There is no doubt that the change in the US Federal Reserve’s monetary policy settings in a historical event that Jackson Hole symposium was the scene for, led by Jerome Powell, was a good reason for the US dollar to drop against the rest of the other major currencies. This contributed to an upward closing of the EUR/USD price, reaching the 1.1919 resistance. As we mentioned earlier that the stability above will support the move towards the 1.2000 psychological resistance as a legitimate target for bulls. With the beginning of this week's trading, the economic calendar has no important US economic releases, while from the Eurozone, German and Spanish consumer price index will be announced. After the last climb, the pair rose above both the 100-hour and 200-hour simple moving average lines. It pushed the pair to the overbought levels of the 14-hour RSI. This could lead to a short-term pullback in profit-taking selloffs.

Last week, the Federal Reserve announced a major change in how it manages interest rates by saying it plans to keep interest rates near zero even after inflation exceeds the 2% target. The change means that the Fed is generally prepared to withstand a higher level of inflation than it has done in the past. This means that household and corporate borrowing rates - for everything from auto loans and mortgages to corporate expansion - are likely to remain extremely low for years to come.

From the Eurozone, German GDP for the second quarter beat expectations (year over year) and (QoQ) of -11.7% and -10.1% respectively, with readings of -11.3% and -9.7%. The IFO Business and Climate Assessment for August beat expectations of 92.2 and 86.9, respectively, with readings of 92.6 and 87.9. On the other hand, the IFO forecast for August came in below 98, with a reading of 97.5. On Friday, European Union consumer confidence for August came in in-line with expectations at -14.7 while business climate sentiment missed expectations of -1.18, with a reading of -1.33.

From the US, primary GDP growth for the second quarter (QoQ) was below expectations of -2% at -2.3%. It surpassed its year-on-year equivalent of -35.2% with a recording of -31.7%. Last week's jobless claims surpassed the one million mark again, with 1,006 million claims recorded, while the previous week’s continuous requests came lower than a reading of 14.45 million with a record of 14,535 million. Core personal spending for the second quarter (quarterly) beat expectations by -1.1%, recording -1% while pending home sales for July beat expectations by 3% with a record of 5.9% (monthly). Prior to that, the durable goods orders for July were reported to exceed 4.3%, recording 11.2%. Non-defense capital goods orders came met expectations of 1.9%.

According to the technical analysis of the pair: In the near term, it appears that the EUR/USD currency pair is trading within a bullish channel on the hourly time frame chart. This indicates a slight short-term bullish bias in market sentiment. The pair rose to 14-hour RSI overbought levels after gains last Friday. Accordingly, bulls will look to extend the current gains towards 1.1950 or higher at 1.2000. On the other hand, bears will target short term pullback gains around 1.1864 or lower at 1.1810.

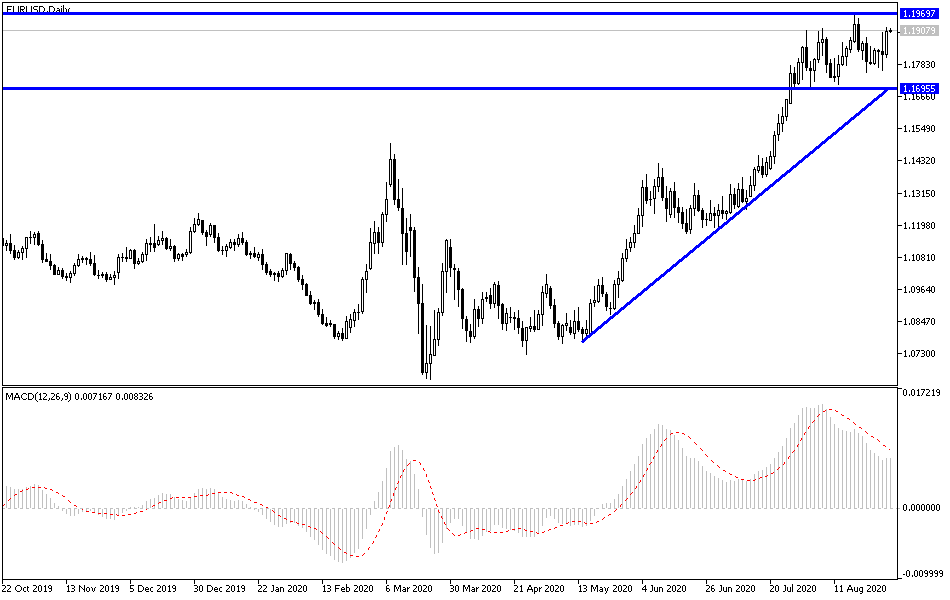

On the long term, and based on the daily chart performance, it appears that the EUR/USD is trading within a sharp bullish channel. This indicates a strong long-term bullish bias in market sentiment. The recent pullback pushed the pair towards the normal 14-day RSI trading territory. Accordingly, bulls will look to maintain long-term control over the pair by targeting profits around 1.2090 or higher at 1.2250. On the other hand, bears will be targeting long-term gains around 1.1746 or lower at 1.1563.