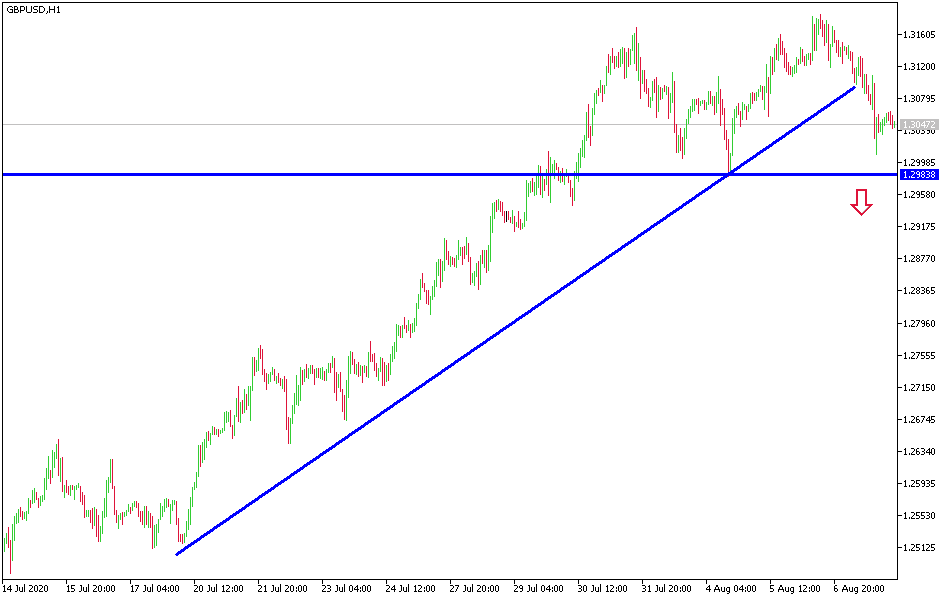

GBP/USD: Bullish momentum under threat.

Today's GBP/USD Signals

- Risked 0.75%

- Trades must be taken before 5 pm London time today.

Short Trade Ideas

- Go short following a bearish price action reversal on the H1 time frame immediately upon the next touch of 1.3010.

- Place the stop loss 1 pip above the local swing high.

- Adjust the stop loss to break even once the trade is 25 pips in profit.

- Take off 50% of the position as profit when the price reaches 25 pips in profit and leave the remainder of the position to ride.

Long Trade Ideas

- Go long following a bullish price action reversal on the H1 time frame immediately upon the next touch of 1.2955, 1.2880.

- Place the stop loss 1 pip below the local swing low.

- Adjust the stop loss to break even once the trade is 25 pips in profit.

- Take off 50% of the position as profit when the price reaches 25 pips in profit and leave the remainder of the position to ride.

The best method to identify a classic “price action reversal” is for an hourly candle to close, such as a pin bar, a doji, an outside or even just an engulfing candle with a higher close. You can exploit these levels or zones by watching the price action that occurs at the given levels.

GBP/USD Analysis

A sudden threat to the GBP/USD uptrend occurred as it approached the 1.3000 level by the end of last week's trading. Despite the surprise, we expected in previous technical analyzes that this would be possible at any time, because the pair's gains are not due to strength in the sterling, as much as a sharp decline in the value of the US currency, which is facing record numbers of cases and deaths from the COVID-19 virus and is waiting for economic stimulus plans to face the crisis. The Bank of England's monetary policy was in favor of the Pound because the bank did not provide any signals for the future of negative interest rates as the markets had been expecting. The bank kept interest rates and stimulus plans to buy assets unchanged, and the decision was made by the bank’s monetary policy members unanimously. The tone of the interest policy statement is "less pessimistic" than the markets had been expecting. The bank governor’s comments after that were neutral to some extent, so the Sterling did not react with the same reaction to the US job numbers announcement at the end of the week.

The British pound rose against the dollar to its highest level in 5 months after the decision of the Bank of England. This week, the sterling will be on a date with a package of important British economic releases, including the announcement of employment and wages figures in Britain, then the announcement of the GDP growth rate and the manufacturing production index. On the other hand, and amid the continuing faltering negotiations between the two sides of Brexit on the future of their relations, the British government recently made offers to global economies in order to agree on free trade relations with them to spite the bloc and also to ensure a better future for Brexit supporters.

The US jobs numbers for July are summarized by the addition of less than expected jobs in the non-farm sector, an improvement in the average hourly wage, and a less-than-expected decline in the US unemployment rate. Before its announcement, US President Trump predicted better job results, and as it can be seen, Trump is trying to improve his image in any way before the presidential elections and after severe criticism of his management of the Coronavirus file. Where the United States leads the world numbers in cases and deaths of the epidemic.

As I mentioned in recent technical analysis, I would still recommend selling the GBP/USD pair after all its gains, as the future of Brexit remains uncertain.

For the British pound, the NIESER evaluation for the UK GDP will be released. For the US dollar, JOLT numbers will be announced.