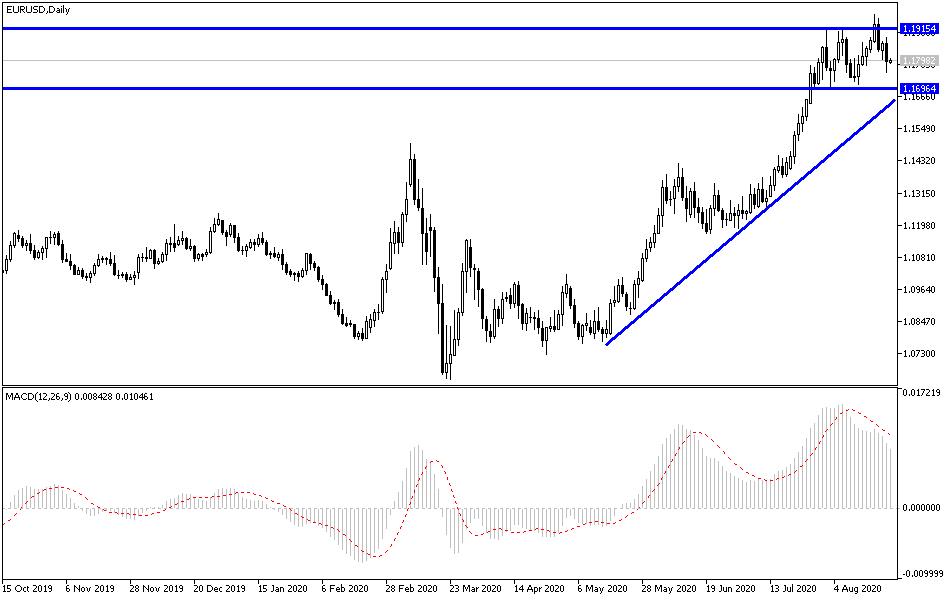

Most of last week’s trading was marked by the downward correction for the EUR/USD, which pushed it towards the 1.1754 support before stabilizing around 1.1800 at the beginning of this week’s trading. The pair's correction came after its gains, which pushed it towards the 1.1966 resistance, its highest in two years, and was supported by a long-awaited uprising in the USD. As the strength of the EUR fluctuates, and the downside pressure facing the EUR/USD, the negative RSI divergence has also developed. Moreover, the EUR/USD pair closed below the 8-day moving average, indicating the possibility of a bearish turn in sentiment. This comes after a reversal of 180 points from the highest level on August 18, with a bearish stance for the pair after the announcement of the PMI results for the manufacturing and services sectors of the bloc economies.

Survey data from IHS Markit last Friday showed that private sector growth in the Eurozone lost momentum in August after recovering from the slowdown caused by the coronavirus pandemic. Therefore, the composite production index - which includes both manufacturing and services - unexpectedly declined to a reading of 51.6 in August, while the result was expected to remain unchanged at 54.9. However, a reading above the 50 level indicates growth. Jessica Hinds, an economist at Capital Economics, said the decline in the composite PMI indicates that the initial V-shaped recovery after the closure was lifted has already faded.

The economist added, "We believe that activity will remain below pre-crisis levels at least in the next two years."

IHS Markit said the recovery was being undermined by signs of a spike in virus cases in various parts of the Eurozone, with renewed restrictions affecting the service sector in particular. The reason for the weak overall growth was a weak service sector, as industrial production growth accelerated in August. The Services PMI fell more than expected to a reading of 50.1 in August from a reading of 54.7 in July. The expected level was 54.5. Meanwhile, the manufacturing PMI came in at 51.7 versus 51.8 a month ago. The reading was expected to rise to 52.9.

Both business activity and new orders rose moderately in August, and at slower rates than in July. Growth in new business has been undermined by a decrease in new export orders. And companies in the Eurozone have continued to shrink their workforce. Employment declined for the sixth consecutive month in August despite the decline rate easing further.

On the price front, the survey showed that input costs rose for the third month, with the increase concentrated on the services sector. The costs of manufacturing inputs have not changed widely. Companies have continued to reduce their selling prices, extending the current downtrend to six months.

According to the technical analysis of the pair: Despite the recent EUR/USD downward correction moves, the pair still has the opportunity for a bullish correction, especially if it returns to stability above the 1.1800 resistance, which is still heading the bulls towards more bullish momentum. Optimism is more in favour of the Euro and therefore it is expected to rebound higher. The 1.2000 psychological resistance will remain a symbolic target for bulls to capture the performance. As I mentioned before, the biggest threat to the bullish momentum will be the pair's retreat to the 1.1660 support.

Today's economic calendar has no important or influential economic data from the Eurozone or the United States.