The difference between success and failure in Forex trading is very likely to depend mostly upon which currency pairs you choose to trade each week, and not on the exact trading methods you might use to determine trade entries and exits. The current market environment has changed from one of crisis to a questionable rebound or recovery, despite the continuing growth in the coronavirus pandemic which is still sweeping the world.

Big Picture 23rd August 2020

In my previous piece last week, I saw the most attractive trade set-ups as likely to be long of the EUR/USD currency pair following a New York close above 1.1876. There was no close above that level, so there was no trade this week.

Last week’s Forex market saw the strongest rise in the relative value of the Canadian Dollar and the strongest fall in the relative value of the Euro, but the numbers were small.

Fundamental Analysis & Market Sentiment

The economic impact of the coronavirus pandemic seems to be transferring income streams from smaller to larger businesses and boosting the profitability of large tech companies.

The market’s focus now is centered on the political dispute in the U.S.A. over the terms of additional fiscal stimulus which the U.S. economy is seen to require as the U.S. economic recovery is endangered by the resurgent coronavirus. This is echoed in other countries around the world, with markets watching to see how effectively local economies bounce back from the initial part of the crisis.

Possibly the second major issue now is progress being made in a number of channels towards a safe and effective coronavirus vaccine. If such a vaccine is credibly confirmed, this can be expected to boost global economic optimism.

Last week saw the number of daily new confirmed coronavirus cases fall to its lowest level in five weeks. This is a sign that globally, this wave of the disease may have already peaked.

We have seen the epicenter of the global coronavirus pandemic move into Latin America, although the U.S.A. and Brazil are recording approximately the same number of daily deaths from the virus. The number of new cases in the U.S.A. has declined notably in recent days. The rolling averages of deaths have decreased significantly in Europe. Globally, coronavirus deaths are still lower than they were during their peak in early April, suggesting the virus may have become less lethal, or medical systems are improving their treatment capacities.

Latin America and the Caribbean are now responsible for approximately 43% of confirmed new daily deaths, with the U.S.A. at 18% and Europe at about 5%. The strongest growth in new confirmed cases is happening in Albania, Argentina, Austria, Bahamas, Bangladesh, Bosnia, Brazil, Bulgaria, Canada, Colombia, Costa Rica, Croatia, Cuba, Czech Republic, Ethiopia, France, Germany, Greece, Guatemala, Hungary, India, Indonesia, Iraq, Israel, Kosovo, Lebanon, Lithuania, Luxembourg, Mexico, Moldova, Morocco, Nepal, Nigeria, Paraguay, Peru, Philippines, Poland, Romania, Slovakia, Slovenia, South Korea, Spain, Sweden, Switzerland, Trinidad, Tunisia, U.A.E., Ukraine, United Kingdom, and Uruguay.

The U.S. stock market rose again by a little last week to make its highest all-time weekly close. Typically, such new all-time highs tend to produce further rises of 8% on average over the next year or so, suggesting the stock market is likely to continue to advance. Despite these high prices, analysts tend to be concerned about the persistence of unemployment from earlier closures and restrictions and the economic impact of the reversals of easing which have been imposed in several states. The market still hopes to see an additional and far-reaching stimulus package from the federal government soon, despite the current political impasse.

The U.S. Federal Reserve released minutes last week showing the bank remains very concerned about the impact of the coronavirus upon the economy, and many analysts saw the release as dovish for the U.S. Dollar. However, the U.S. Dollar Index ended last week almost unchanged in value.

The European economic recovery still seems to be in relatively good shape although there are signs that the coronavirus is growing again in some countries, especially France and the Netherlands. Nevertheless, this macro environment has helped to boost the Euro.

There is an increased feeling that the Eurozone economy may be better placed to recover from the economic impact of the coronavirus than the U.S. economy, which has helped boost the Euro against the U.S. Dollar. The Canadian Dollar has also been strong, boosted by the recovery of the price of Crude Oil as a major oil producer.

The coming week will bring almost no important releases concerning major currencies: as we are now well into August, which is traditionally a holiday season in much of the world, we can probably expect a relatively quiet market this week.

Technical Analysis

U.S. Dollar Index

The weekly price chart below shows last week printed a relatively small but bullish pin candlestick at a new 2-year low closing price. The high of the week’s range rejected the resistance level I identified at 12087 which is a bearish sign. However, the pin candlestick in combination with the previous week’s inside candlestick is a bullish sign. There is a long-term bearish trend, as the price is lower than it was both 3 and 6 months ago. Overall, next week’s price movement in the U.S. Dollar looks very uncertain.

S&P 500 Index

Last week printed a small bullish candlestick, which closed right at a new all-time high weekly closing price. This is a bullish sign and usually new all-time highs signal that the price is going to rise further over the coming weeks and months. However, bulls should be worried about the low volatility and volume, and we may well see a strong dip from this area before there is a further rise over the long-term.

USD/CAD

The Canadian Dollar is in a long-term bullish trend and rose again last week against the U.S. Dollar, as part of the long-term the bearish trend we see here in this currency pair. The “Loonie” is currently one of the strongest major currencies, but bears should probably be wary of the key support at and below the major psychological level at the round number of 1.3000.

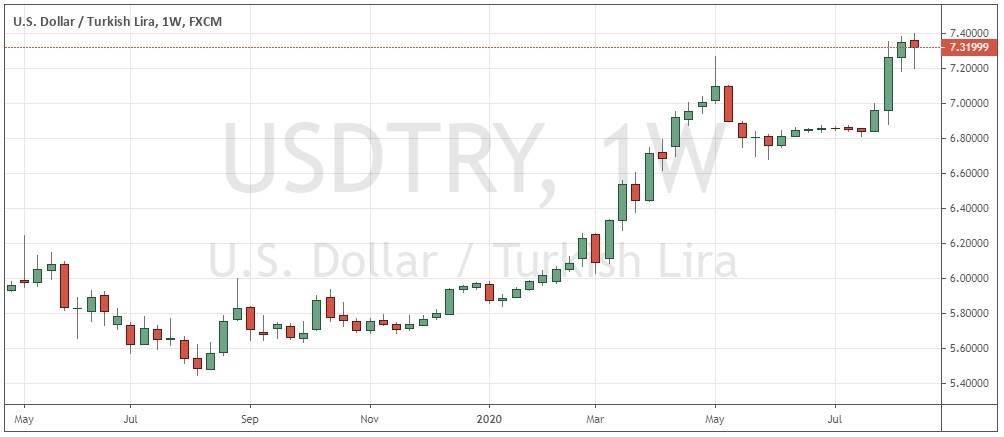

USD/TRY

The Turkish Lira has been in a long-term decline but pulled back a little over the past week. Despite its increase, it remains vulnerable to further losses against the U.S. Dollar. Trading this pair long can be challenging due to high spreads and a very high overnight financing fee, but it is definitely a trade based upon strong fundamental factors. It is important to use a good stop-loss methodology as volatility can be very high and drops extremely sharp.

Bottom Line

I see the most attractive trade set-up for this week as likely to be long of the S&P 500 Index.