sector, should lead to a strong rebound in the third quarter.

The second-quarter data showed a -20.4% slowdown in growth on a quarterly basis, meaning that the UK suffered the largest economic slowdown among all other major economies.

One of the main reasons for this slowdown was that the largest share of the economy is dependent on the service sector, which accounts for more than 80% of economic activity in the UK. The closure of bars, restaurants, medical service providers, schools, arts, entertainment, and other service industries has left the British economy particularly vulnerable. However, data shows that the economy started to grow again in May and June, but opening up service industry models in early July should add further momentum to the recovery.

Commenting on the results, Sanjay Raja, an economist at Deutsche Bank, said: "We believe that the third-quarter rebound will be more dramatic with the increase in activity data significantly during the summer". And added that: "The recession ended in May. GDP rebounded in May and June, erasing some of the 26% decline between February and April. As things stand, the economy is now 17% below pre-virus levels - slightly better than we expected”.

Undoubtedly, supporting the recovery in the services sector in the third quarter will be the government's "Eat out to Help Out" scheme, which sees the government subsidizing restaurant and bar meals Monday through Wednesday in August. Data released by the government this week shows that the scheme has been well received, with 10.5 million meals being claimed under the scheme and that some of the companies that reported business in the first part of the week were now actually higher than they were at the same point in 2019.

Economists at Deutsche Bank believe that the British economy is on its way back to about 90% of pre-virus levels in the UK by the end of September.

As a result of the slightly better numbers yesterday, Deutsche Bank revised its economic forecast for the UK and now expects growth to drop by 11% in 2020, which is 0.5% lower than its previous forecast. And they expect next year's bounce to be slightly better as well, given its strong starting point and projected 2021 growth of 4%, up 0.3%. However, this level is still below the consensus seen among economists with a 6% growth in 2021.

According to the technical analysis of the pair: On the downtrend, the 1.3000 support will remain important for the bears to dominate the GBP/USD performance. Moving below it will support the move towards stronger support levels, the closest of which are currently 1.2965, 1.2880 and 1.2790, respectively. On the upside, breaching the 1.3200 resistance will remain important for bulls to gain stronger control over performance, as it symbolizes overcoming the 1.3185 resistance recorded by the pair last week. Nevertheless, I would still prefer to sell the pair from every higher level, as the outlook for the post-Brexit phase is still bleak.

As for the economic calendar data today: From Britain, RICS house prices data will be announced. From the United States, the number of weekly jobless claims will be announced.